- South Korea

- /

- Consumer Services

- /

- KOSDAQ:A066620

Returns On Capital At Kukbo Design (KOSDAQ:066620) Have Hit The Brakes

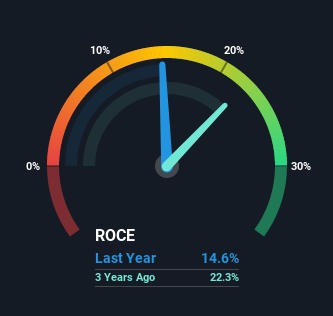

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. With that in mind, the ROCE of Kukbo Design (KOSDAQ:066620) looks decent, right now, so lets see what the trend of returns can tell us.

Return On Capital Employed (ROCE): What is it?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Kukbo Design is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.15 = ₩25b ÷ (₩269b - ₩95b) (Based on the trailing twelve months to December 2020).

So, Kukbo Design has an ROCE of 15%. In absolute terms, that's a satisfactory return, but compared to the Consumer Services industry average of 10% it's much better.

See our latest analysis for Kukbo Design

Historical performance is a great place to start when researching a stock so above you can see the gauge for Kukbo Design's ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of Kukbo Design, check out these free graphs here.

What The Trend Of ROCE Can Tell Us

The trend of ROCE doesn't stand out much, but returns on a whole are decent. The company has employed 101% more capital in the last five years, and the returns on that capital have remained stable at 15%. 15% is a pretty standard return, and it provides some comfort knowing that Kukbo Design has consistently earned this amount. Over long periods of time, returns like these might not be too exciting, but with consistency they can pay off in terms of share price returns.

The Bottom Line On Kukbo Design's ROCE

The main thing to remember is that Kukbo Design has proven its ability to continually reinvest at respectable rates of return. And given the stock has only risen 21% over the last five years, we'd suspect the market is beginning to recognize these trends. So because of the trends we're seeing, we'd recommend looking further into this stock to see if it has the makings of a multi-bagger.

Kukbo Design does have some risks though, and we've spotted 1 warning sign for Kukbo Design that you might be interested in.

While Kukbo Design may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kukbo Design might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A066620

Kukbo Design

Operates as an interior design company in South Korea and internationally.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A buy recommendation

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026