- Taiwan

- /

- Transportation

- /

- TWSE:2611

Kangwon Land And 2 Other Top Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a landscape marked by accelerating U.S. inflation and climbing stock indexes, investors are keenly observing opportunities that balance growth with stability. In this context, dividend stocks like Kangwon Land offer potential appeal by providing consistent income streams, which can be particularly attractive during periods of economic uncertainty and market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Padma Oil (DSE:PADMAOIL) | 7.58% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.88% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.34% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.02% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.90% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.21% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.89% | ★★★★★★ |

Click here to see the full list of 1990 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

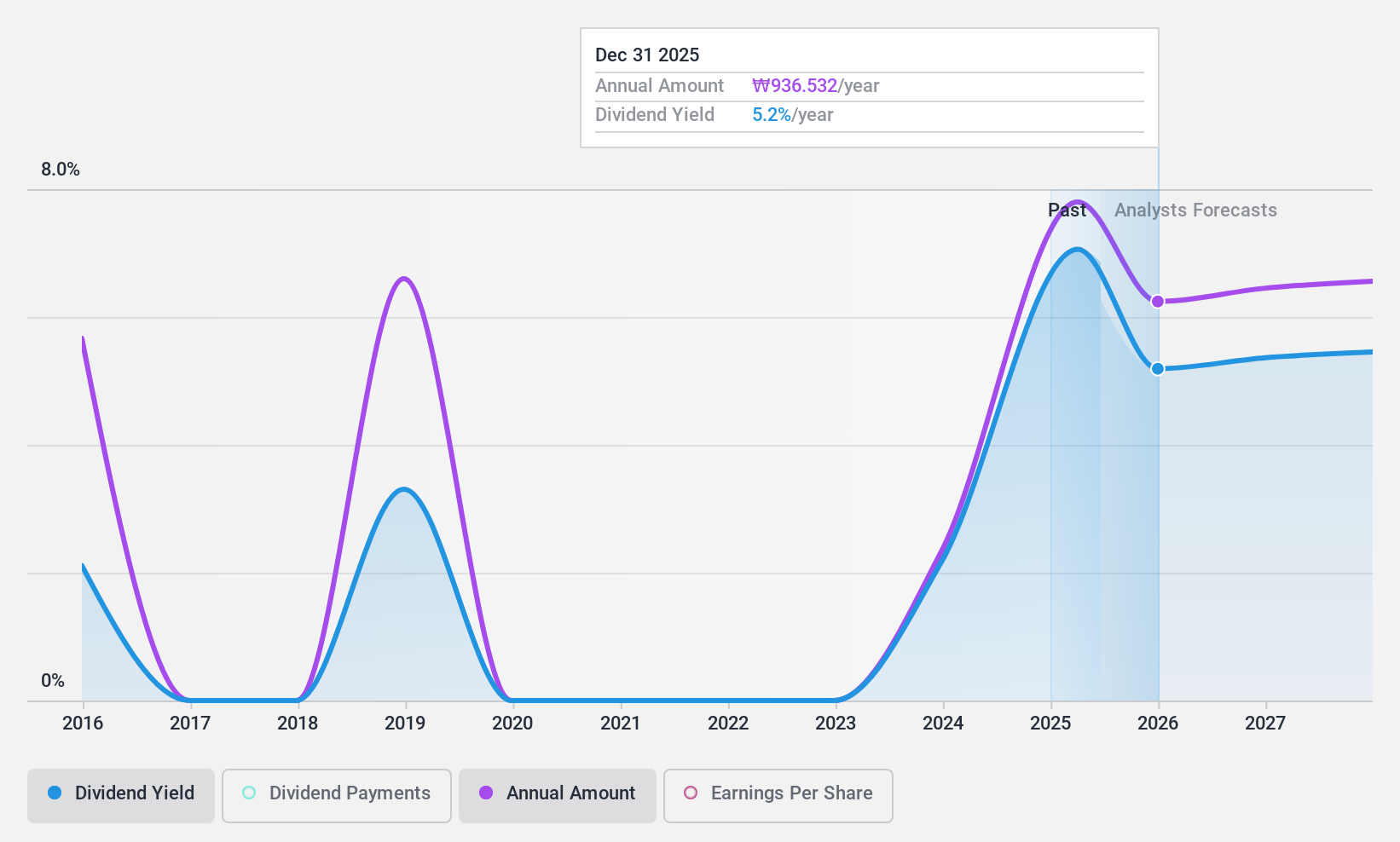

Kangwon Land (KOSE:A035250)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kangwon Land, Inc. operates in the casino, tourist hotel, and ski resort sectors in South Korea with a market cap of approximately ₩3.25 trillion.

Operations: Kangwon Land, Inc.'s primary revenue segment is its Casinos & Resorts business, generating approximately ₩1.43 billion.

Dividend Yield: 5.7%

Kangwon Land's dividend yield of 5.71% places it in the top 25% of Korean market payers, though its history is marked by volatility and instability. Despite this, dividends are well-covered by earnings (payout ratio: 45.1%) and cash flows (cash payout ratio: 80.4%). The stock trades at a favorable P/E ratio of 7.2x compared to the market average of 12.2x, with recent share buybacks totaling ₩40 billion indicating potential shareholder value enhancement efforts.

- Delve into the full analysis dividend report here for a deeper understanding of Kangwon Land.

- In light of our recent valuation report, it seems possible that Kangwon Land is trading behind its estimated value.

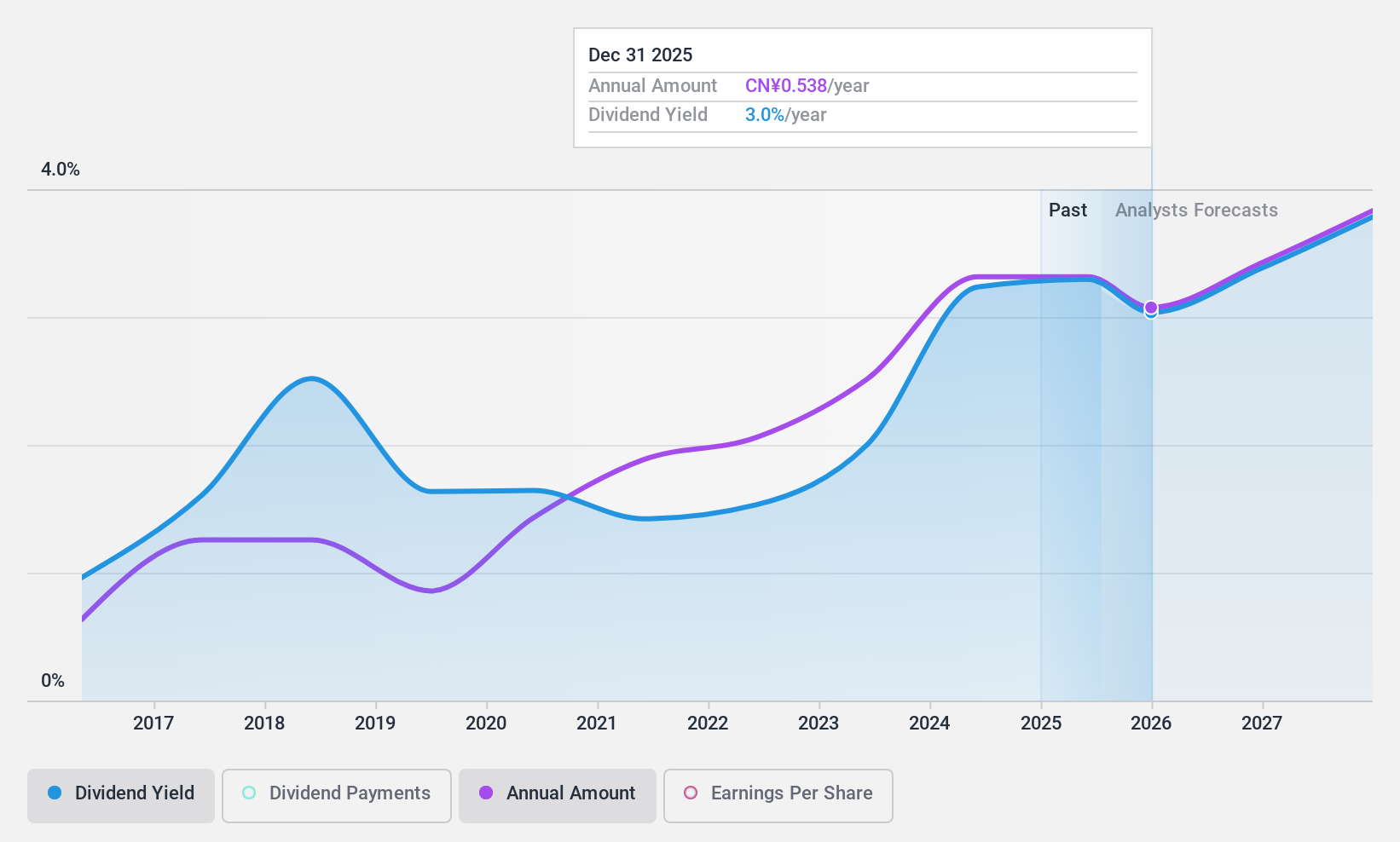

Shanghai Hanbell Precise Machinery (SZSE:002158)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shanghai Hanbell Precise Machinery Co., Ltd. operates in the manufacturing of compressors and related machinery, with a market cap of CN¥9.88 billion.

Operations: Shanghai Hanbell Precise Machinery Co., Ltd. generates its revenue primarily through the manufacturing of compressors and related machinery.

Dividend Yield: 3.1%

Shanghai Hanbell Precise Machinery's dividend yield of 3.05% ranks it among the top 25% in the Chinese market, yet its payout history has been unreliable and volatile over the past decade. Despite this, dividends are supported by a low earnings payout ratio of 34.2% and a cash payout ratio of 51%. The stock is trading at a significant discount, approximately 63.9% below its estimated fair value, suggesting potential for capital appreciation alongside income generation.

- Get an in-depth perspective on Shanghai Hanbell Precise Machinery's performance by reading our dividend report here.

- Our valuation report here indicates Shanghai Hanbell Precise Machinery may be undervalued.

Tze Shin International (TWSE:2611)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tze Shin International Co., Ltd. offers transportation services in Taiwan and has a market cap of approximately NT$4.30 billion.

Operations: Tze Shin International Co., Ltd. generates revenue from its Transportation Division (NT$341.79 million) and Hotel Sector (NT$317.80 million).

Dividend Yield: 10%

Tze Shin International's dividend yield of 9.98% places it in the top 25% of Taiwan's market, but its sustainability is questionable due to lack of free cash flow coverage and a high payout ratio of 78.1%. Despite earnings growth of 98.1% last year, dividends have been volatile and unreliable over the past decade. The stock trades at a substantial discount, about 42.5% below estimated fair value, indicating potential for capital gains despite dividend concerns.

- Click here to discover the nuances of Tze Shin International with our detailed analytical dividend report.

- Our expertly prepared valuation report Tze Shin International implies its share price may be lower than expected.

Make It Happen

- Navigate through the entire inventory of 1990 Top Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tze Shin International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2611

Good value with proven track record and pays a dividend.

Market Insights

Community Narratives