- South Korea

- /

- Capital Markets

- /

- KOSDAQ:A078020

EBEST Investment & Securities Co., Ltd. (KOSDAQ:078020) Looks Inexpensive But Perhaps Not Attractive Enough

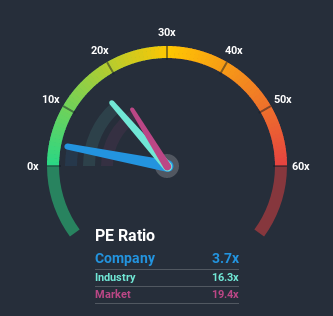

EBEST Investment & Securities Co., Ltd.'s (KOSDAQ:078020) price-to-earnings (or "P/E") ratio of 3.7x might make it look like a strong buy right now compared to the market in Korea, where around half of the companies have P/E ratios above 20x and even P/E's above 46x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for EBEST Investment & Securities as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for EBEST Investment & Securities

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as EBEST Investment & Securities' is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 118%. The latest three year period has also seen an excellent 78% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 38% during the coming year according to the sole analyst following the company. That's not great when the rest of the market is expected to grow by 42%.

In light of this, it's understandable that EBEST Investment & Securities' P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From EBEST Investment & Securities' P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of EBEST Investment & Securities' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 4 warning signs for EBEST Investment & Securities (2 make us uncomfortable!) that you need to take into consideration.

Of course, you might also be able to find a better stock than EBEST Investment & Securities. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

If you decide to trade EBEST Investment & Securities, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A078020

LS SECURITIES

Engages in the investment brokerage and trading businesses in South Korea.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives