- South Korea

- /

- Consumer Durables

- /

- KOSDAQ:A037070

Should You Be Adding Paseco (KOSDAQ:037070) To Your Watchlist Today?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Paseco (KOSDAQ:037070). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Paseco

How Fast Is Paseco Growing Its Earnings Per Share?

Over the last three years, Paseco has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a wedge-tailed eagle on the wind, Paseco's EPS soared from ₩770 to ₩969, in just one year. That's a commendable gain of 26%.

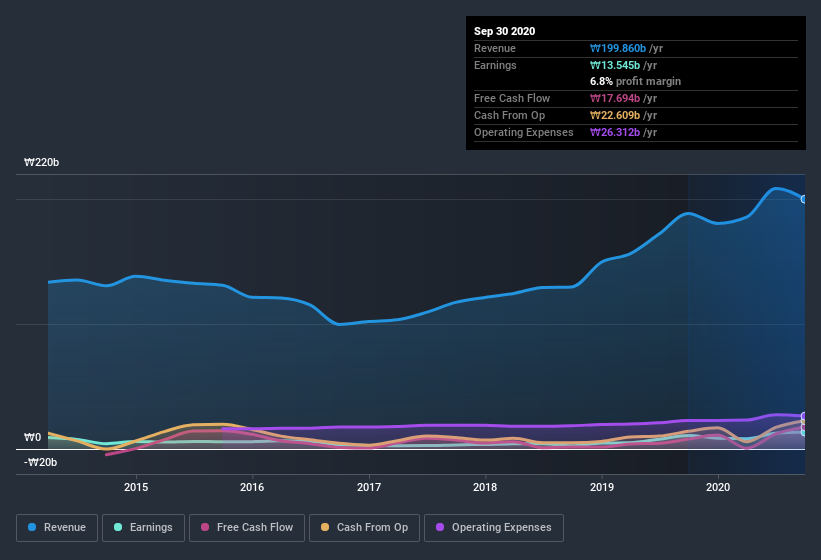

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Paseco shareholders can take confidence from the fact that EBIT margins are up from 6.4% to 8.7%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Paseco is no giant, with a market capitalization of ₩308b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Paseco Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Paseco insiders own a meaningful share of the business. In fact, they own 79% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. At the current share price, that insider holding is worth a whopping ₩243b. That means they have plenty of their own capital riding on the performance of the business!

Should You Add Paseco To Your Watchlist?

For growth investors like me, Paseco's raw rate of earnings growth is a beacon in the night. Further, the high level of insider ownership impresses me, and suggests that I'm not the only one who appreciates the EPS growth. So this is very likely the kind of business that I like to spend time researching, with a view to discerning its true value. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Paseco that you should be aware of.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Paseco, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A037070

Paseco

Manufactures and sells water appliances, heaters, and commercial and home appliances primarily in Korea.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion