- South Korea

- /

- Consumer Durables

- /

- KOSE:A021240

COWAY Co., Ltd.'s (KRX:021240) Earnings Are Not Doing Enough For Some Investors

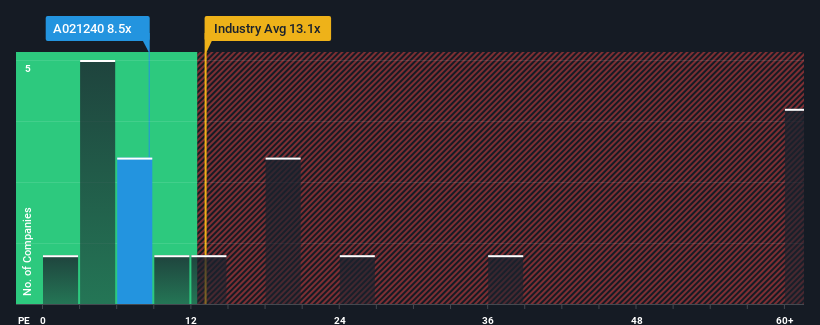

COWAY Co., Ltd.'s (KRX:021240) price-to-earnings (or "P/E") ratio of 8.5x might make it look like a buy right now compared to the market in Korea, where around half of the companies have P/E ratios above 14x and even P/E's above 27x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, COWAY has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for COWAY

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as COWAY's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a decent 5.6% gain to the company's bottom line. The solid recent performance means it was also able to grow EPS by 10% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings should grow by 8.7% per annum over the next three years. Meanwhile, the rest of the market is forecast to expand by 20% each year, which is noticeably more attractive.

In light of this, it's understandable that COWAY's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On COWAY's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of COWAY's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with COWAY, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on COWAY, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade COWAY, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A021240

COWAY

Engages in the production and sale of environmental home appliances in South Korea and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives