- South Korea

- /

- Capital Markets

- /

- KOSDAQ:A241520

DSC Investment Inc. (KOSDAQ:241520) Looks Just Right With A 35% Price Jump

DSC Investment Inc. (KOSDAQ:241520) shares have continued their recent momentum with a 35% gain in the last month alone. Notwithstanding the latest gain, the annual share price return of 7.2% isn't as impressive.

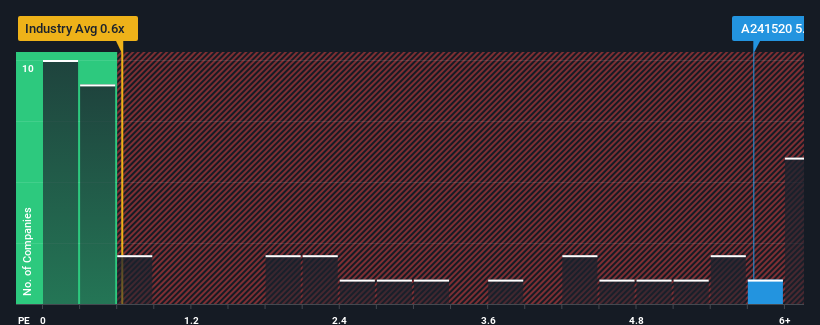

Since its price has surged higher, given around half the companies in Korea's Capital Markets industry have price-to-sales ratios (or "P/S") below 0.6x, you may consider DSC Investment as a stock to avoid entirely with its 5.7x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for DSC Investment

What Does DSC Investment's Recent Performance Look Like?

As an illustration, revenue has deteriorated at DSC Investment over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on DSC Investment will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, DSC Investment would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 52% decrease to the company's top line. As a result, revenue from three years ago have also fallen 20% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to shrink 60% in the next 12 months, the company's downward momentum is still superior based on recent medium-term annualised revenue results.

With this information, it might not be hard to see why DSC Investment is trading at a higher P/S in comparison. However, even if the company's recent growth rates were to continue outperforming the industry, shrinking revenues are unlikely to make the P/S premium sustainable over the longer term. There is potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

What We Can Learn From DSC Investment's P/S?

DSC Investment's P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite experiencing declining revenues, DSC Investment has been able to maintain its high P/S off the back of its recentthree-year revenue not being as bad as the forecasts for a struggling industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under any additional threat. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Although, if the company's relative outperformance doesn't change it will continue to provide strong support to the share price.

Before you take the next step, you should know about the 4 warning signs for DSC Investment that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A241520

DSC Investment

A venture capital firm specializing in early stage, startups, growth capital, mezzanine and secondary direct.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives