- South Korea

- /

- Professional Services

- /

- KOSDAQ:A046120

Additional Considerations Required While Assessing Orbitech's (KOSDAQ:046120) Strong Earnings

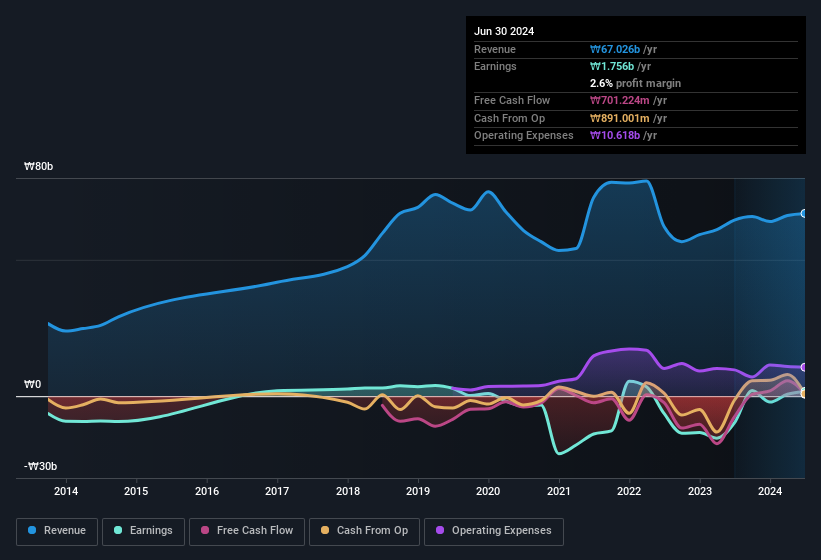

Orbitech Co., Ltd.'s (KOSDAQ:046120) robust earnings report didn't manage to move the market for its stock. Our analysis suggests that shareholders have noticed something concerning in the numbers.

View our latest analysis for Orbitech

How Do Unusual Items Influence Profit?

Importantly, our data indicates that Orbitech's profit received a boost of ₩618m in unusual items, over the last year. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. Which is hardly surprising, given the name. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Orbitech.

Our Take On Orbitech's Profit Performance

Arguably, Orbitech's statutory earnings have been distorted by unusual items boosting profit. Because of this, we think that it may be that Orbitech's statutory profits are better than its underlying earnings power. On the bright side, the company showed enough improvement to book a profit this year, after losing money last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. So while earnings quality is important, it's equally important to consider the risks facing Orbitech at this point in time. For example, Orbitech has 3 warning signs (and 1 which can't be ignored) we think you should know about.

Today we've zoomed in on a single data point to better understand the nature of Orbitech's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A046120

Orbitech

Engages in the nuclear energy, ISI, and aviation businesses in South Korea and internationally.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

My view on CSL Limited is positive. It’s a high-quality growth stock with strong barriers to entry through its global plasma network.

Nu holdings will continue to disrupt the South American banking market

The Transition From Automaker To AI Behemoth Is Underway, But Priced In

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion