- South Korea

- /

- Luxury

- /

- KOSE:A111770

Top 3 KRX Dividend Stocks For June 2024

Reviewed by Simply Wall St

The South Korean market has shown resilience with a steady 5.7% increase over the past year, despite recent stagnation in the last week. In light of expected earnings growth of 29% per annum in the coming years, dividend stocks remain an attractive option for those looking to potentially benefit from solid yields in a growing market environment.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 4.28% | ★★★★★★ |

| NH Investment & Securities (KOSE:A005940) | 6.39% | ★★★★★☆ |

| Shinhan Financial Group (KOSE:A055550) | 4.41% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 7.18% | ★★★★★☆ |

| KT (KOSE:A030200) | 5.38% | ★★★★★☆ |

| LOTTE Fine Chemical (KOSE:A004000) | 4.55% | ★★★★★☆ |

| KB Financial Group (KOSE:A105560) | 3.88% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 4.85% | ★★★★★☆ |

| Korea Cast Iron Pipe Ind (KOSE:A000970) | 5.91% | ★★★★☆☆ |

| Hansae Yes24 Holdings (KOSE:A016450) | 5.34% | ★★★★☆☆ |

Click here to see the full list of 68 stocks from our Top KRX Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

Koryo Credit Information (KOSDAQ:A049720)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koryo Credit Information Co., Ltd. operates in debt collection, credit investigation, and civil complaint agency services both domestically and internationally, with a market capitalization of approximately ₩151.51 billion.

Operations: Koryo Credit Information Co., Ltd. generates its revenue primarily from debt collection, credit investigation, and civil complaint agency services across both domestic and international markets.

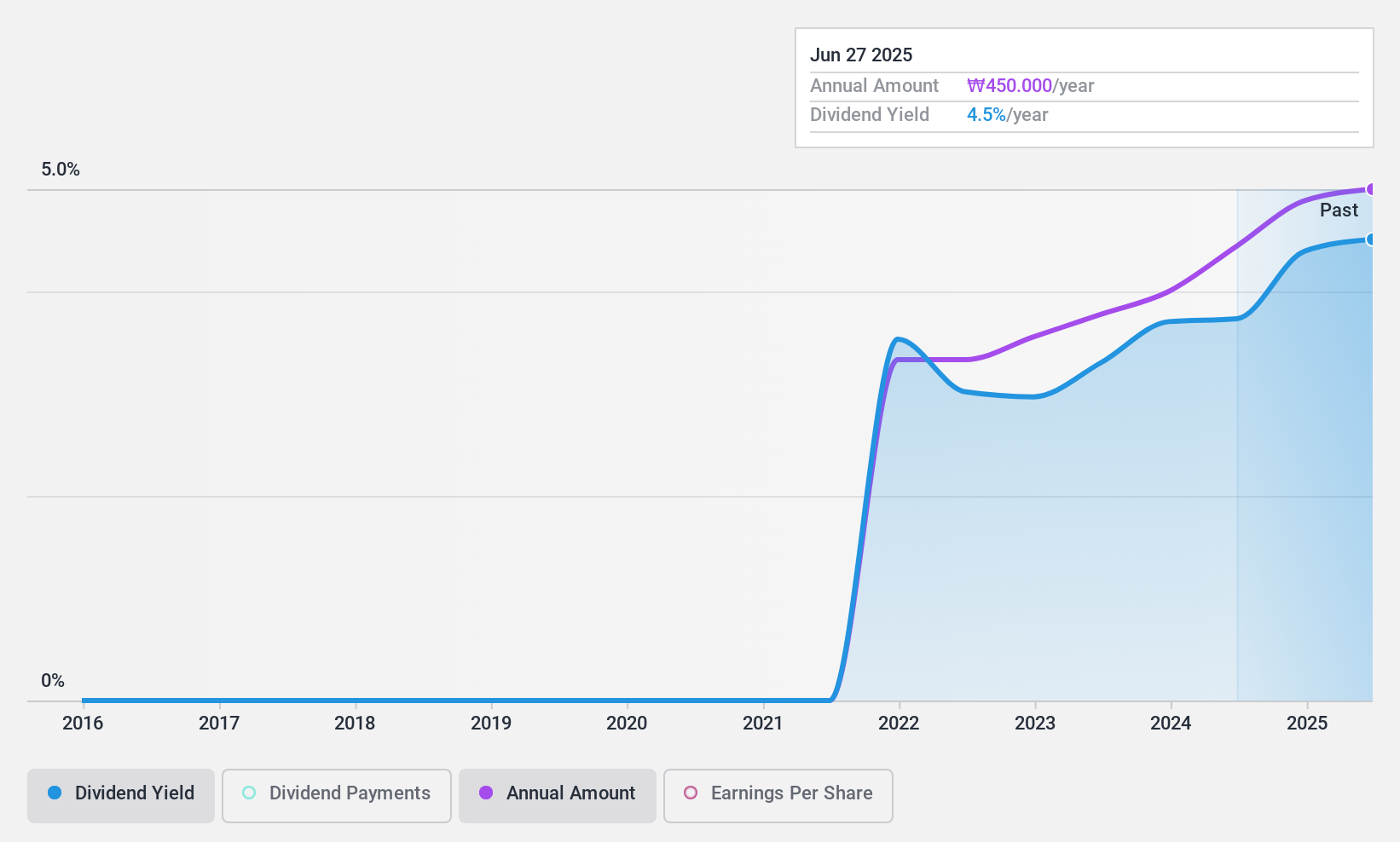

Dividend Yield: 3.7%

Koryo Credit Information has demonstrated a growing commitment to dividends, with increments over the past three years, despite its short dividend history. With a current yield of 3.67%, it stands above the market average of 3.55%. The sustainability of these payments is supported by a modest payout ratio of 46.8% and an even lower cash payout ratio at 26.1%, indicating strong coverage by both earnings and cash flows. However, the company's relatively recent initiation into dividend distribution suggests potential volatility in its future dividend stability.

- Unlock comprehensive insights into our analysis of Koryo Credit Information stock in this dividend report.

- Our expertly prepared valuation report Koryo Credit Information implies its share price may be too high.

Youngone (KOSE:A111770)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Youngone Corporation specializes in manufacturing and selling clothing, shoes, and outdoor supplies globally, with a market capitalization of approximately ₩1.51 trillion.

Operations: Youngone Corporation generates its revenue primarily from the global sales of clothing, footwear, and outdoor equipment.

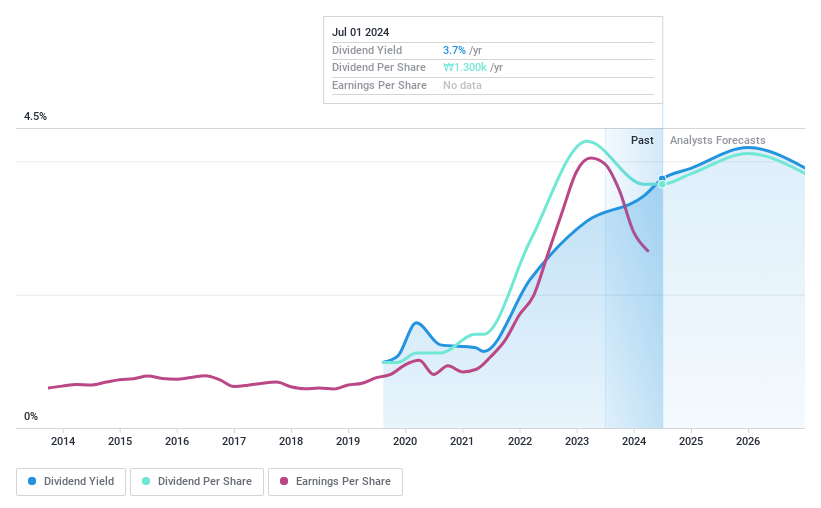

Dividend Yield: 3.8%

Youngone Corporation, with a dividend yield of 3.76%, ranks in the top 25% of dividend payers in the South Korean market. The company's dividends are well-supported by both earnings and cash flows, with payout ratios of 12.2% and 14.2% respectively, indicating robust coverage. Despite this strong financial backing, Youngone has a relatively short dividend history of only five years and an unstable track record, which may raise concerns about the sustainability of future dividends. Additionally, on June 10, 2024, Youngone announced a share repurchase program to buy back up to ₩50 billion worth of shares to enhance shareholder value.

- Click here and access our complete dividend analysis report to understand the dynamics of Youngone.

- Upon reviewing our latest valuation report, Youngone's share price might be too pessimistic.

Cuckoo Holdings (KOSE:A192400)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cuckoo Holdings Co., Ltd. operates in the manufacture and sale of electric heaters and daily necessities, serving both domestic and international markets, with a market capitalization of approximately ₩675.95 billion.

Operations: Cuckoo Holdings Co., Ltd. generates its revenue primarily from the production and sales of electric heaters and daily necessities across global markets.

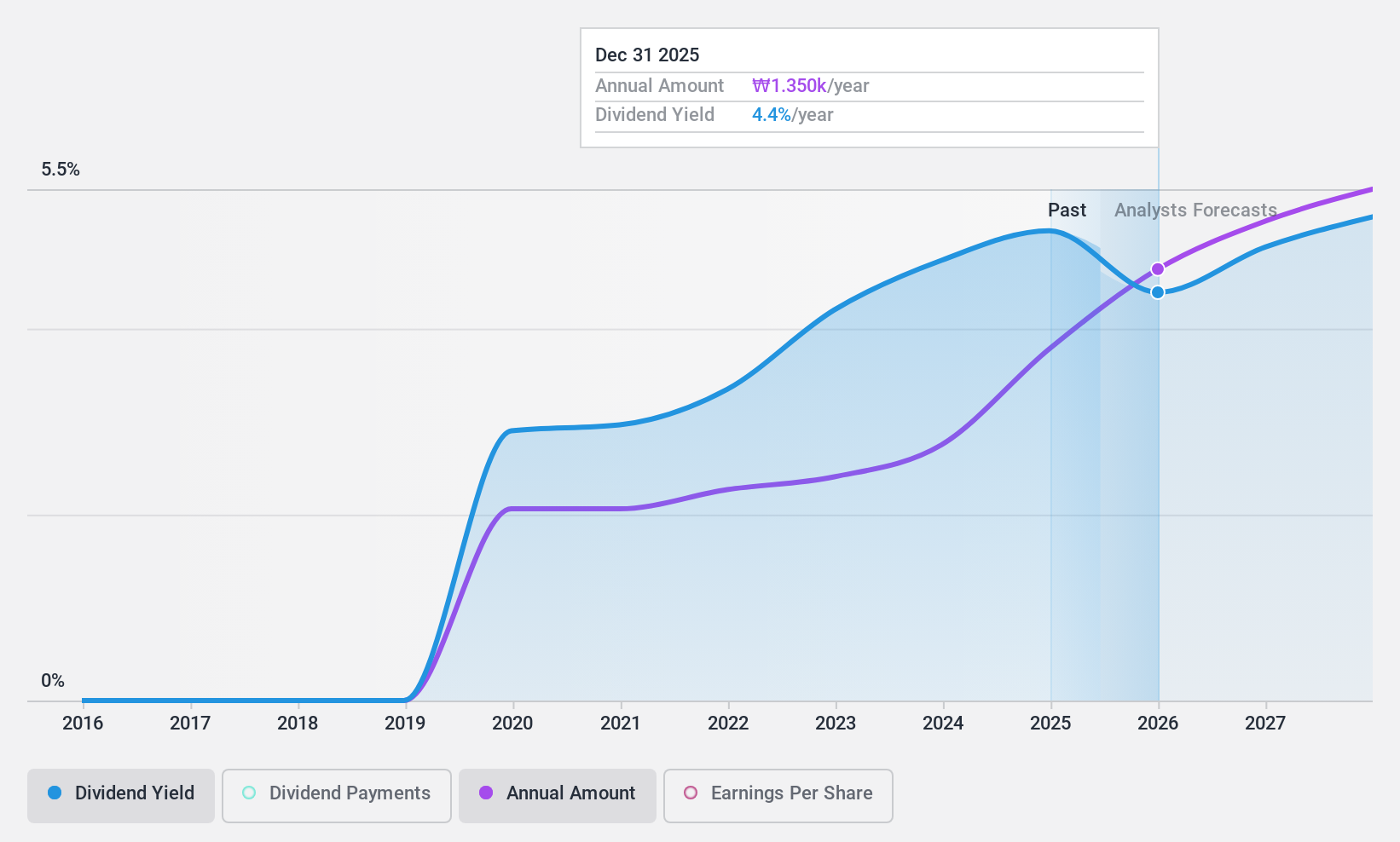

Dividend Yield: 5%

Cuckoo Holdings, trading at 75.3% below its estimated fair value, offers a dividend yield of 5.02%, placing it in the top 25% of Korean dividend payers. The dividends, supported by a payout ratio of 28% and a cash payout ratio of 40.5%, show strong coverage by both earnings and cash flows. However, the company's dividend track record is relatively short and unstable, having initiated payments only five years ago with inconsistent growth patterns since then.

- Delve into the full analysis dividend report here for a deeper understanding of Cuckoo Holdings.

- The analysis detailed in our Cuckoo Holdings valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Navigate through the entire inventory of 68 Top KRX Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A111770

Youngone

Engages in the manufacture and sale of clothing, shoes, and supplies market worldwide.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives