- South Korea

- /

- Luxury

- /

- KOSE:A008500

There's No Escaping Iljeong Industrial Co.,Ltd's (KRX:008500) Muted Earnings Despite A 29% Share Price Rise

Iljeong Industrial Co.,Ltd (KRX:008500) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. Looking further back, the 11% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

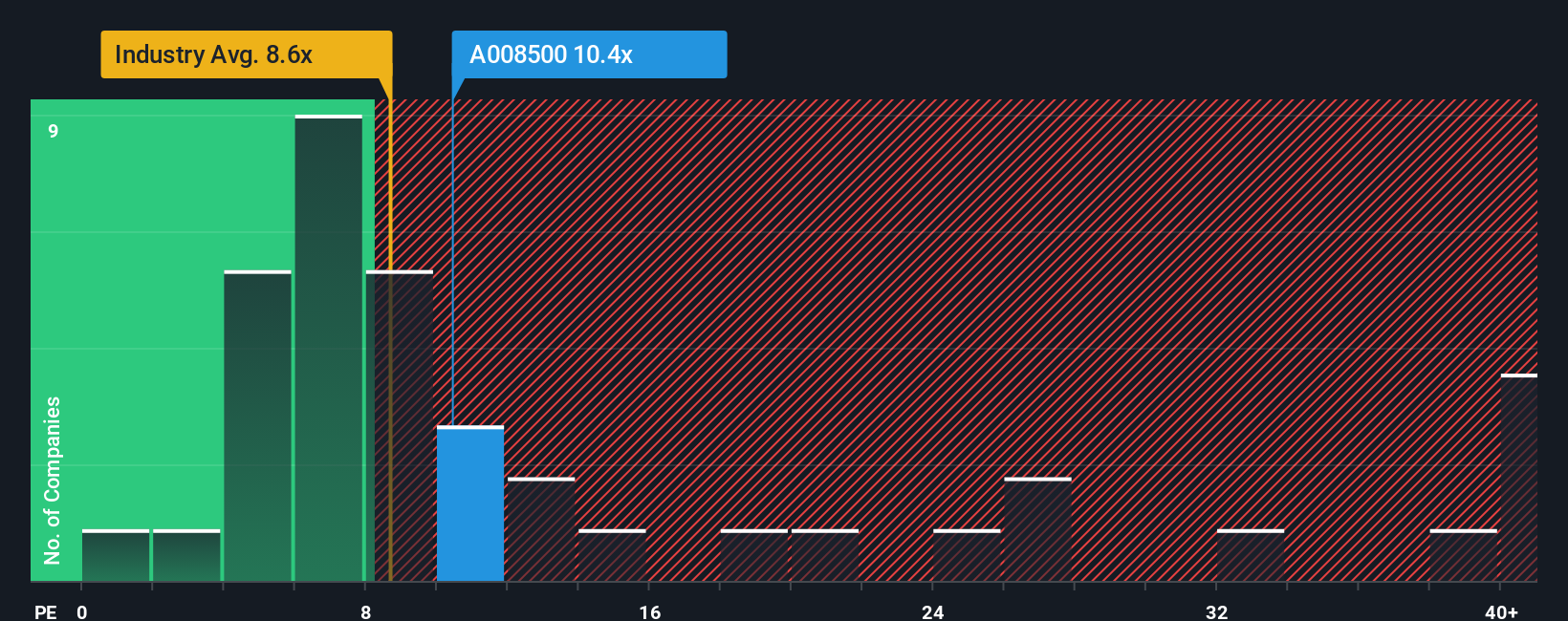

Even after such a large jump in price, Iljeong IndustrialLtd's price-to-earnings (or "P/E") ratio of 10.4x might still make it look like a buy right now compared to the market in Korea, where around half of the companies have P/E ratios above 16x and even P/E's above 35x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

For instance, Iljeong IndustrialLtd's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for Iljeong IndustrialLtd

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Iljeong IndustrialLtd would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 7.6%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 33% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Iljeong IndustrialLtd is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Iljeong IndustrialLtd's P/E?

Despite Iljeong IndustrialLtd's shares building up a head of steam, its P/E still lags most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Iljeong IndustrialLtd revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Iljeong IndustrialLtd (2 are concerning!) that you need to be mindful of.

If you're unsure about the strength of Iljeong IndustrialLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A008500

Iljeong IndustrialLtd

Iljeong Industrial Co.Ltd. provides car seat fabrics to automobile makers in Korea.

Slight risk with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.