- Sweden

- /

- Specialty Stores

- /

- OM:BILI A

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by record highs in U.S. indexes and geopolitical uncertainties, investors are increasingly focusing on the Federal Reserve's upcoming decisions regarding interest rate cuts. Amidst this backdrop of broad-based gains and economic optimism, dividend stocks can offer a stable income stream, making them an attractive option for those looking to balance growth with consistent returns in their investment portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.34% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.55% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.55% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.64% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.87% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.49% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.10% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 1982 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

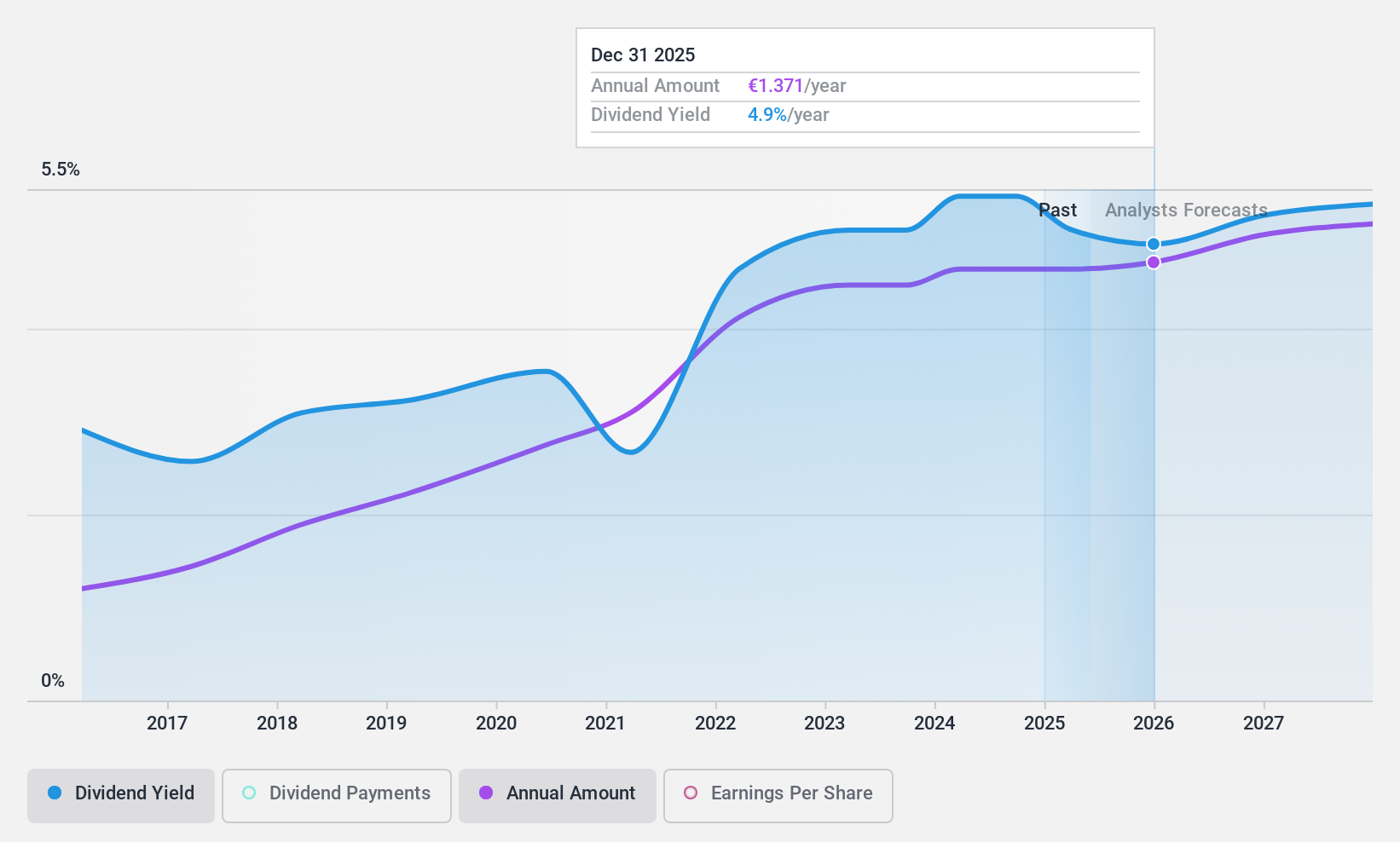

Valmet Oyj (HLSE:VALMT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Valmet Oyj is a company that develops and supplies process technologies, automation, and services for the pulp, paper, and energy industries across various regions including North America, South America, China, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of €4.09 billion.

Operations: Valmet Oyj's revenue is primarily derived from its Process Technologies segment at €2.10 billion, followed by Services at €1.84 billion and Automation at €1.39 billion.

Dividend Yield: 6.1%

Valmet Oyj has consistently increased its dividend payments over the past decade, supported by stable cash flows with a cash payout ratio of 64.4%. While its dividend yield is slightly below the top quartile in Finland, at 6.1%, it remains reliable and well-covered by earnings with an 87.2% payout ratio. Recent strategic expansions and significant orders, such as a €1 billion contract for a pulp mill in Brazil, may bolster future financial stability and support continued dividends.

- Click to explore a detailed breakdown of our findings in Valmet Oyj's dividend report.

- Upon reviewing our latest valuation report, Valmet Oyj's share price might be too pessimistic.

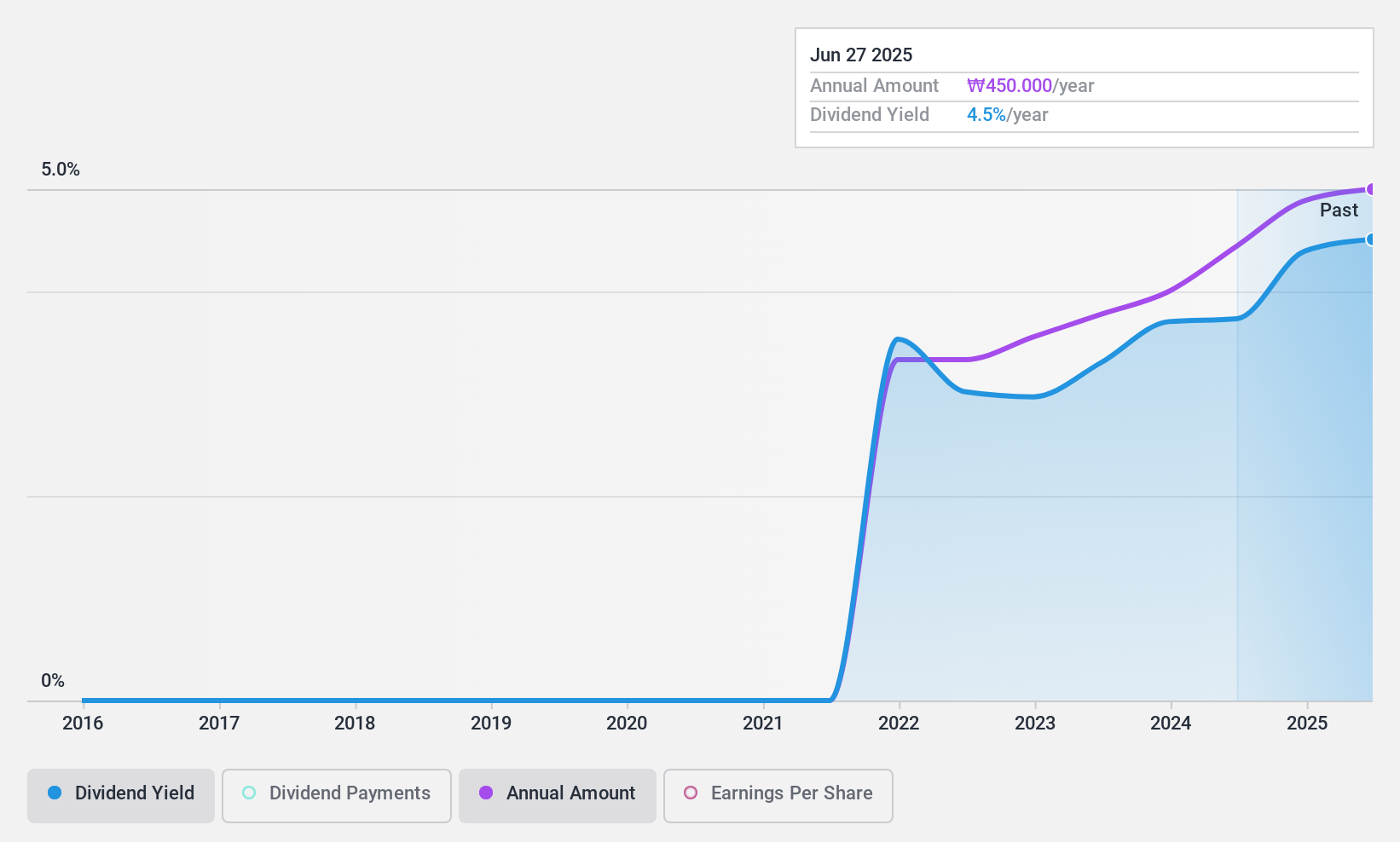

Koryo Credit Information (KOSDAQ:A049720)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koryo Credit Information Co., Ltd. operates in the debt collection, credit investigation, and civil complaint agency sectors both in South Korea and internationally, with a market cap of ₩141.62 billion.

Operations: Koryo Credit Information Co., Ltd. generates revenue through its operations in debt collection, credit investigation, and civil complaint agency services across South Korea and international markets.

Dividend Yield: 4.3%

Koryo Credit Information's dividend yield of 4.33% ranks in the top 25% within its market, supported by a low payout ratio of 40.5%, ensuring dividends are well covered by earnings and cash flows. Though dividends have been stable, they have only been paid for three years. Recent earnings show significant growth, with net income rising to KRW 3.22 billion for Q3, indicating potential for sustained dividend payments amid improving financial performance.

- Dive into the specifics of Koryo Credit Information here with our thorough dividend report.

- Our expertly prepared valuation report Koryo Credit Information implies its share price may be lower than expected.

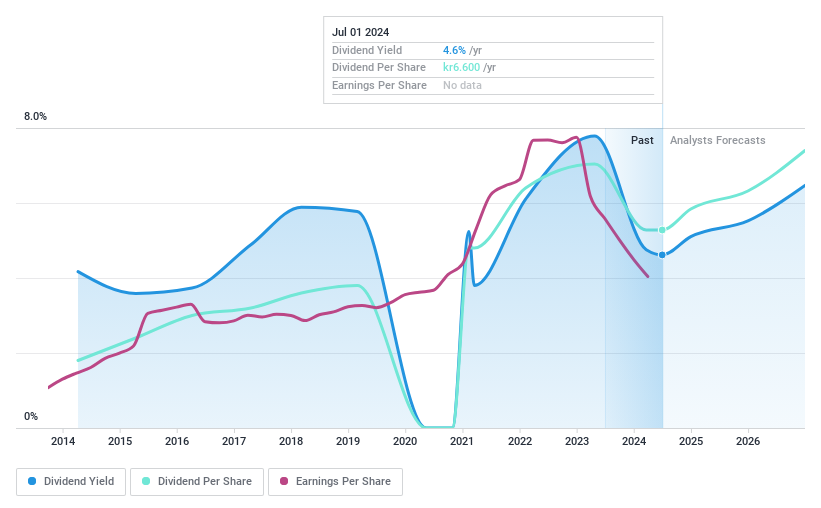

Bilia (OM:BILI A)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bilia AB (publ) is a full-service supplier for car ownership operating in Sweden, Norway, Luxembourg, and Belgium with a market cap of SEK11.34 billion.

Operations: Bilia AB (publ) generates revenue through several segments including Car - Sweden (SEK19.85 billion), Car - Norway (SEK7.39 billion), Service - Sweden (SEK6.50 billion), Car - Western Europe (SEK3.53 billion), Service - Norway (SEK2.29 billion), Fuel (SEK964 million), and Service - Western Europe (SEK678 million).

Dividend Yield: 5.2%

Bilia's dividend yield of 5.2% is among the top 25% in the Swedish market, but sustainability concerns arise as dividends are not covered by free cash flows and have been volatile over the past decade. Despite a high payout ratio of 84.7%, recent earnings show declining net income to SEK 105 million for Q3, impacting dividend reliability. The company also faces financial challenges with high debt levels, further complicating its dividend outlook.

- Click here to discover the nuances of Bilia with our detailed analytical dividend report.

- According our valuation report, there's an indication that Bilia's share price might be on the cheaper side.

Make It Happen

- Unlock our comprehensive list of 1982 Top Dividend Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bilia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BILI A

Bilia

Operates as a full-service supplier for car ownership in Sweden, Norway, Luxemburg, and Belgium.

Undervalued with high growth potential and pays a dividend.