- South Korea

- /

- Capital Markets

- /

- KOSDAQ:A307930

Why We're Not Concerned About Company K Partners Limited's (KOSDAQ:307930) Share Price

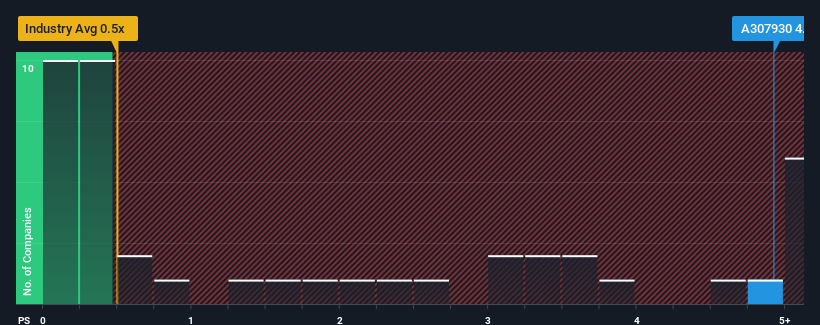

When you see that almost half of the companies in the Capital Markets industry in Korea have price-to-sales ratios (or "P/S") below 0.5x, Company K Partners Limited (KOSDAQ:307930) looks to be giving off strong sell signals with its 4.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Company K Partners

What Does Company K Partners' Recent Performance Look Like?

For instance, Company K Partners' receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Company K Partners, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Company K Partners' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 7.3%. This means it has also seen a slide in revenue over the longer-term as revenue is down 16% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to decline by 78% over the next year, even worse than the company's recent medium-term annualised revenue decline.

With this information, it might not be hard to see why Company K Partners is trading at a higher P/S in comparison. However, even if the company's recent growth rates were to continue outperforming the industry, shrinking revenues are unlikely to make the P/S premium sustainable over the longer term. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite experiencing declining revenues, Company K Partners has been able to maintain its high P/S off the back of its recentthree-year revenue not being as bad as the forecasts for a struggling industry, as expected. At this stage investors feel the potential for outperformance relative to the industry justifies a premium on the P/S ratio. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Although, if the company's relative outperformance doesn't change it will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Company K Partners (1 can't be ignored) you should be aware of.

If you're unsure about the strength of Company K Partners' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A307930

Company K Partners

A venture capital firm specializing in start-ups and companies at early-stage operating in emerging industries.

Excellent balance sheet slight.

Market Insights

Community Narratives