- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A007660

Exploring High Growth Tech Stocks in South Korea October 2024

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has experienced a 2.8% decline, although it has seen a 5.5% increase over the past year and earnings are expected to grow by 29% annually. In this context, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation capabilities and robust financial health to capitalize on these promising earnings forecasts.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| NEXON Games | 27.44% | 69.62% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 23.21% | 34.63% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 47 stocks from our KRX High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

JYP Entertainment (KOSDAQ:A035900)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JYP Entertainment Corporation operates as an entertainment company in South Korea and internationally, with a market cap of ₩1.75 trillion.

Operations: The company generates revenue primarily from its Entertainment segment, contributing ₩456.35 billion, followed by Distribution and Sales at ₩60.51 billion, and Music Publishing at ₩12.07 billion.

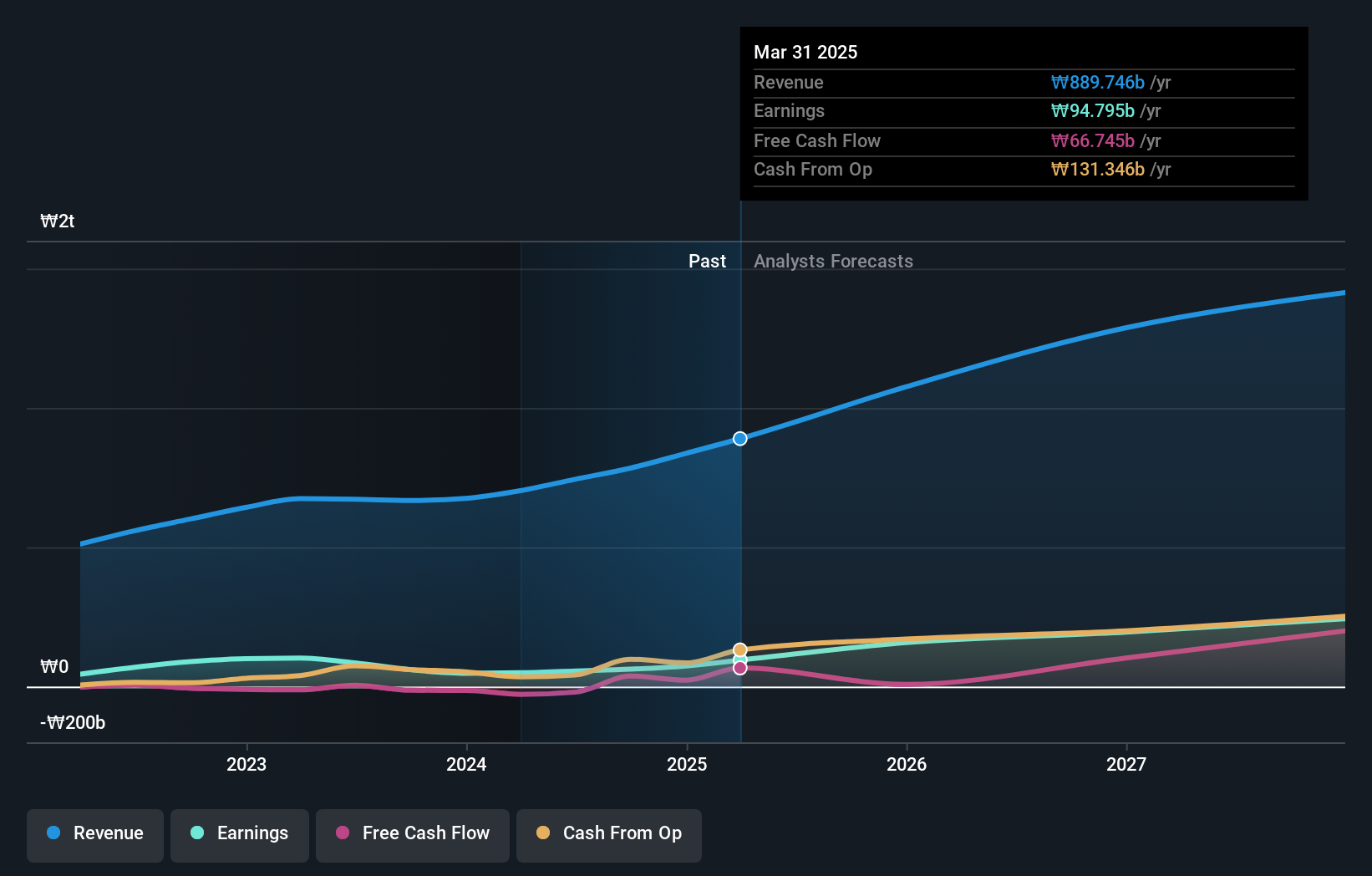

JYP Entertainment, navigating through a challenging landscape with a net profit margin drop to 13.5% from last year's 21.4%, still shows promise with expected revenue growth at 11.5% per year, outpacing the South Korean market average of 10.2%. Despite recent earnings contraction by 30.2%, future projections are more optimistic, forecasting annual earnings growth at a robust rate of 21.6%. This is underpinned by significant R&D investments aimed at innovating within the entertainment sector, ensuring the company remains competitive in evolving digital and global markets. These strategic initiatives could potentially recalibrate its financial trajectory and enhance its market position amidst intense industry competition.

- Take a closer look at JYP Entertainment's potential here in our health report.

Explore historical data to track JYP Entertainment's performance over time in our Past section.

ISU Petasys (KOSE:A007660)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ISU Petasys Co., Ltd. is a global manufacturer and seller of printed circuit boards (PCBs) with a market capitalization of ₩2.89 trillion.

Operations: ISU Petasys generates revenue primarily through the manufacture and sale of printed circuit boards, amounting to ₩743.88 billion. The company's market capitalization stands at ₩2.89 trillion.

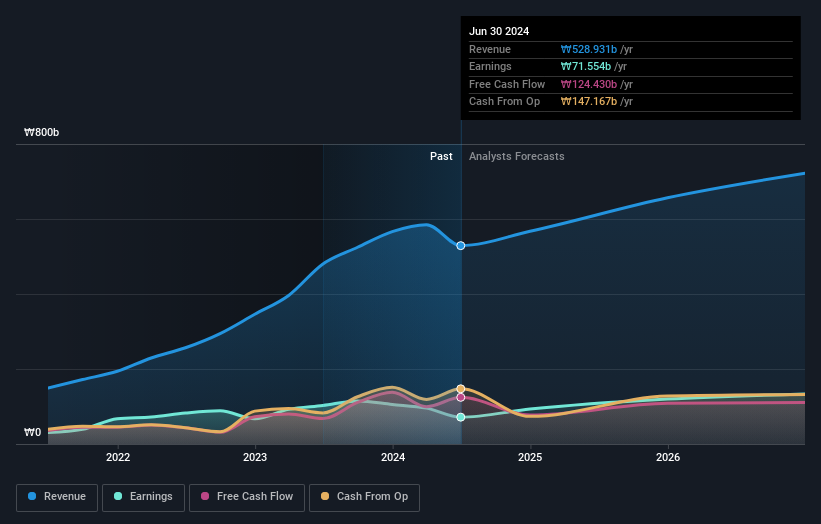

ISU Petasys, amid South Korea's bustling tech scene, demonstrates robust growth prospects with its revenue expected to surge by 18.6% annually, outstripping the national market average of 10.2%. This escalation is further complemented by a forecasted earnings growth of 44.4% per year, positioning it well above many peers in the electronics sector. However, it's important to note a significant dip in profit margins from 12.6% to 7.5% last year, reflecting some underlying challenges despite high growth forecasts. The company’s commitment to innovation is evident from its R&D spending trends which are critical for sustaining long-term competitiveness in this high-stakes market environment.

- Delve into the full analysis health report here for a deeper understanding of ISU Petasys.

Assess ISU Petasys' past performance with our detailed historical performance reports.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management, with a market cap of ₩8.07 trillion.

Operations: HYBE generates revenue primarily from its Label and Solution segments, with the Label segment contributing ₩1.28 trillion and the Solution segment adding ₩1.24 trillion. The Platform segment also plays a significant role, bringing in ₩361.12 billion.

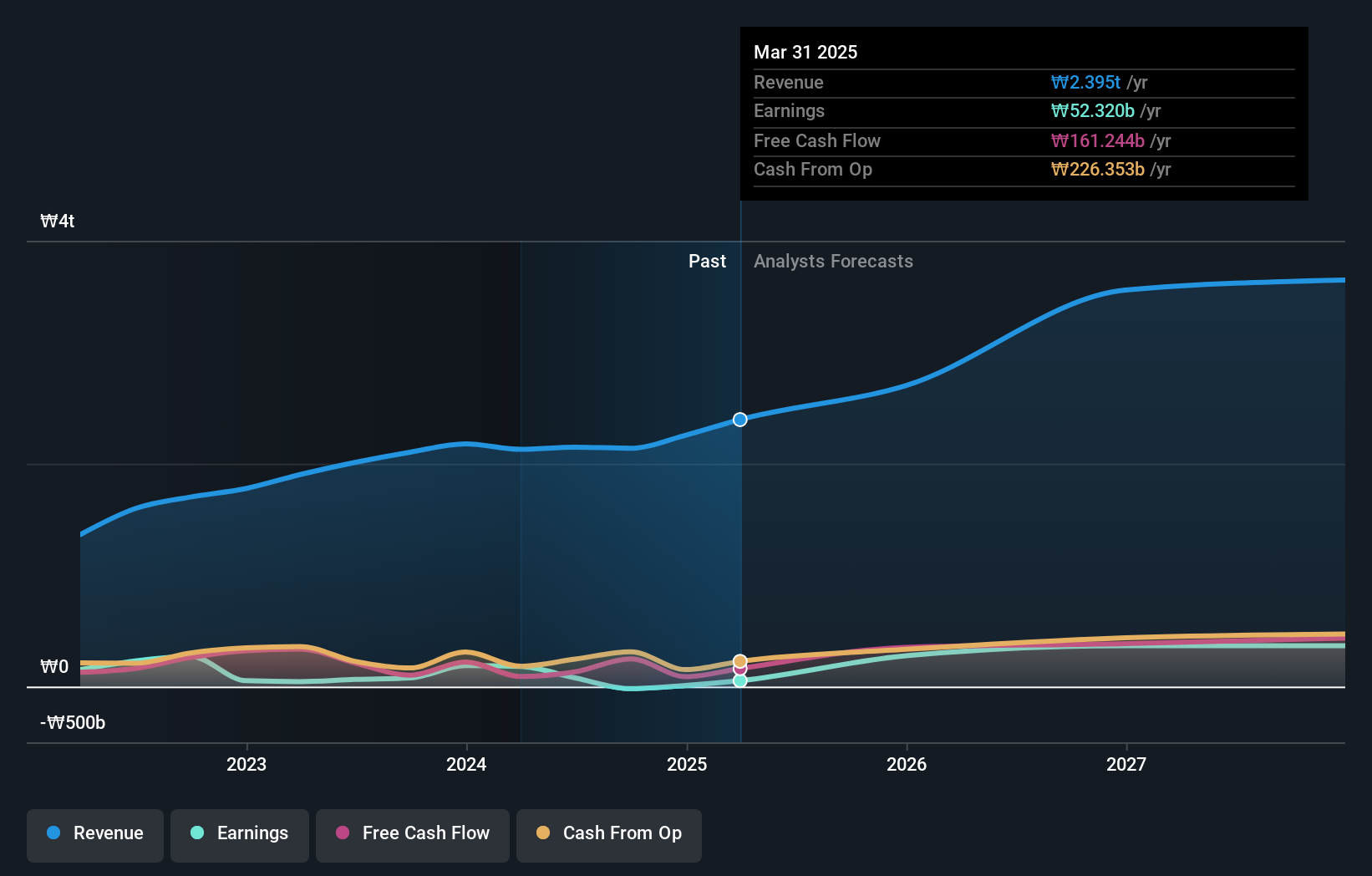

HYBE, a South Korean tech firm, is navigating through a dynamic growth trajectory with its revenue projected to increase by 13.7% annually, outpacing the broader market's 10.2%. This growth is bolstered by an aggressive R&D investment strategy, crucial for maintaining its competitive edge in the entertainment technology sector. Recently, HYBE has also completed a share repurchase program aimed at stock price stabilization, buying back 150,000 shares for KRW 26.09 billion. Despite facing significant one-off losses of ₩189.4B that impacted recent financial results, the company's earnings are expected to surge by 42.5% annually over the next few years—showcasing its resilience and potential for rapid recovery in profitability.

- Click here and access our complete health analysis report to understand the dynamics of HYBE.

Understand HYBE's track record by examining our Past report.

Make It Happen

- Reveal the 47 hidden gems among our KRX High Growth Tech and AI Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A007660

ISU Petasys

Manufactures and sells printed circuit boards (PCBs) worldwide.

High growth potential and good value.