- South Korea

- /

- Food

- /

- KOSE:A005180

Undiscovered Gems in South Korea to Watch This October 2024

Reviewed by Simply Wall St

The South Korean stock market has experienced a series of fluctuations recently, with the KOSPI index hovering just above the 2,580-point mark amid mixed global forecasts and varied performances in financial and industrial sectors. In this dynamic environment, identifying promising stocks involves looking for companies that demonstrate resilience and potential growth despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.74% | ★★★★★★ |

| Samyang | 49.49% | 6.68% | 23.96% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 3.97% | 42.22% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Woori Technology Investment | NA | 25.66% | -1.45% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| Namuga | 14.47% | 0.88% | 38.25% | ★★★★★★ |

| iMarketKorea | 28.53% | 5.35% | 1.30% | ★★★★★☆ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Yuanta Securities Korea (KOSE:A003470)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Yuanta Securities Korea Co., Ltd. offers a range of financial services both domestically and internationally, with a market capitalization of approximately ₩596.82 billion.

Operations: Yuanta Securities Korea generates its revenue primarily through financial services offered in both domestic and international markets. The company has a market capitalization of approximately ₩596.82 billion, reflecting its position in the financial sector.

Yuanta Securities Korea, a notable player in South Korea's financial sector, has shown impressive earnings growth of 73% over the past year, outpacing the industry's 21.5%. The company's price-to-earnings ratio stands at 7.8x, which is below the Korean market average of 11x, suggesting potential undervaluation. Despite this growth spurt, a significant one-off loss of ₩261 billion impacted recent financial results as of June 2024. Over five years, its debt to equity ratio improved from 476.8% to 447.4%, indicating better financial management and positioning it as an intriguing prospect for investors seeking value in emerging markets.

Binggrae (KOSE:A005180)

Simply Wall St Value Rating: ★★★★★☆

Overview: Binggrae Co., Ltd. is involved in the production and distribution of dairy products both in South Korea and internationally, with a market cap of ₩555.27 billion.

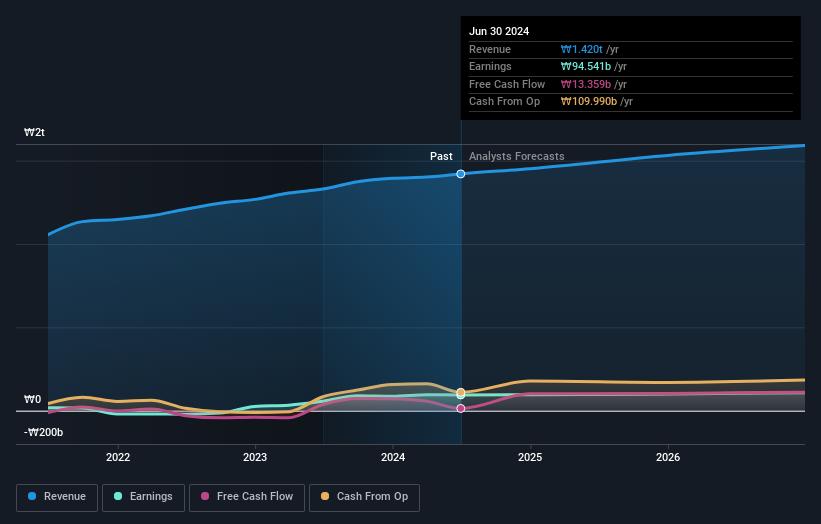

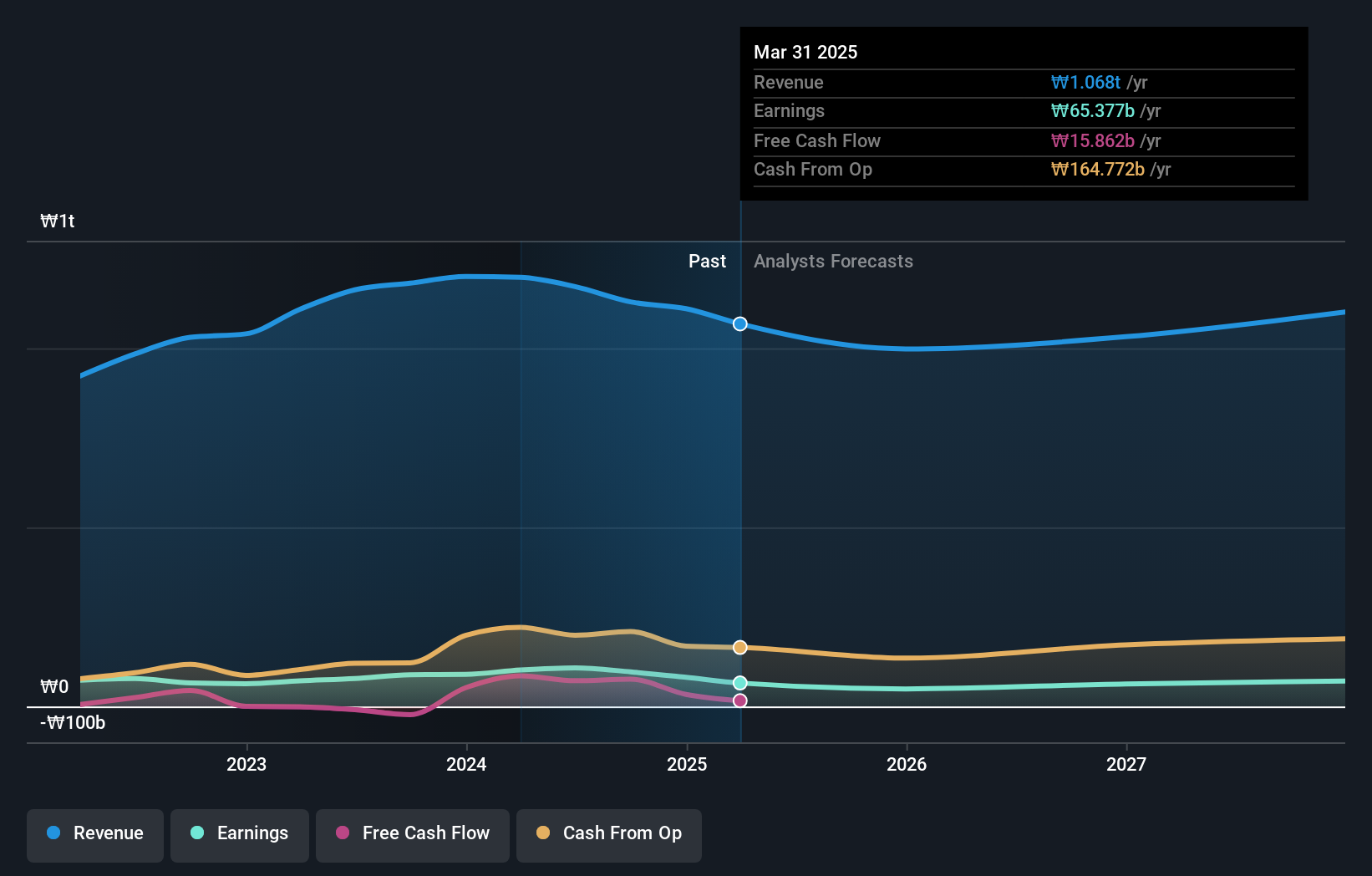

Operations: Revenue from manufacturing and selling dairy products amounts to ₩1.42 trillion.

Binggrae, a notable player in the food industry, has shown impressive earnings growth of 66.8% over the past year, outpacing the industry's 23.2%. Despite a slight dip in quarterly net income to KRW 36.33 billion from KRW 37.63 billion last year, its six-month figures reveal an increase to KRW 54.65 billion from KRW 46.33 billion previously, reflecting resilience and potential for investors eyeing value opportunities at current levels trading significantly below fair value estimates by about 82%. The company's debt-to-equity ratio rose to just 2.8% over five years while maintaining more cash than total debt suggests prudent financial management amidst expansion efforts.

- Click to explore a detailed breakdown of our findings in Binggrae's health report.

Gain insights into Binggrae's historical performance by reviewing our past performance report.

Asia CementLtd (KOSE:A183190)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Asia Cement Co., Ltd. operates in the manufacture and sale of cement and ready-mixed concrete in South Korea, with a market cap of approximately ₩411.88 billion.

Operations: Asia Cement Co., Ltd. generates revenue primarily from its cement business, which accounts for ₩1.20 trillion, while other business activities contribute ₩52.09 billion.

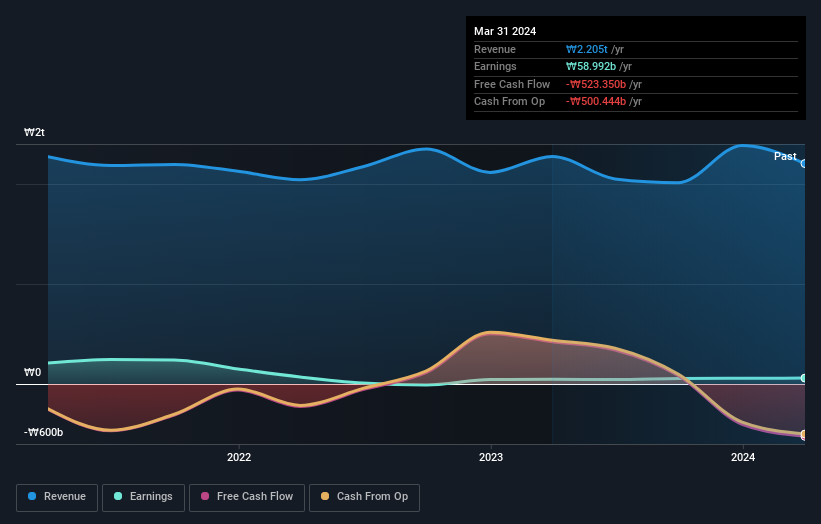

Asia Cement, a promising player in South Korea's market, has demonstrated robust financial health with a 38% earnings growth over the past year, outpacing the Basic Materials industry's -2.6%. Despite its high net debt to equity ratio at 44%, interest payments are comfortably covered by EBIT at 7.3x. The company is trading significantly below its estimated fair value by 81.5%, indicating potential undervaluation. Recent buyback announcements worth KRW 5 billion aim to stabilize stock prices and enhance shareholder value, while net income for Q2 surged to KRW 36 billion from KRW 30 billion last year.

- Dive into the specifics of Asia CementLtd here with our thorough health report.

Explore historical data to track Asia CementLtd's performance over time in our Past section.

Key Takeaways

- Investigate our full lineup of 177 KRX Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Binggrae might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A005180

Binggrae

Engages in production and distribution of dairy products in South Korea and internationally.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives