- Italy

- /

- Energy Services

- /

- BIT:TEN

Three Prominent Dividend Stocks To Consider

Reviewed by Simply Wall St

In a week marked by busy earnings reports and fluctuating economic signals, global markets experienced varied performances, with major indices like the Nasdaq Composite and S&P MidCap 400 hitting highs before retreating. Amidst this backdrop of cautious optimism and market volatility, dividend stocks remain a compelling option for investors seeking steady income streams.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.86% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.19% | ★★★★★★ |

| Globeride (TSE:7990) | 4.12% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 5.03% | ★★★★★★ |

| Innotech (TSE:9880) | 4.86% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.22% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.57% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.10% | ★★★★★★ |

Click here to see the full list of 2030 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

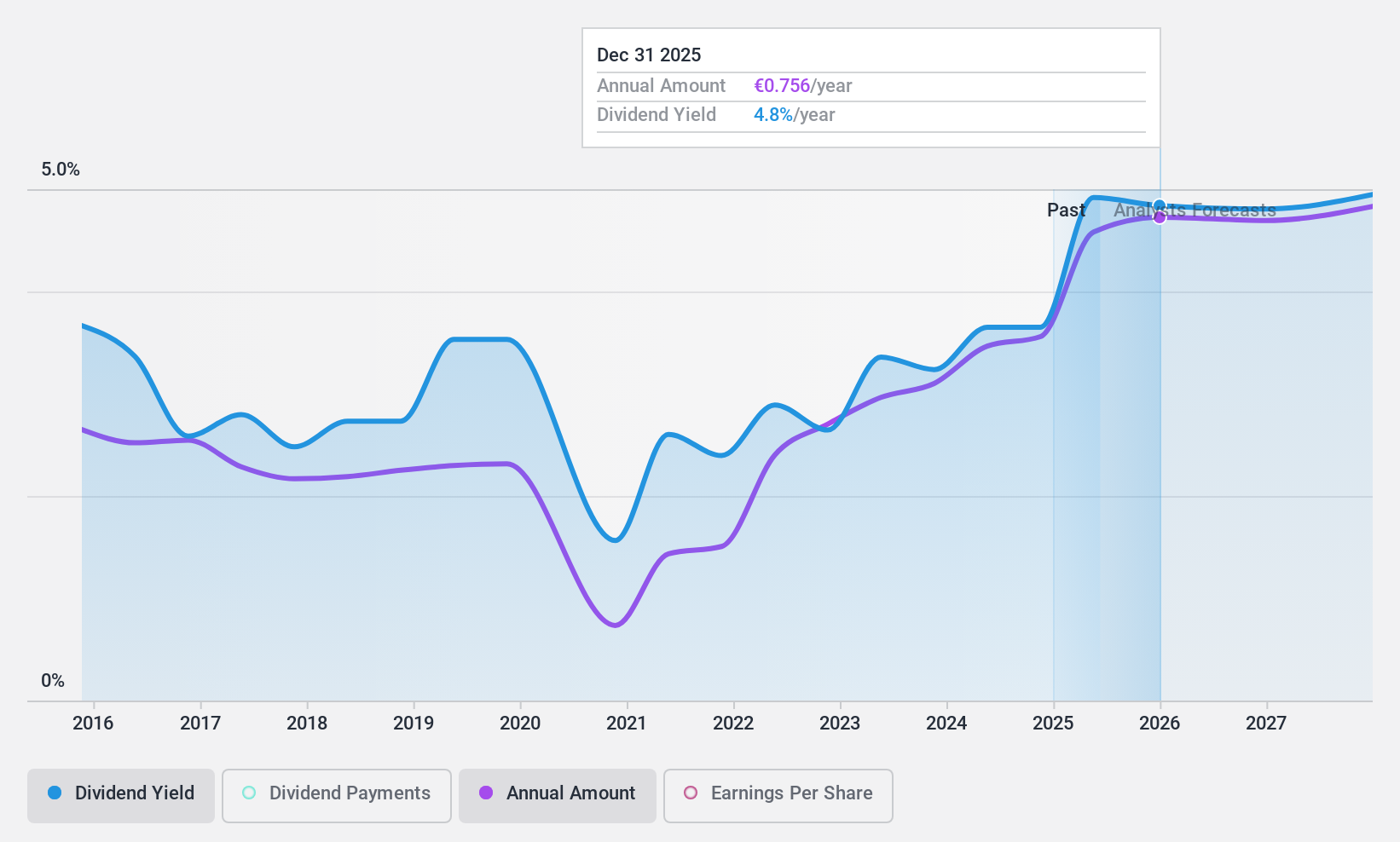

Tenaris (BIT:TEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tenaris S.A. manufactures and distributes steel pipes for the energy industry and other industrial applications across multiple regions, with a market cap of €17.04 billion.

