- South Korea

- /

- Media

- /

- KOSE:A030000

3 Top KRX Dividend Stocks Yielding Up To 6%

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has experienced a 2.8% decline, yet it remains up by 5.5% over the past year with earnings projected to grow by 29% annually. In these fluctuating conditions, dividend stocks can offer stability and income potential for investors seeking reliable returns amidst market volatility.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 6.02% | ★★★★★★ |

| Kangwon Land (KOSE:A035250) | 5.73% | ★★★★★☆ |

| Woori Financial Group (KOSE:A316140) | 4.34% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.56% | ★★★★★☆ |

| Hansae (KOSE:A105630) | 3.23% | ★★★★★☆ |

| KT (KOSE:A030200) | 4.68% | ★★★★★☆ |

| JW Holdings (KOSE:A096760) | 3.45% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 7.07% | ★★★★★☆ |

| ORION Holdings (KOSE:A001800) | 4.61% | ★★★★★☆ |

| Samsung Fire & Marine Insurance (KOSE:A000810) | 4.38% | ★★★★★☆ |

Click here to see the full list of 74 stocks from our Top KRX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

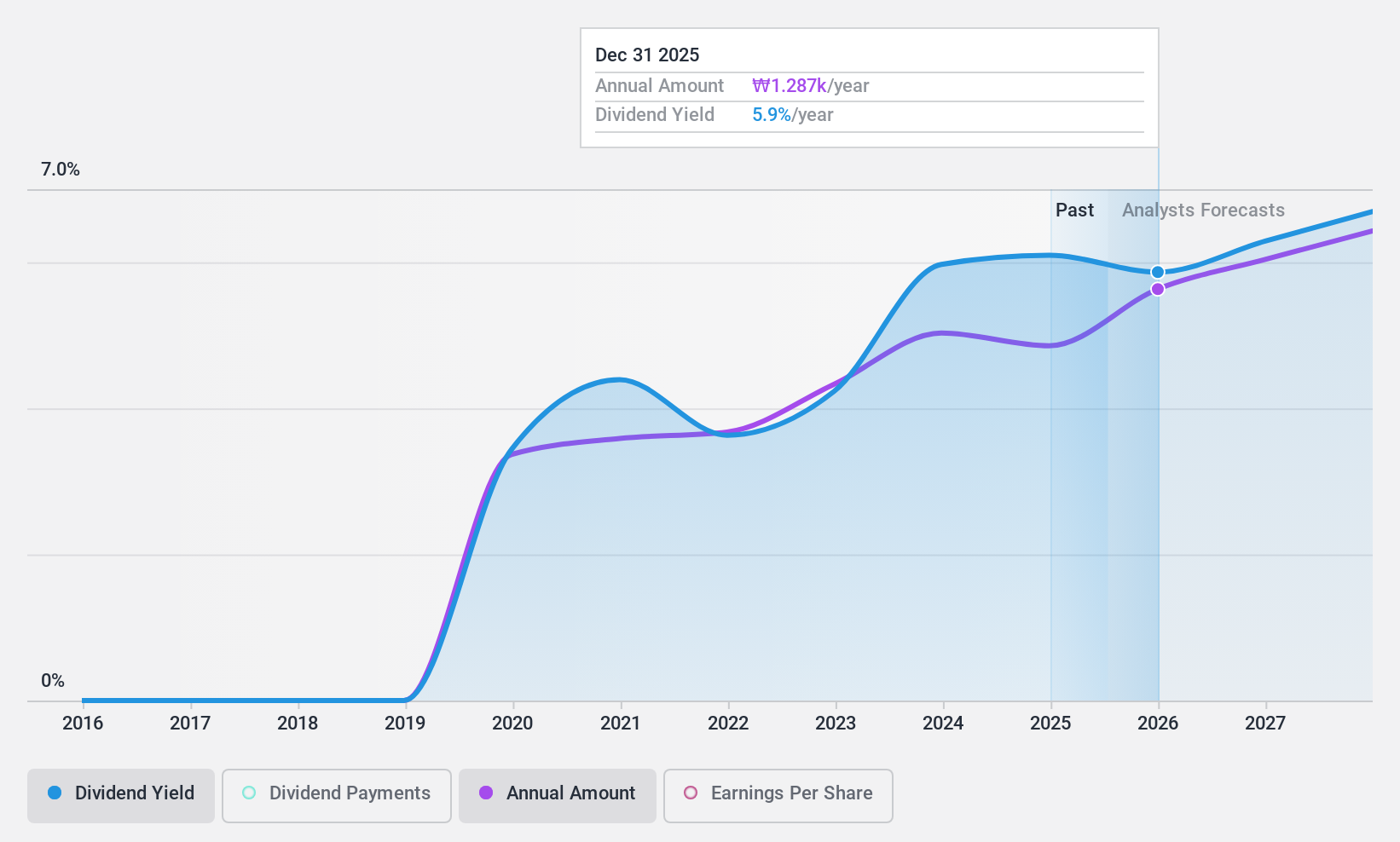

Cheil Worldwide (KOSE:A030000)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cheil Worldwide Inc. offers a range of marketing solutions globally and has a market cap of ₩1.86 trillion.

Operations: Cheil Worldwide Inc.'s revenue is primarily derived from its advertising segment, totaling ₩4.33 billion.

Dividend Yield: 6%

Cheil Worldwide offers a compelling dividend yield of 6.03%, placing it in the top 25% of South Korean dividend payers, with dividends well-covered by both earnings and cash flows (payout ratio: 59%, cash payout ratio: 40.5%). Despite trading at a significant discount to its estimated fair value, its dividend history is short, having been paid for only five years. Earnings are expected to grow annually by 8.12%, supporting future payouts.

- Get an in-depth perspective on Cheil Worldwide's performance by reading our dividend report here.

- Our valuation report here indicates Cheil Worldwide may be undervalued.

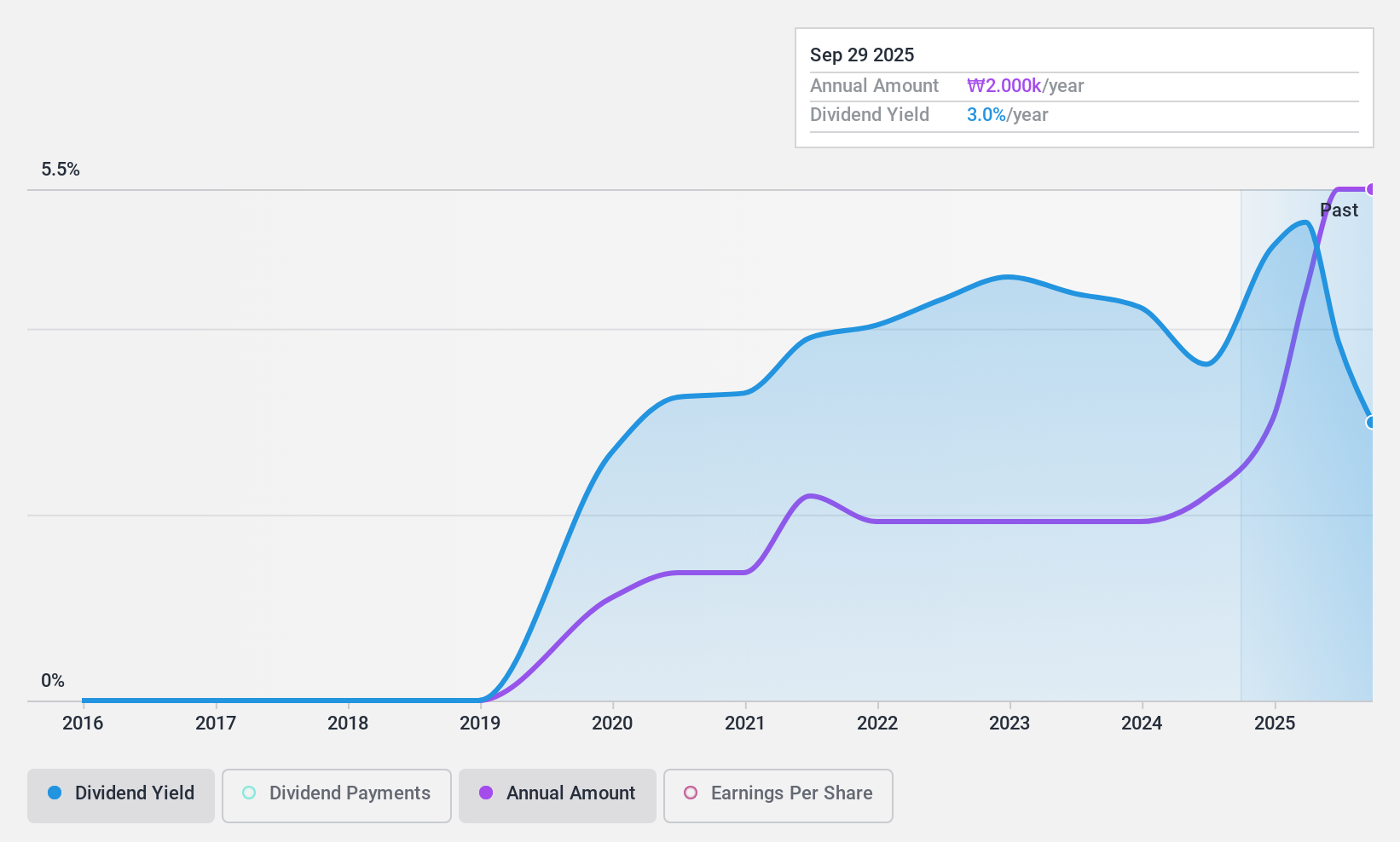

SNT Holdings (KOSE:A036530)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SNT Holdings CO., LTD operates in the auto parts and industrial facilities sectors, with a market cap of ₩334.74 billion.

Operations: SNT Holdings CO., LTD generates revenue from its Vehicle Parts segment, amounting to ₩1.30 billion, and its Industrial Equipment segment, contributing ₩303.46 million.

Dividend Yield: 4.8%

SNT Holdings' dividend yield of 4.75% ranks in the top 25% in South Korea, with a low payout ratio of 10.5%, ensuring dividends are well-covered by earnings and cash flows (cash payout ratio: 11.5%). However, its dividend history is short and volatile over the past five years. Recent financials show strong earnings growth, with net income reaching KRW 46.74 billion for Q2 2024, indicating potential for future stability if maintained.

- Unlock comprehensive insights into our analysis of SNT Holdings stock in this dividend report.

- Our comprehensive valuation report raises the possibility that SNT Holdings is priced lower than what may be justified by its financials.

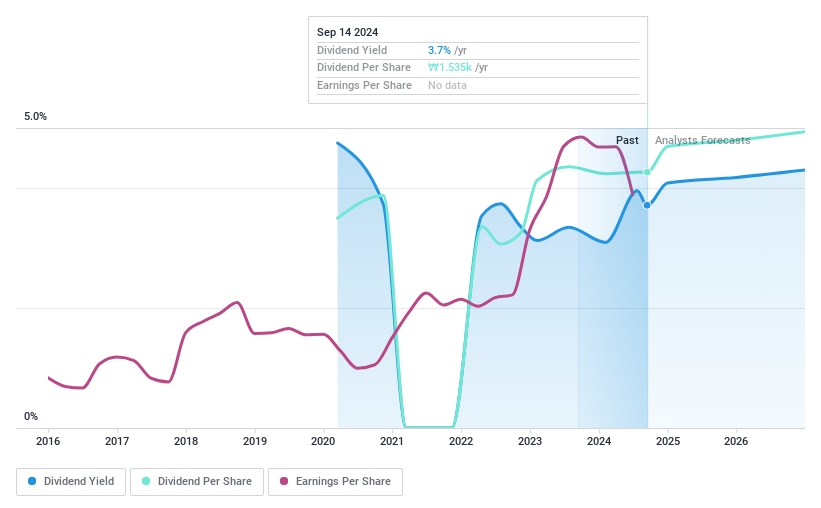

Doosan Bobcat (KOSE:A241560)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Doosan Bobcat Inc. designs, manufactures, markets, and distributes compact construction equipment for various industries globally, with a market cap of ₩4.09 trillion.

Operations: The company's revenue primarily comes from its construction equipment segment, totaling $6.99 billion.

Dividend Yield: 3.9%

Doosan Bobcat's dividend yield of 3.91% is among the top quartile in South Korea, supported by a low payout ratio of 31% and cash payout ratio of 25.9%, indicating solid coverage by earnings and cash flows. However, its dividend history is volatile with less than a decade of payments, lacking reliability. Recent financials show declining performance with Q2 sales at US$1.63 billion and net income at US$114.47 million, down from the previous year.

- Click here and access our complete dividend analysis report to understand the dynamics of Doosan Bobcat.

- Our expertly prepared valuation report Doosan Bobcat implies its share price may be lower than expected.

Seize The Opportunity

- Discover the full array of 74 Top KRX Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A030000

Very undervalued with flawless balance sheet and pays a dividend.