- Hong Kong

- /

- Auto Components

- /

- SEHK:2488

Asian Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As Asian markets navigate a landscape marked by economic slowdowns and cautious consumer behavior, investors are increasingly looking towards stable income-generating opportunities to bolster their portfolios. In this context, dividend stocks stand out as attractive options, offering potential for steady returns amidst the broader market fluctuations.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.86% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.60% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.93% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.71% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.05% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.09% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.82% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.83% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.42% | ★★★★★★ |

Click here to see the full list of 1029 stocks from our Top Asian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

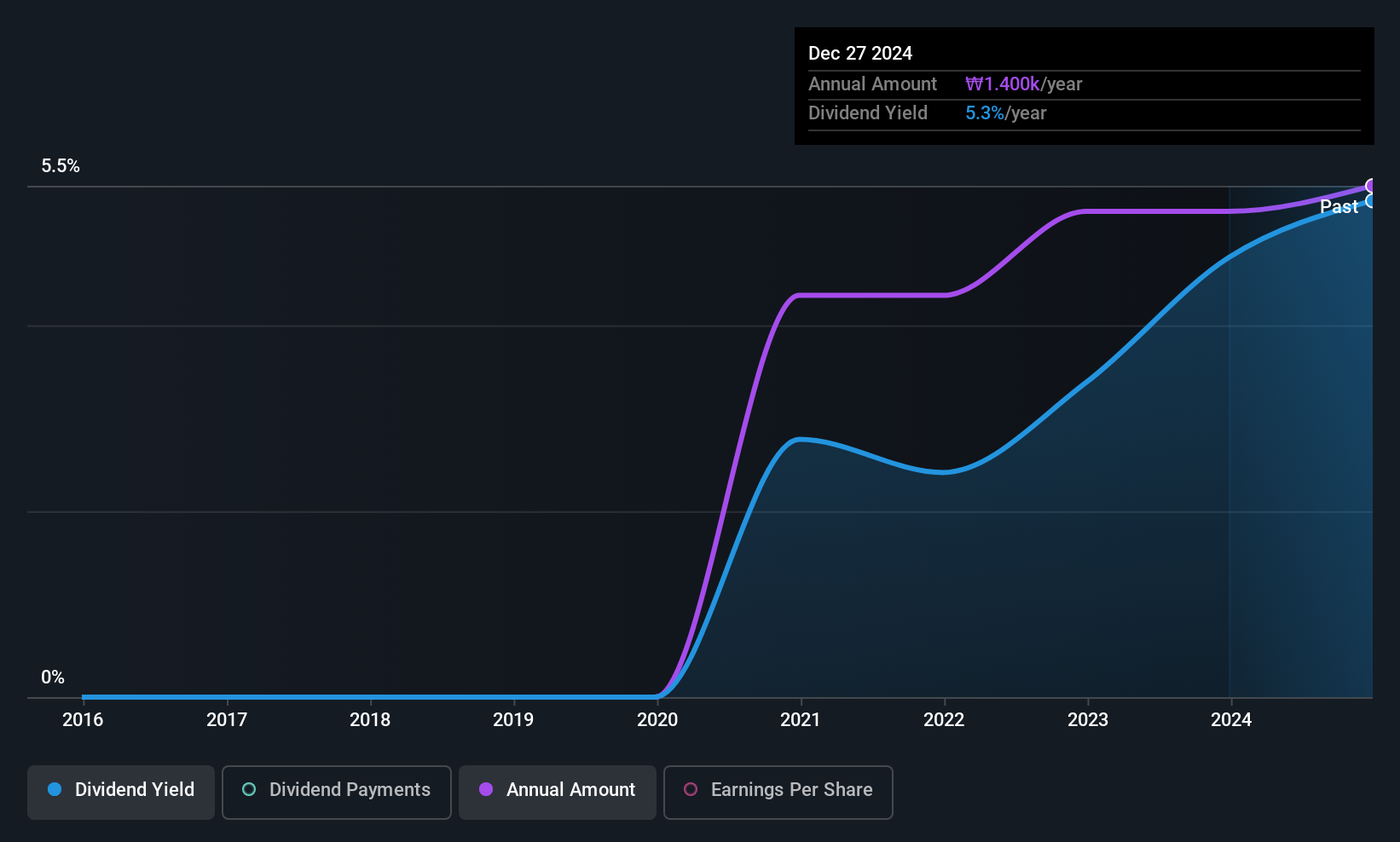

Ace Bed (KOSDAQ:A003800)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ace Bed Company Limited manufactures and sells beds and furniture products in Korea and internationally, with a market cap of ₩335.71 billion.

Operations: Ace Bed Company Limited generates revenue from the manufacture and sale of beds and furniture products both domestically in Korea and internationally.

Dividend Yield: 4.6%

Ace Bed's dividend yield of 4.56% places it among the top 25% of KR market payers, supported by a low payout ratio (24%) and stable earnings growth. Despite only five years of dividend history, payments have been reliable with minimal volatility. Recent earnings reports show strong sales growth, though net income slightly declined over nine months. The announced annual dividend of KRW 1,450 per share underscores Ace Bed's commitment to returning value to shareholders.

- Unlock comprehensive insights into our analysis of Ace Bed stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Ace Bed is priced higher than what may be justified by its financials.

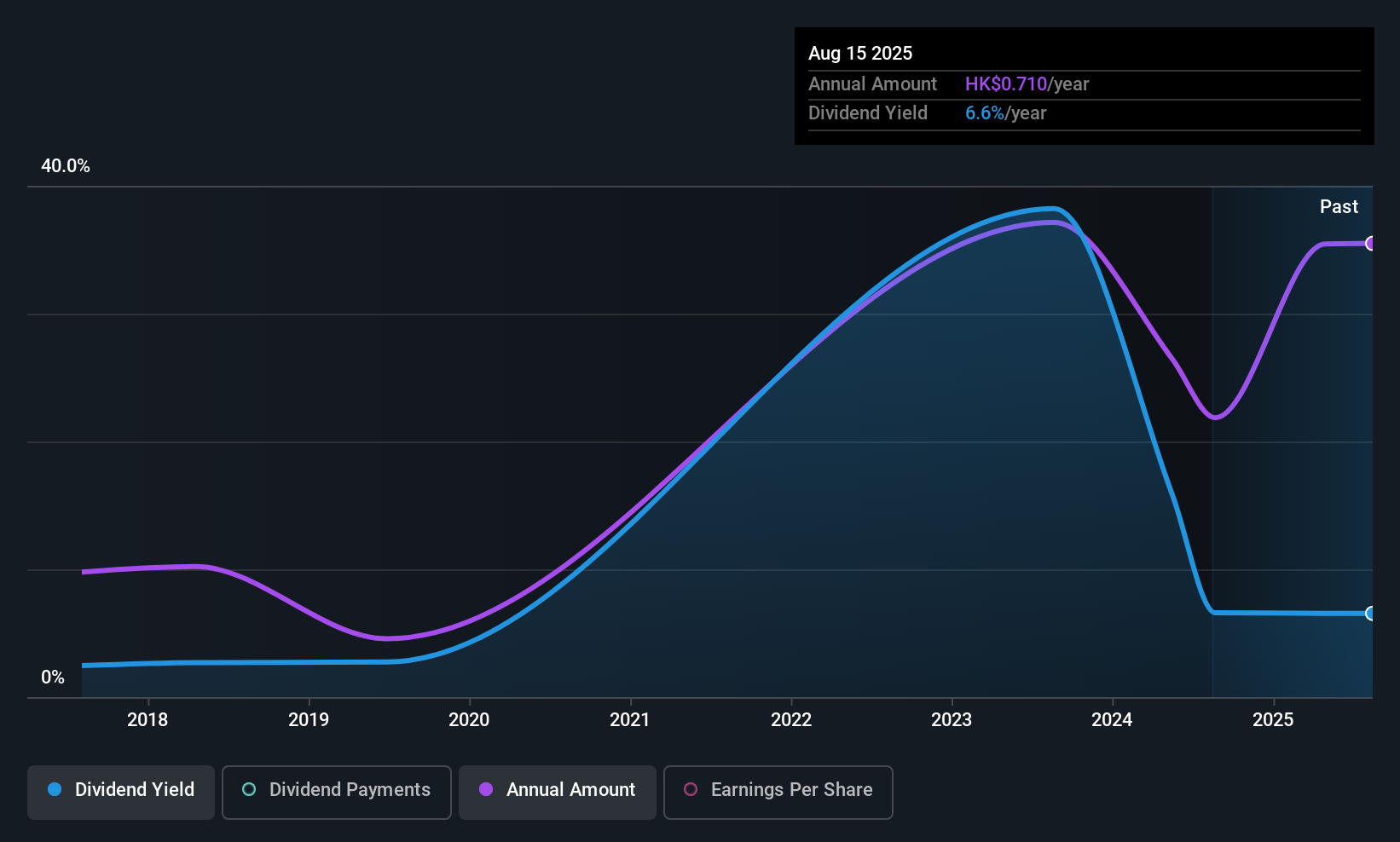

Launch Tech (SEHK:2488)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Launch Tech Company Limited, along with its subsidiaries, offers products and services to the automotive aftermarket and automobile industry in China and internationally, with a market cap of HK$3.51 billion.

Operations: Launch Tech Company Limited generates its revenue from providing automotive aftermarket products and services to the automobile industry both within China and on a global scale.

Dividend Yield: 8.4%

Launch Tech's dividend yield, at 8.37%, ranks in the top quartile of Hong Kong market payers. Despite a high payout ratio of 82.8%, dividends are covered by earnings and cash flows, with a cash payout ratio at 61.4%. However, the company's eight-year dividend history shows volatility and unreliability, with significant annual drops exceeding 20%. Recent amendments to its Articles of Association aim to enhance governance but may not immediately impact dividend stability or growth prospects.

- Navigate through the intricacies of Launch Tech with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Launch Tech is priced lower than what may be justified by its financials.

Inner Mongolia Dian Tou Energy (SZSE:002128)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Inner Mongolia Dian Tou Energy Corporation Limited, with a market cap of CN¥62.70 billion, is involved in the research, production, and sale of coal products in China through its subsidiaries.

Operations: Inner Mongolia Dian Tou Energy Corporation Limited generates revenue primarily through its coal production and sales operations in China.

Dividend Yield: 3%

Inner Mongolia Dian Tou Energy's dividend yield of 3.04% is among the top 25% in the Chinese market, yet its sustainability is questionable due to a high cash payout ratio of 156.7%. While dividends are well covered by earnings with a low payout ratio of 35.4%, historical volatility and unreliability persist, with significant drops over the past decade. Recent earnings showed slight revenue growth but declining net income, reflecting potential challenges for future dividend stability.

- Delve into the full analysis dividend report here for a deeper understanding of Inner Mongolia Dian Tou Energy.

- Insights from our recent valuation report point to the potential undervaluation of Inner Mongolia Dian Tou Energy shares in the market.

Where To Now?

- Delve into our full catalog of 1029 Top Asian Dividend Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2488

Launch Tech

Provides products and services to the automotive aftermarket and the automobile industry in the People's Republic of China and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026