- South Korea

- /

- Oil and Gas

- /

- KOSE:A267250

Hyundai Heavy Industries Holdings'(KRX:267250) Share Price Is Down 37% Over The Past Three Years.

As an investor its worth striving to ensure your overall portfolio beats the market average. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term Hyundai Heavy Industries Holdings Co., Ltd. (KRX:267250) shareholders have had that experience, with the share price dropping 37% in three years, versus a market return of about 34%. There was little comfort for shareholders in the last week as the price declined a further 1.5%.

Check out our latest analysis for Hyundai Heavy Industries Holdings

Hyundai Heavy Industries Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years Hyundai Heavy Industries Holdings saw its revenue shrink by 1.2% per year. That's not what investors generally want to see. The annual decline of 11% per year in that period has clearly disappointed holders. And with no profits, and weak revenue, are you surprised? Of course, sentiment could become too negative, and the company may actually be making progress to profitability.

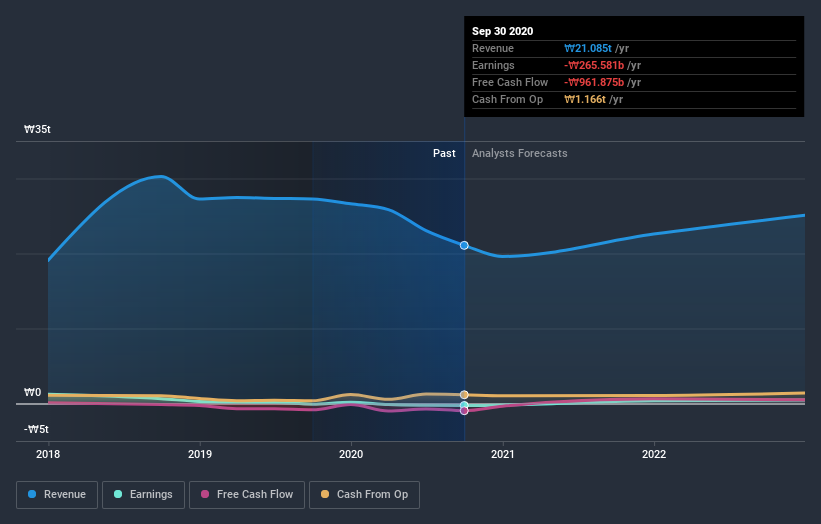

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Hyundai Heavy Industries Holdings' TSR for the last 3 years was -26%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

The last twelve months weren't great for Hyundai Heavy Industries Holdings shares, which cost holders 1.0%, including dividends, while the market was up about 48%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Unfortunately, the longer term story isn't pretty, with investment losses running at 8% per year over three years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Hyundai Heavy Industries Holdings has 2 warning signs (and 1 which can't be ignored) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading Hyundai Heavy Industries Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if HD Hyundai might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A267250

HD Hyundai

Through its subsidiaries, engages in oil refining business in Korea and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives