- South Korea

- /

- Luxury

- /

- KOSDAQ:A900110

Impressive Earnings May Not Tell The Whole Story For East Asia Holdings Investment (KOSDAQ:900110)

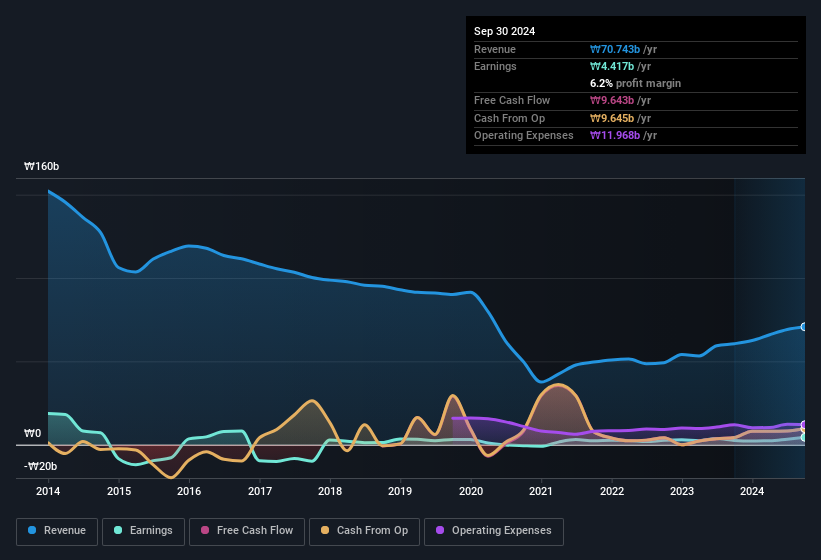

East Asia Holdings Investment Limited's (KOSDAQ:900110) robust earnings report didn't manage to move the market for its stock. We did some digging, and we found some concerning factors in the details.

See our latest analysis for East Asia Holdings Investment

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. East Asia Holdings Investment expanded the number of shares on issue by 7.5% over the last year. As a result, its net income is now split between a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of East Asia Holdings Investment's EPS by clicking here.

A Look At The Impact Of East Asia Holdings Investment's Dilution On Its Earnings Per Share (EPS)

East Asia Holdings Investment has improved its profit over the last three years, with an annualized gain of 84% in that time. But on the other hand, earnings per share actually fell by 48% per year. And at a glance the 73% gain in profit over the last year impresses. On the other hand, earnings per share are only up 19% in that time. And so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, earnings per share growth should beget share price growth. So it will certainly be a positive for shareholders if East Asia Holdings Investment can grow EPS persistently. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of East Asia Holdings Investment.

How Do Unusual Items Influence Profit?

Alongside that dilution, it's also important to note that East Asia Holdings Investment's profit suffered from unusual items, which reduced profit by ₩681m in the last twelve months. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And that's hardly a surprise given these line items are considered unusual. Assuming those unusual expenses don't come up again, we'd therefore expect East Asia Holdings Investment to produce a higher profit next year, all else being equal.

Our Take On East Asia Holdings Investment's Profit Performance

East Asia Holdings Investment suffered from unusual items which depressed its profit in its last report; if that is not repeated then profit should be higher, all else being equal. But unfortunately the dilution means that shareholders now own a smaller proportion of the company (assuming they maintained the same number of shares). That will weigh on earnings per share, even if it is not reflected in net income. Given the contrasting considerations, we don't have a strong view as to whether East Asia Holdings Investment's profits are an apt reflection of its underlying potential for profit. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. For example - East Asia Holdings Investment has 2 warning signs we think you should be aware of.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

Valuation is complex, but we're here to simplify it.

Discover if East Asia Holdings Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A900110

East Asia Holdings Investment

Through its subsidiaries, engages in the design, production and sale of sports footwear products, and the sale of sports apparel products under the Qiuzhi brand in mainland China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives