- South Korea

- /

- Hospitality

- /

- KOSE:A070960

Even With A 25% Surge, Cautious Investors Are Not Rewarding HJ Magnolia Yongpyong Hotel & Resort's (KRX:070960) Performance Completely

The HJ Magnolia Yongpyong Hotel & Resort (KRX:070960) share price has done very well over the last month, posting an excellent gain of 25%. Looking further back, the 17% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

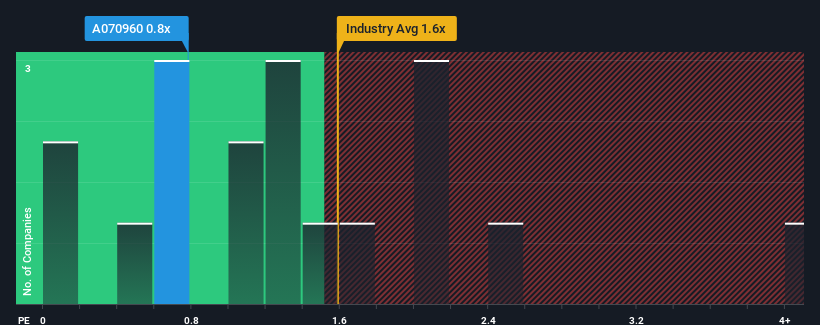

Even after such a large jump in price, it's still not a stretch to say that HJ Magnolia Yongpyong Hotel & Resort's price-to-sales (or "P/S") ratio of 0.8x right now seems quite "middle-of-the-road" compared to the Hospitality industry in Korea, where the median P/S ratio is around 1.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for HJ Magnolia Yongpyong Hotel & Resort

How Has HJ Magnolia Yongpyong Hotel & Resort Performed Recently?

HJ Magnolia Yongpyong Hotel & Resort certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on HJ Magnolia Yongpyong Hotel & Resort will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For HJ Magnolia Yongpyong Hotel & Resort?

In order to justify its P/S ratio, HJ Magnolia Yongpyong Hotel & Resort would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 43% last year. The strong recent performance means it was also able to grow revenue by 83% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is only predicted to deliver 7.1% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we find it interesting that HJ Magnolia Yongpyong Hotel & Resort is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Its shares have lifted substantially and now HJ Magnolia Yongpyong Hotel & Resort's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that HJ Magnolia Yongpyong Hotel & Resort currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for HJ Magnolia Yongpyong Hotel & Resort with six simple checks on some of these key factors.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A070960

Mona YongpyongLtd

Engages in the ownership and operation of resort in South Korea.

Good value with moderate growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026