- South Korea

- /

- Electrical

- /

- KOSE:A450080

Ecopro Materials (KOSE:A450080) poised for Q3 2024 earnings call with strategic alliances focus

Reviewed by Simply Wall St

Dive into the specifics of Ecopro Materials here with our thorough analysis report.

Innovative Factors Supporting Ecopro Materials

With a remarkable 25% year-over-year revenue increase, Ecopro Materials is making significant strides in expanding its market share. This growth, as highlighted by CFO Kim Jang Woo, underscores the company's financial health and strategic positioning. The introduction of new product lines has been pivotal, boosting gross margins by 15%, as noted by Ji Sun Chung. Such product-related announcements not only enhance customer satisfaction but also improve profitability, showcasing effective innovation strategies. Furthermore, strong customer relationships, as emphasized by Managing Director Soon-Ju Kim, have led to long-term contracts that secure revenue streams, indicating strategic alliances that bolster stability and future growth.

See what the latest analyst reports say about Ecopro Materials's future prospects and potential market movements.Strategic Gaps That Could Affect Ecopro Materials

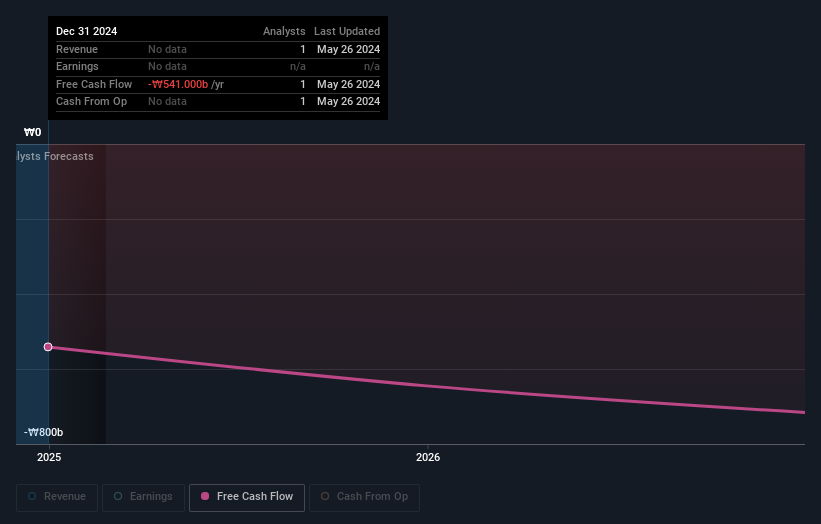

Operational inefficiencies, particularly in the supply chain, have been a challenge, as acknowledged by CFO Kim Jang Woo. These issues could hinder growth if not addressed promptly. Additionally, rising raw material costs are pressuring margins, requiring strategic cost management. Certain segments have underperformed against forecasts, suggesting a need for reassessment of strategies. No specific summary is provided, but addressing these financial challenges is crucial for maintaining competitive positioning.

To dive deeper into how Ecopro Materials's valuation metrics are shaping its market position, check out our detailed analysis of Ecopro Materials's Valuation.Potential Strategies for Leveraging Growth and Competitive Advantage

Opportunities for Ecopro Materials lie in expanding business operations and refining product offerings. Strategic alliances and product updates can enhance market position and capitalize on emerging opportunities. With the upcoming Q3 2024 earnings release scheduled for October 31, the company is poised to announce further product-related developments that could drive growth.

To gain deeper insights into Ecopro Materials's historical performance, explore our detailed analysis of past performance.Market Volatility Affecting Ecopro Materials's Position

Economic headwinds, such as inflationary pressures, pose risks to consumer spending, as highlighted by Managing Director Soon-Ju Kim. Increased competition in core markets necessitates continuous innovation to maintain market position. Regulatory hurdles also present potential challenges, requiring proactive adaptation to ensure compliance and sustainability. These external factors could impact growth and market share if not strategically managed.

Explore the current health of Ecopro Materials and how it reflects on its financial stability and growth potential.Conclusion

Ecopro Materials' impressive 25% revenue growth and 15% margin improvement highlight its effective innovation and strategic positioning, which are crucial for sustaining its market expansion. However, operational inefficiencies and rising raw material costs pose significant challenges that, if unresolved, could impede future growth. The company's ability to leverage strategic alliances and introduce new products will be key in navigating market volatility and regulatory hurdles. While no specific summary is provided, addressing these operational and financial challenges is essential for maintaining its competitive edge and ensuring continued success in the face of external pressures.

Seize The Opportunity

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Ecopro Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About KOSE:A450080

Ecopro Materials

Produces precursor materials for nickel-based anode materials for secondary batteries in South Korea.

Very low with weak fundamentals.