- South Korea

- /

- Luxury

- /

- KOSE:A111110

How Much Did Hojeon's(KRX:111110) Shareholders Earn From Share Price Movements Over The Last Year?

It is a pleasure to report that the Hojeon Limited (KRX:111110) is up 34% in the last quarter. But that is minimal compensation for the share price under-performance over the last year. The cold reality is that the stock has dropped 30% in one year, under-performing the market.

Check out our latest analysis for Hojeon

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

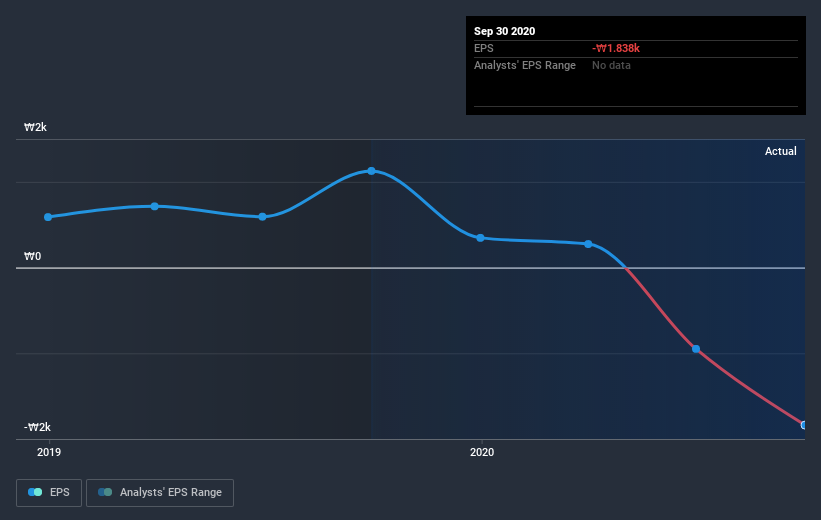

Hojeon fell to a loss making position during the year. While this may prove temporary, we'd consider it a negative, so it doesn't surprise us that the stock price is down. We hope for shareholders' sake that the company becomes profitable again soon.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

Over the last year, Hojeon shareholders took a loss of 28%, including dividends. In contrast the market gained about 47%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. The three-year loss of 7% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. It's always interesting to track share price performance over the longer term. But to understand Hojeon better, we need to consider many other factors. For example, we've discovered 6 warning signs for Hojeon (2 shouldn't be ignored!) that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade Hojeon, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hojeon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A111110

Hojeon

A garment company, produces and sells garments in South Korea, Indonesia, and Vietnam.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives