- South Korea

- /

- Luxury

- /

- KOSE:A009970

Exploring Dividend Stocks On The KRX HANYANG ENGLtd And 2 Others

Reviewed by Simply Wall St

The South Korean stock market has been experiencing a downward trend, with the KOSPI index declining over recent sessions amid global economic uncertainties and mixed performances across different sectors. As investors navigate these challenging conditions, focusing on dividend stocks like HANYANG ENG Ltd could offer potential stability, as these stocks typically provide regular income regardless of market volatility.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 4.76% | ★★★★★★ |

| Shinhan Financial Group (KOSE:A055550) | 4.45% | ★★★★★☆ |

| KT (KOSE:A030200) | 5.46% | ★★★★★☆ |

| KB Financial Group (KOSE:A105560) | 3.85% | ★★★★★☆ |

| LOTTE Fine Chemical (KOSE:A004000) | 4.17% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.10% | ★★★★★☆ |

| Cheil Worldwide (KOSE:A030000) | 5.94% | ★★★★☆☆ |

| Snt DynamicsLtd (KOSE:A003570) | 3.65% | ★★★★☆☆ |

| Samyang (KOSE:A145990) | 3.49% | ★★★★☆☆ |

| Korea Cast Iron Pipe Ind (KOSE:A000970) | 6.13% | ★★★★☆☆ |

Click here to see the full list of 70 stocks from our Top KRX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

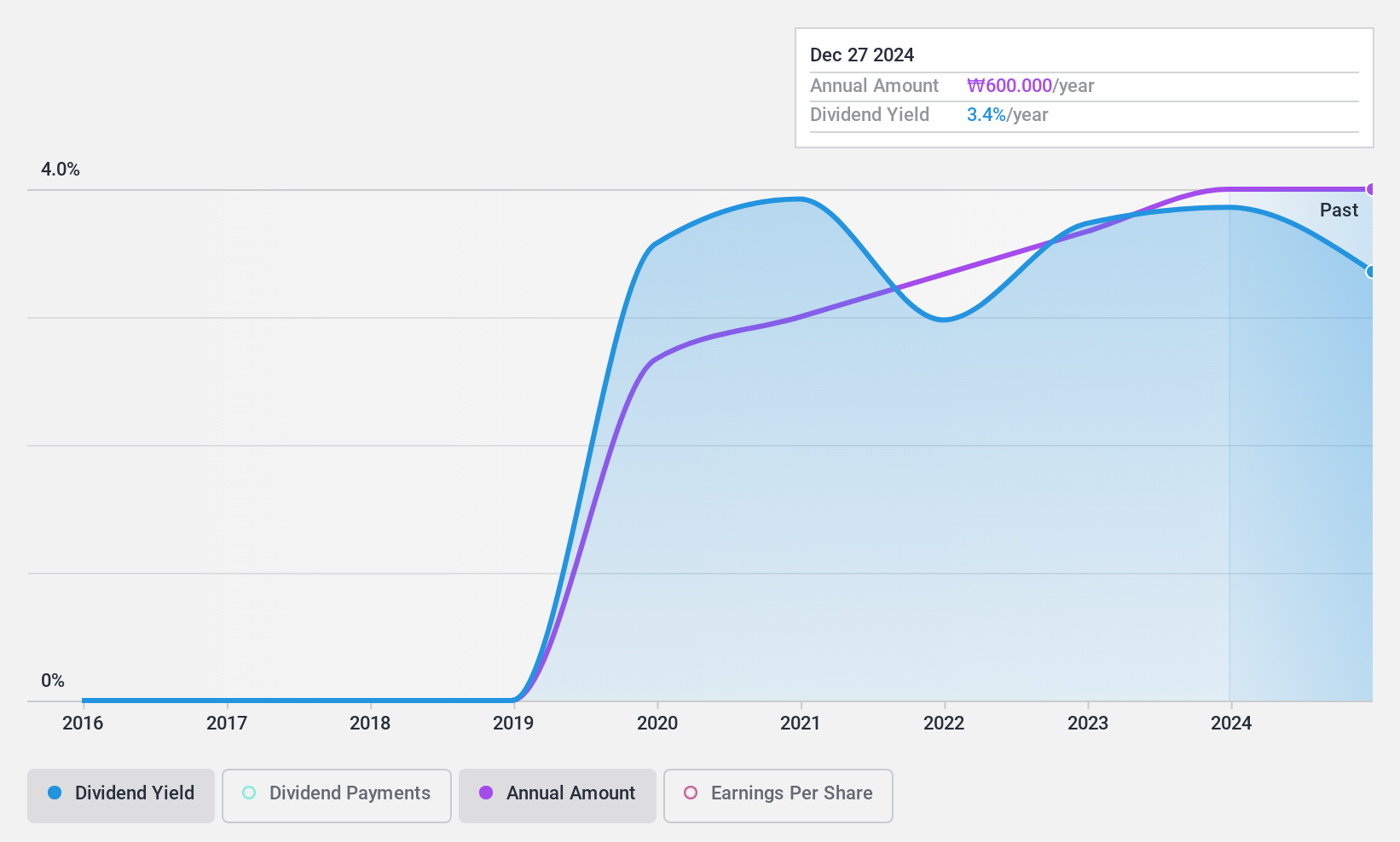

HANYANG ENGLtd (KOSDAQ:A045100)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hanyang ENG Co., Ltd specializes in constructing semiconductor facilities both domestically in South Korea and internationally, with a market capitalization of approximately ₩327.40 billion.

Operations: Hanyang ENG Co., Ltd generates its revenue primarily from the construction of semiconductor facilities across South Korea and various global markets.

Dividend Yield: 3.1%

HANYANG ENG Ltd. offers a modest dividend yield of 3.1%, slightly below the top quartile of South Korean dividend stocks at 3.52%. Despite this, the company's dividends are well-supported by both earnings and cash flows, with a payout ratio of 12.5% and a cash payout ratio of 8.9%, indicating sustainability and reliability over the past decade. Additionally, its Price-To-Earnings ratio stands at an attractive 4x compared to the broader market's 12.6x, enhancing its appeal for value-oriented dividend investors.

- Click here and access our complete dividend analysis report to understand the dynamics of HANYANG ENGLtd.

- In light of our recent valuation report, it seems possible that HANYANG ENGLtd is trading beyond its estimated value.

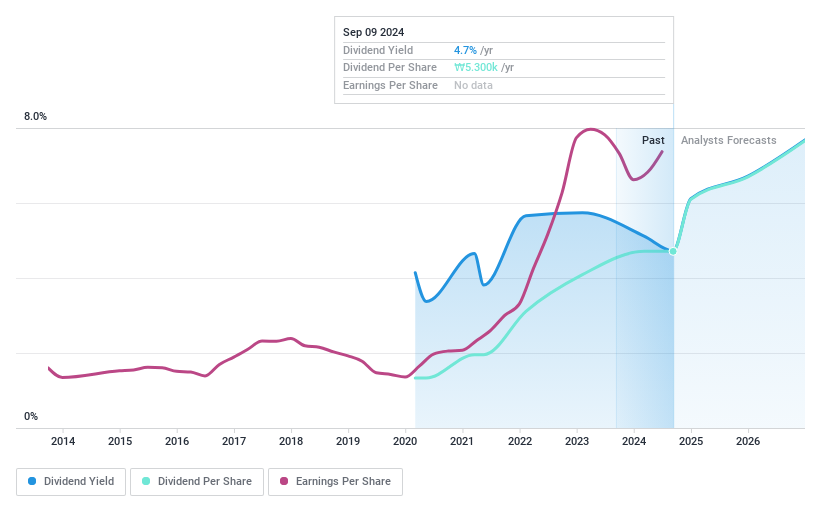

DB Insurance (KOSE:A005830)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DB Insurance Co., Ltd. offers a range of insurance products and services in South Korea, with a market capitalization of approximately ₩6.21 billion.

Operations: DB Insurance Co., Ltd. generates revenue primarily from its Non-Life Insurance Sector, which brought in ₩19.04 billion, followed by the Life Insurance Sector at ₩1.50 billion, and a smaller contribution from the Installment Finance Sector at ₩0.04 billion.

Dividend Yield: 5.1%

DB Insurance has increased its dividend payments over the past four years, with a current yield of 5.12%, placing it in the top 25% of dividend payers in South Korea. The dividends are well-supported, evidenced by a low payout ratio of 18.3% and an even lower cash payout ratio of 7.2%, indicating strong coverage by both earnings and cash flows. Despite trading at 82.6% below estimated fair value and favorably against peers, its dividend track record is relatively short and unstable, which might concern long-term focused investors.

- Unlock comprehensive insights into our analysis of DB Insurance stock in this dividend report.

- In light of our recent valuation report, it seems possible that DB Insurance is trading behind its estimated value.

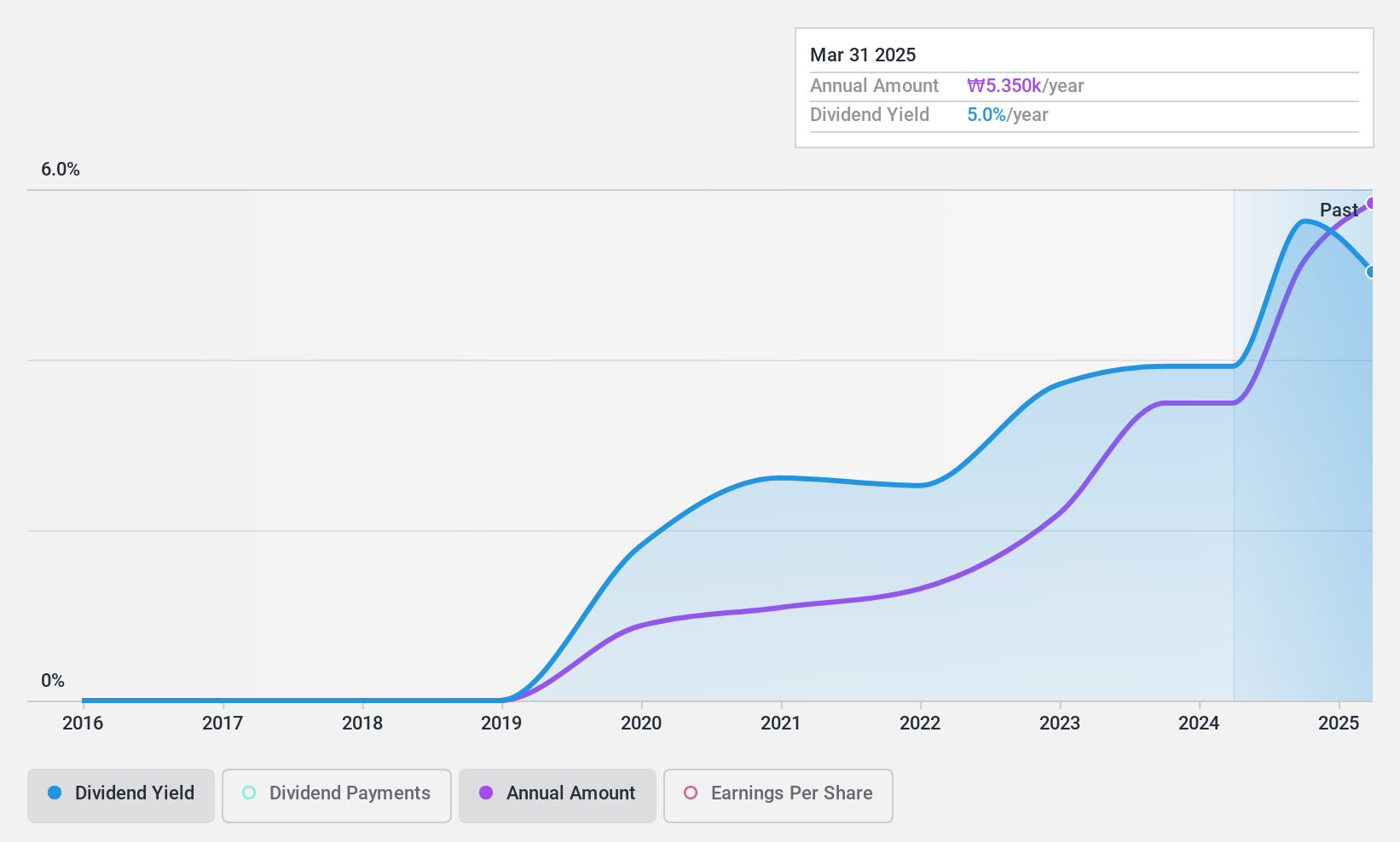

Youngone Holdings (KOSE:A009970)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Youngone Holdings Co., Ltd. is a global manufacturer and seller of apparel, footwear, gear, sportswear, and jackets, with a market capitalization of approximately ₩1.01 trillion.

Operations: Youngone Holdings Co., Ltd. generates its revenues primarily through the manufacture and international sale of apparel, footwear, gear, sportswear, and jackets.

Dividend Yield: 5.4%

Youngone Holdings offers a dividend yield of 5.44%, ranking it among the top 25% in the South Korean market. The company's dividends are well-supported by a low payout ratio of 13.3% and an even lower cash payout ratio of 9.9%, ensuring strong coverage by earnings and cash flows alike. Despite its appealing valuation, trading at 76.9% below estimated fair value, Youngone has paid dividends for less than ten years, which might raise concerns about the sustainability and reliability of its dividend payments in the longer term.

- Dive into the specifics of Youngone Holdings here with our thorough dividend report.

- Our expertly prepared valuation report Youngone Holdings implies its share price may be lower than expected.

Make It Happen

- Discover the full array of 70 Top KRX Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Youngone Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A009970

Youngone Holdings

Manufactures and sells apparel, footwear, gear, sportswear, and jackets in South Korea and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives