As global markets navigate the uncertainty surrounding the incoming Trump administration's policies, investors are closely watching sector performances and interest rate expectations. In this environment of fluctuating yields and policy implications, dividend stocks offer a potential for steady income streams, making them an attractive consideration for those seeking stability amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.78% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.16% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.37% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.58% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.39% | ★★★★★★ |

Click here to see the full list of 1966 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

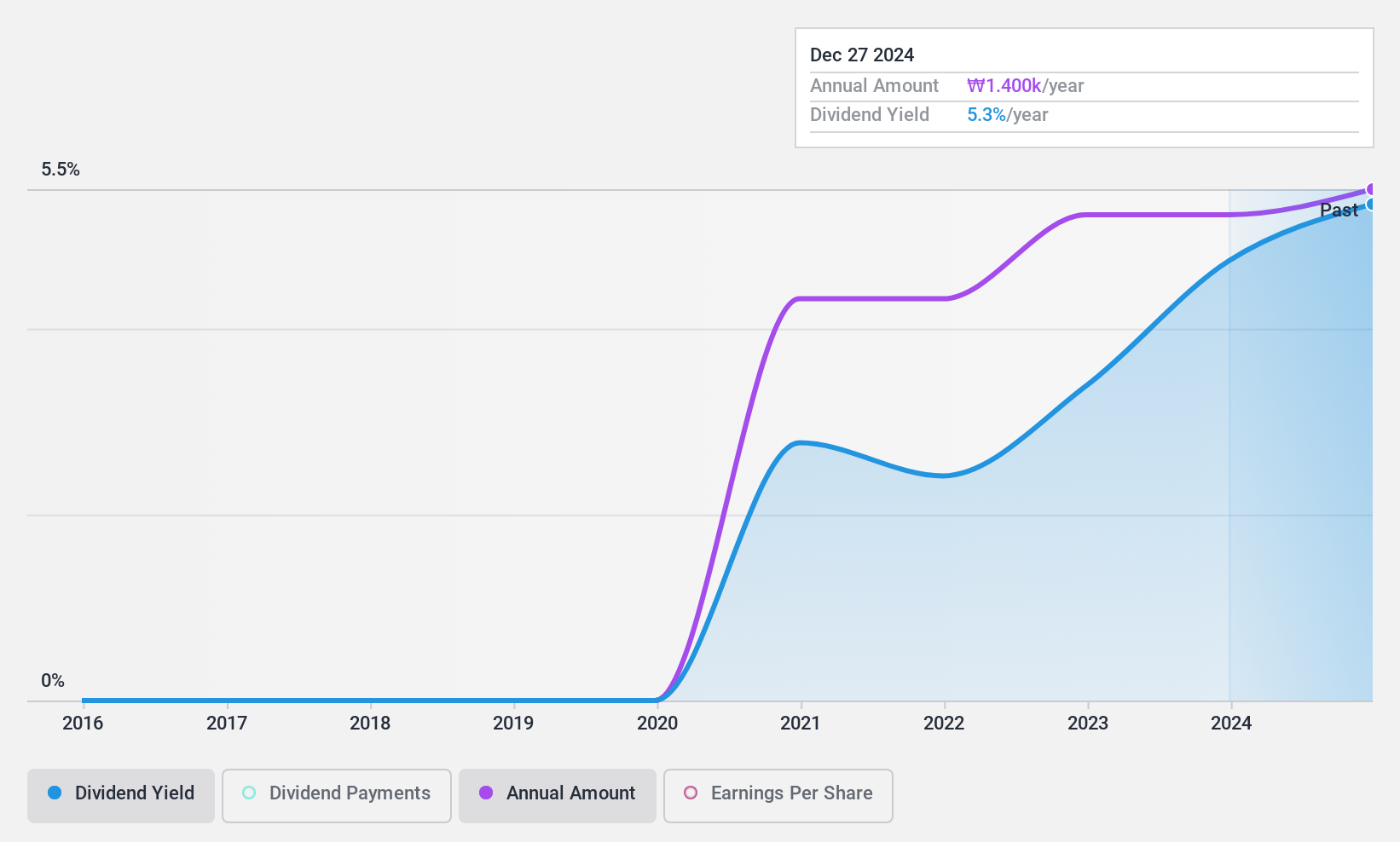

Ace Bed (KOSDAQ:A003800)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ace Bed Company Limited manufactures and sells beds and furniture products both in Korea and internationally, with a market cap of ₩276.59 billion.

Operations: Ace Bed Company Limited generates revenue from the manufacture and sale of beds and furniture products in Korea and international markets.

Dividend Yield: 5.3%

Ace Bed's dividend payments are well-supported by both earnings and cash flows, with payout ratios of 23.6% and 35.2%, respectively. Although the company has only been paying dividends for four years, they have been stable and reliable during this period. Trading at a significant discount to its estimated fair value, Ace Bed offers a competitive dividend yield in the top quartile of the KR market. Recent earnings growth further supports its dividend sustainability.

- Click here and access our complete dividend analysis report to understand the dynamics of Ace Bed.

- Our valuation report here indicates Ace Bed may be undervalued.

Multi-Chem (SGX:AWZ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Multi-Chem Limited is an investment holding company that distributes information technology products in Singapore, Greater China, Australia, India, and internationally with a market cap of SGD255.87 million.

Operations: Multi-Chem Limited generates revenue primarily from its IT business across various regions, including SGD389.78 million in Singapore, SGD68.30 million in India, SGD45.99 million in Australia, and SGD142.69 million from other international markets; additionally, it earns SGD1.63 million from its PCB business in Singapore.

Dividend Yield: 9.4%

Multi-Chem's dividend payments, supported by earnings and cash flows with payout ratios of 79.8% and 72.7%, respectively, are among the top tier in the SG market. However, its dividends have been volatile over the past decade, lacking reliability despite some growth. Recent earnings results show a slight decrease in quarterly net income to S$7.11 million but an increase for nine months to S$23.53 million, indicating potential for future stability if trends continue positively.

- Dive into the specifics of Multi-Chem here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Multi-Chem is trading behind its estimated value.

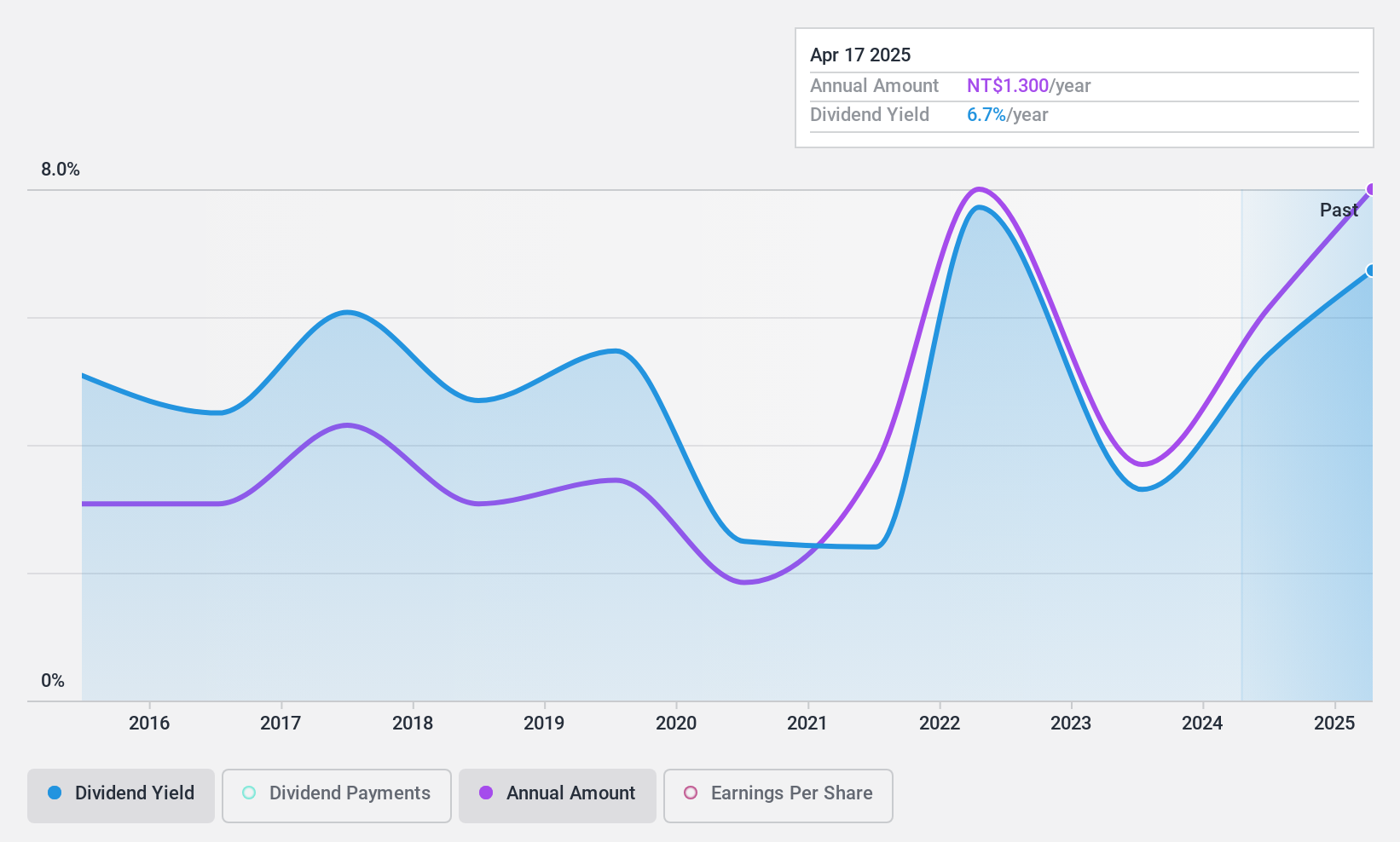

Chun Yuan Steel Industry (TWSE:2010)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chun Yuan Steel Industry Co., Ltd. is a company that produces and sells steel products in Taiwan and the rest of Asia, with a market cap of NT$11.85 billion.

Operations: Chun Yuan Steel Industry Co., Ltd.'s revenue segments include NT$1.36 billion from Qingdao Chunyuan, NT$710.64 million from Shenzhen Hongyuan, NT$2.55 billion from the Second Business Unit, NT$8.96 billion from the Construction Division, NT$9.23 billion from the First Business Segment, and NT$1.95 billion from Shanghai Huateng Metal Processing Co., Ltd.

Dividend Yield: 5.5%

Chun Yuan Steel Industry's dividends, with payout ratios of 64% from earnings and 62.3% from cash flows, are covered but have been volatile and unreliable over the past decade. Despite this instability, its dividend yield is in the top 25% of Taiwan's market. Recent earnings growth of TWD 302.7 million for Q3 indicates improved profitability, yet historical dividend fluctuations suggest caution for income-focused investors seeking consistent returns.

- Delve into the full analysis dividend report here for a deeper understanding of Chun Yuan Steel Industry.

- Our valuation report here indicates Chun Yuan Steel Industry may be overvalued.

Seize The Opportunity

- Click through to start exploring the rest of the 1963 Top Dividend Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Multi-Chem, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:AWZ

Multi-Chem

An investment holding company, distributes information technology products in Singapore, Greater China, Australia, India, and internationally.

Flawless balance sheet with solid track record and pays a dividend.