- South Korea

- /

- Consumer Durables

- /

- KOSE:A011090

EnexLtd (KRX:011090) Has Debt But No Earnings; Should You Worry?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Enex Co.,Ltd (KRX:011090) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for EnexLtd

What Is EnexLtd's Net Debt?

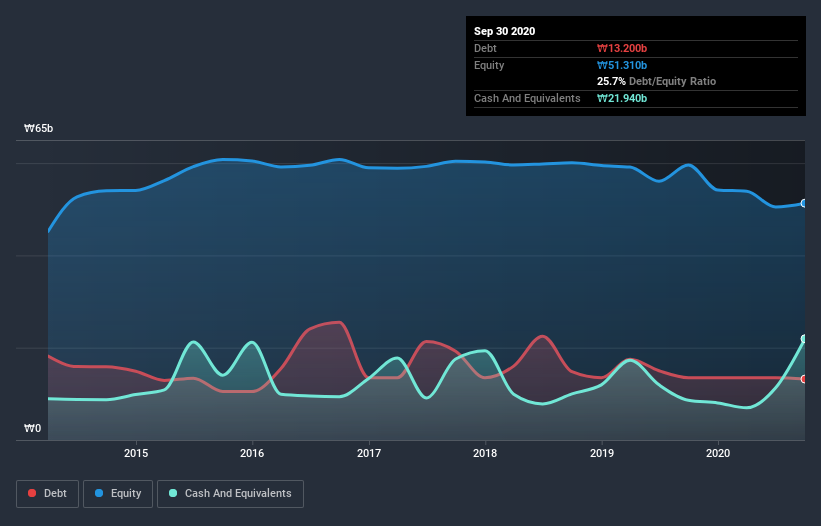

The chart below, which you can click on for greater detail, shows that EnexLtd had ₩13.2b in debt in September 2020; about the same as the year before. However, its balance sheet shows it holds ₩21.9b in cash, so it actually has ₩8.74b net cash.

How Strong Is EnexLtd's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that EnexLtd had liabilities of ₩58.1b due within 12 months and liabilities of ₩9.02b due beyond that. On the other hand, it had cash of ₩21.9b and ₩42.5b worth of receivables due within a year. So its liabilities total ₩2.71b more than the combination of its cash and short-term receivables.

Given EnexLtd has a market capitalization of ₩66.6b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, EnexLtd also has more cash than debt, so we're pretty confident it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But it is EnexLtd's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, EnexLtd made a loss at the EBIT level, and saw its revenue drop to ₩246b, which is a fall of 38%. That makes us nervous, to say the least.

So How Risky Is EnexLtd?

While EnexLtd lost money on an earnings before interest and tax (EBIT) level, it actually generated positive free cash flow ₩9.8b. So taking that on face value, and considering the net cash situation, we don't think that the stock is too risky in the near term. With revenue growth uninspiring, we'd really need to see some positive EBIT before mustering much enthusiasm for this business. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 2 warning signs for EnexLtd you should be aware of, and 1 of them shouldn't be ignored.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading EnexLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if ENEX might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A011090

ENEX

Enex Co., Ltd. manufactures and sells furniture in Korea and internationally.

Acceptable track record with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026