- South Korea

- /

- Electrical

- /

- KOSE:A267260

Investors Appear Satisfied With HD Hyundai Electric Co., Ltd.'s (KRX:267260) Prospects As Shares Rocket 28%

HD Hyundai Electric Co., Ltd. (KRX:267260) shares have continued their recent momentum with a 28% gain in the last month alone. The annual gain comes to 236% following the latest surge, making investors sit up and take notice.

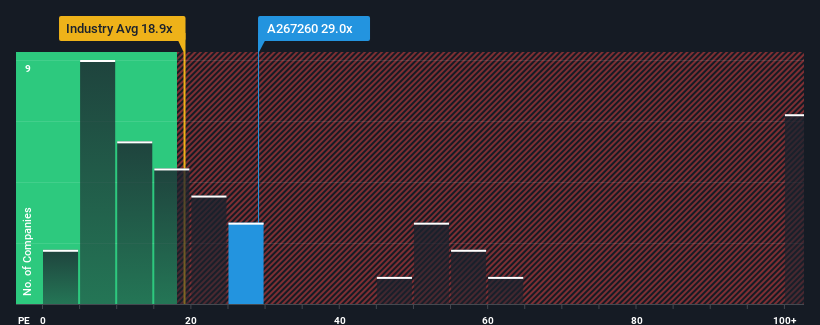

After such a large jump in price, HD Hyundai Electric may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 29x, since almost half of all companies in Korea have P/E ratios under 14x and even P/E's lower than 7x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

HD Hyundai Electric certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for HD Hyundai Electric

Is There Enough Growth For HD Hyundai Electric?

HD Hyundai Electric's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 239% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 74% over the next year. Meanwhile, the rest of the market is forecast to only expand by 37%, which is noticeably less attractive.

In light of this, it's understandable that HD Hyundai Electric's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

HD Hyundai Electric's P/E is flying high just like its stock has during the last month. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that HD Hyundai Electric maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for HD Hyundai Electric that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if HD Hyundai Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A267260

HD Hyundai Electric

Manufactures and sells electrical equipment in South Korea.

Outstanding track record with flawless balance sheet.