Operations: The company's revenue primarily comes from its Tubes segment, which generated $12.39 billion.

Dividend Yield: 3.6%

Tenaris offers a low cash payout ratio of 20.3%, indicating dividends are well-covered by cash flows, but its yield of 3.58% lags behind top dividend payers in Italy. Despite a history of volatile and unreliable dividends, the company has managed to increase payouts over the past decade. Trading slightly below fair value, Tenaris presents good relative value compared to peers, although earnings are expected to decline by 8.5% annually over the next three years.

- Get an in-depth perspective on Tenaris' performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Tenaris is priced lower than what may be justified by its financials.

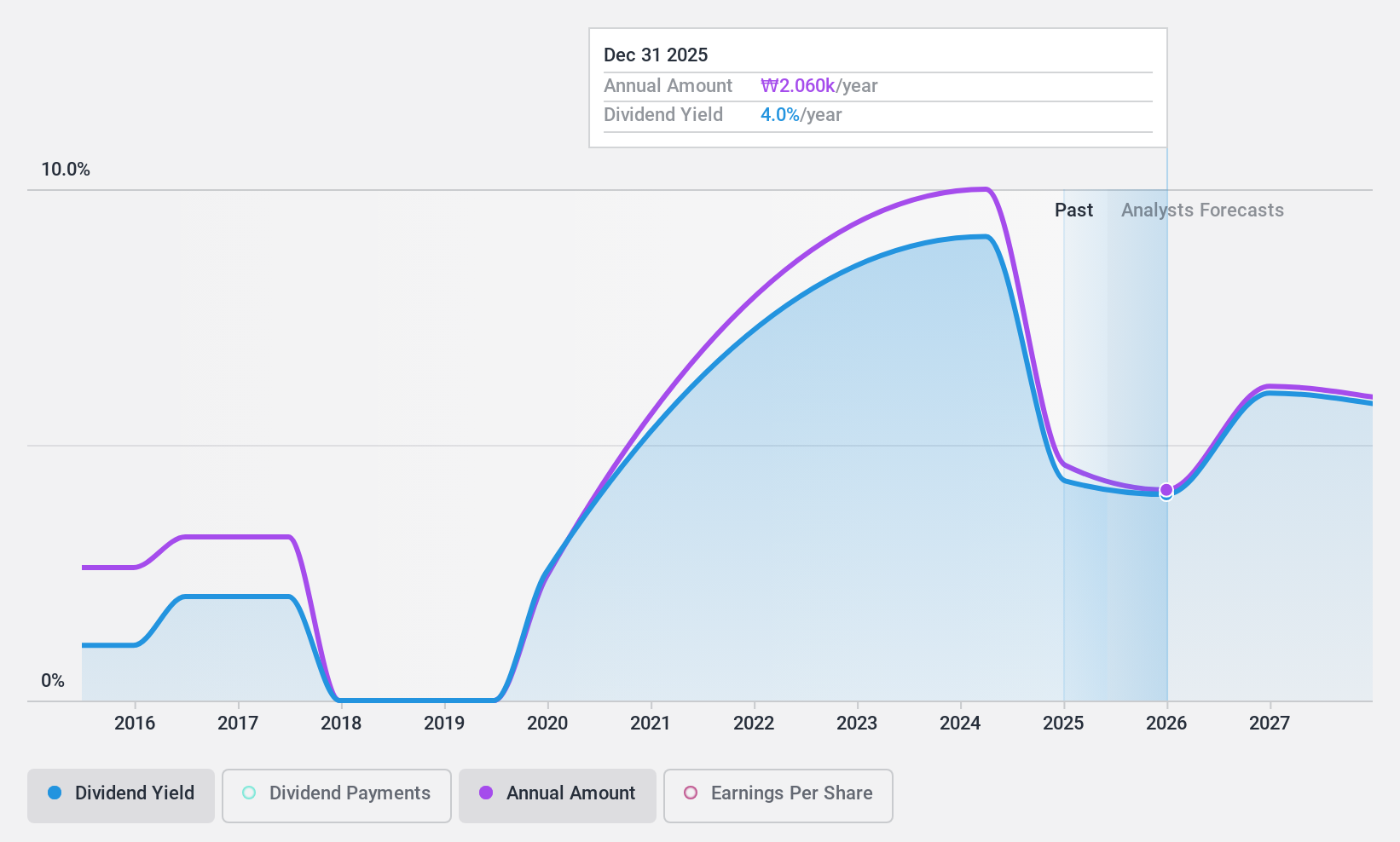

Hanatour Service (KOSE:A039130)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hanatour Service Inc. offers travel and related services across South Korea, Northeast and Southeast Asia, the United States, and Europe, with a market cap of ₩788.44 billion.

Operations: Hanatour Service Inc. generates revenue primarily from its Trip segment, amounting to ₩250.87 billion, and its Hotel segment, contributing ₩23.89 billion.

Dividend Yield: 9.8%

Hanatour Service's dividend yield of 9.82% ranks in the top 25% of Korean market payers, but its sustainability is questionable due to a high payout ratio of 140.3%, indicating dividends aren't well covered by earnings. Although the company has seen significant profit growth recently, its dividend history is marked by volatility and unreliability over the past decade, despite increased payments during this period. The stock trades at a discount to estimated fair value.

- Click here and access our complete dividend analysis report to understand the dynamics of Hanatour Service.

- The analysis detailed in our Hanatour Service valuation report hints at an deflated share price compared to its estimated value.

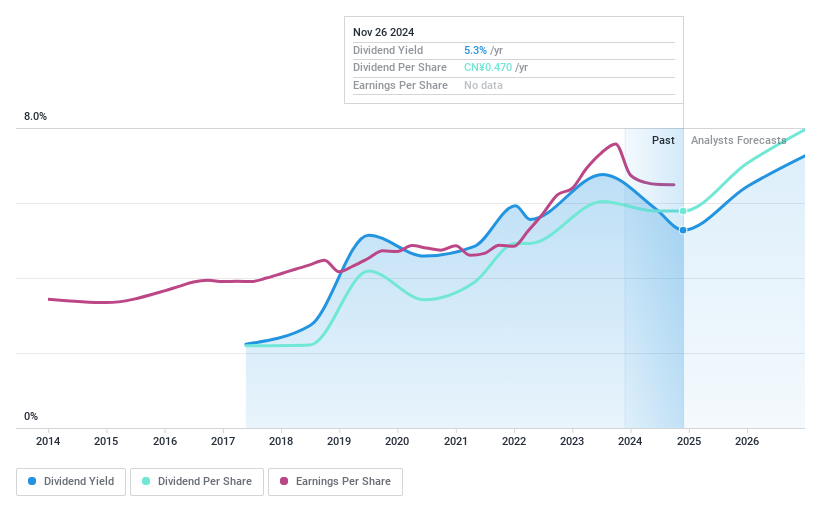

Bank of Jiangsu (SHSE:600919)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Jiangsu Co., Ltd. operates as a provider of diverse banking products and services in China, with a market cap of approximately CN¥168.10 billion.

Operations: Bank of Jiangsu Co., Ltd.'s revenue primarily comes from its diverse range of banking products and services offered in China.

Dividend Yield: 5.1%

Bank of Jiangsu offers a dividend yield of 5.13%, placing it in the top 25% of dividend payers in China. While the company has only paid dividends for seven years, its payments have been stable and reliable with low volatility. The dividends are well covered by earnings, with a payout ratio of 29%. Recent earnings showed growth, with net income rising to ¥28.23 billion from ¥25.65 billion year-over-year, supporting future dividend sustainability.

- Take a closer look at Bank of Jiangsu's potential here in our dividend report.

- The valuation report we've compiled suggests that Bank of Jiangsu's current price could be quite moderate.

Next Steps

- Get an in-depth perspective on all 2030 Top Dividend Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Tenaris, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tenaris might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:TEN

Tenaris

Manufactures and supplies steel pipe products and related services for the energy industry and other industrial applications in North America, South America, Europe, the Middle East and Africa, and the Asia Pacific.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives