- South Korea

- /

- Machinery

- /

- KOSE:A329180

Here's Why HD Hyundai Heavy IndustriesLtd (KRX:329180) Can Manage Its Debt Responsibly

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, HD Hyundai Heavy Industries Co.,Ltd. (KRX:329180) does carry debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for HD Hyundai Heavy IndustriesLtd

What Is HD Hyundai Heavy IndustriesLtd's Net Debt?

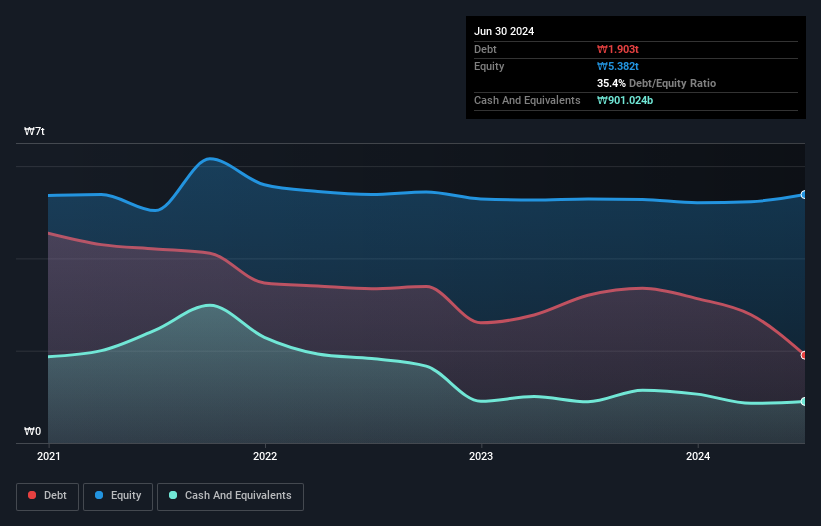

The image below, which you can click on for greater detail, shows that HD Hyundai Heavy IndustriesLtd had debt of ₩1.90t at the end of June 2024, a reduction from ₩3.20t over a year. However, it also had ₩901.0b in cash, and so its net debt is ₩1.00t.

A Look At HD Hyundai Heavy IndustriesLtd's Liabilities

The latest balance sheet data shows that HD Hyundai Heavy IndustriesLtd had liabilities of ₩10t due within a year, and liabilities of ₩1.86t falling due after that. Offsetting these obligations, it had cash of ₩901.0b as well as receivables valued at ₩1.55t due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₩9.86t.

While this might seem like a lot, it is not so bad since HD Hyundai Heavy IndustriesLtd has a huge market capitalization of ₩20t, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

HD Hyundai Heavy IndustriesLtd's net debt is sitting at a very reasonable 1.5 times its EBITDA, while its EBIT covered its interest expense just 4.0 times last year. While these numbers do not alarm us, it's worth noting that the cost of the company's debt is having a real impact. Notably, HD Hyundai Heavy IndustriesLtd's EBIT launched higher than Elon Musk, gaining a whopping 413% on last year. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine HD Hyundai Heavy IndustriesLtd's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last two years, HD Hyundai Heavy IndustriesLtd actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

Happily, HD Hyundai Heavy IndustriesLtd's impressive conversion of EBIT to free cash flow implies it has the upper hand on its debt. But truth be told we feel its interest cover does undermine this impression a bit. When we consider the range of factors above, it looks like HD Hyundai Heavy IndustriesLtd is pretty sensible with its use of debt. While that brings some risk, it can also enhance returns for shareholders. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of HD Hyundai Heavy IndustriesLtd's earnings per share history for free.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if HD Hyundai Heavy IndustriesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A329180

HD Hyundai Heavy IndustriesLtd

Engages in operating shipbuilding and offshore, naval and special ships, and engine and machinery business units worldwide.

High growth potential with solid track record.

Market Insights

Community Narratives