- South Korea

- /

- Biotech

- /

- KOSDAQ:A214450

High Growth Tech Stocks In South Korea To Watch

Reviewed by Simply Wall St

The South Korean stock market has recently experienced a downturn, with the KOSPI index dropping 1.31 percent to close at 2,570.70 amid global concerns over rising treasury yields and mixed performances across sectors. In this environment of uncertainty, identifying high-growth tech stocks becomes crucial as investors seek opportunities that can potentially outperform despite broader market challenges.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| NEXON Games | 27.93% | 67.05% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 23.21% | 34.63% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 48 stocks from our KRX High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★★☆

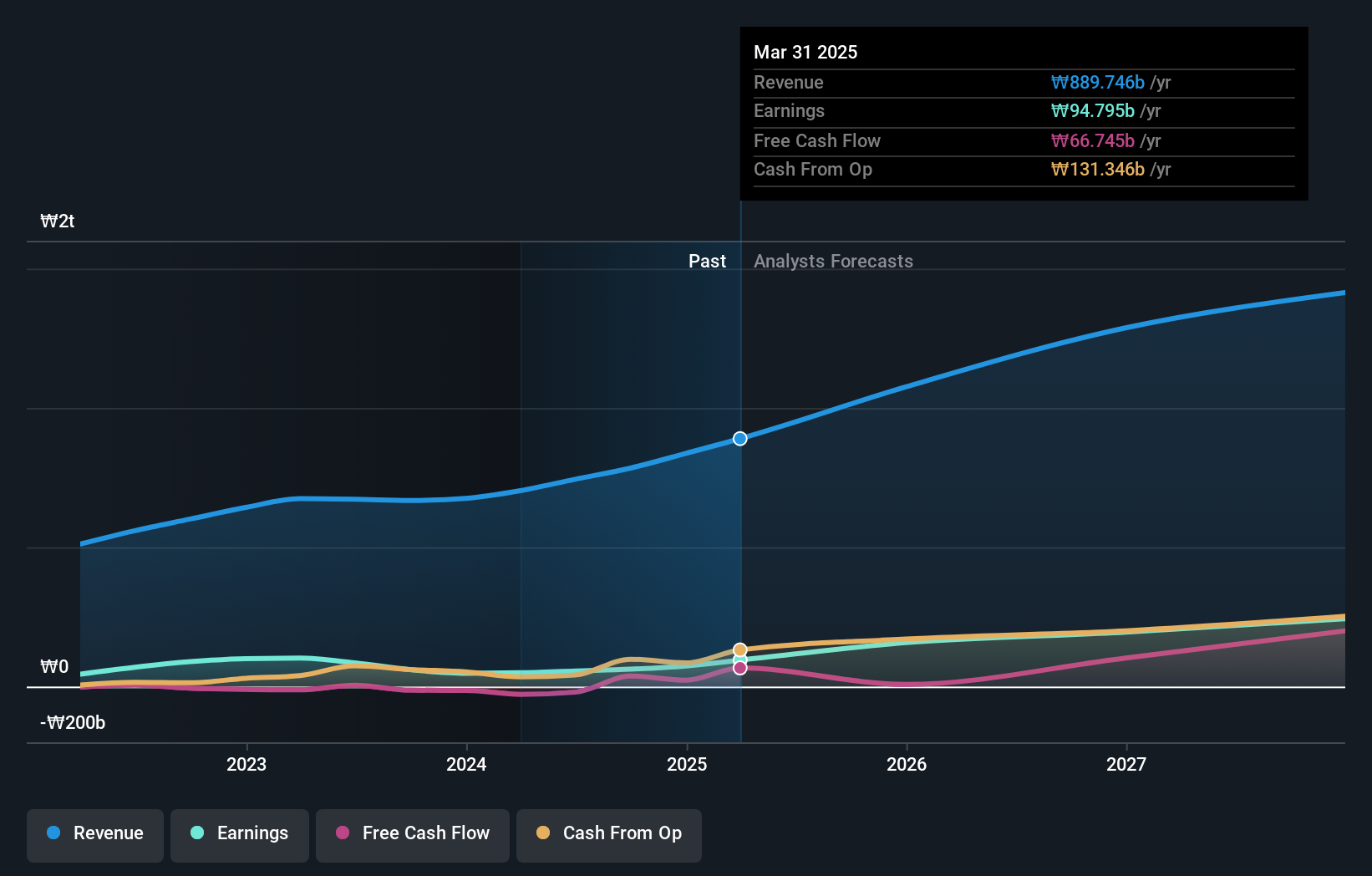

Overview: PharmaResearch Co., Ltd., along with its subsidiaries, functions as a biopharmaceutical company mainly in South Korea, with a market capitalization of ₩2.38 trillion.

Operations: PharmaResearch Co., Ltd. primarily generates revenue from its pharmaceuticals segment, which amounts to ₩296.59 billion.

PharmaResearch is navigating the competitive landscape of South Korea's biotech sector with a notable focus on innovation and market expansion. The company's R&D expenses, crucial for its growth trajectory, have been strategically high, aligning with its revenue growth rate of 22.3% per year, outpacing the Korean market average of 10.3%. Recently, PharmaResearch enhanced its financial flexibility through a private placement, issuing shares to raise nearly KRW 200 billion; this move could further bolster its research capabilities and drive future earnings growth projected at 22.2% annually. With earnings having surged by 63.2% over the past year—significantly above the industry average—PharmaResearch is poised to maintain a robust position in high-tech biotechnology innovations while continuing to attract substantial investment interest.

- Click here to discover the nuances of PharmaResearch with our detailed analytical health report.

Gain insights into PharmaResearch's past trends and performance with our Past report.

ISU Petasys (KOSE:A007660)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ISU Petasys Co., Ltd. is a global manufacturer and seller of printed circuit boards (PCBs) with a market capitalization of ₩2.75 billion.

Operations: The company focuses on the manufacture and sale of printed circuit boards, generating revenue of ₩743.88 billion from this segment. With a market capitalization of approximately ₩2.75 trillion, ISU Petasys operates on a global scale in the PCB industry.

ISU Petasys, a South Korean tech firm, is navigating its niche in the high-growth technology sector with a strategic emphasis on R&D investments. The company's R&D expenditure has been robust, aligning with an 18.6% annual revenue growth rate and outpacing the broader Korean market average of 10.3%. This focus on innovation is further underscored by an impressive projected earnings growth rate of 44.4% per year, signaling strong future prospects despite current industry challenges such as volatile share prices and underwhelming debt coverage by operating cash flow. These figures highlight ISU Petasys's commitment to maintaining a competitive edge through continuous technological advancements and market responsiveness.

- Get an in-depth perspective on ISU Petasys' performance by reading our health report here.

Understand ISU Petasys' track record by examining our Past report.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. operates in the music production, publishing, and artist development and management sectors with a market capitalization of ₩8.16 trillion.

Operations: HYBE Co., Ltd. generates revenue primarily from its Label and Solution segments, with contributions of approximately ₩1.28 trillion and ₩1.24 trillion, respectively. The Platform segment adds another significant stream at around ₩361 billion.

HYBE, navigating South Korea's dynamic tech landscape, emphasizes R&D to foster innovation and maintain competitiveness. In 2024, the company allocated a significant portion of its budget to R&D expenses, reinforcing its commitment to technological advancement amidst a challenging market. This strategic focus is evident as HYBE reported a robust revenue growth of 13.7% annually, outpacing the broader Korean market's growth rate of 10.3%. Moreover, HYBE's earnings are projected to surge by an impressive 42.5% annually, highlighting its potential in leveraging R&D for substantial financial gains and market share expansion. Recent initiatives include a share repurchase program completed in September 2024 for KRW 26 billion, aimed at stock price stabilization—a move reflecting confidence in its financial health and future prospects.

- Navigate through the intricacies of HYBE with our comprehensive health report here.

Explore historical data to track HYBE's performance over time in our Past section.

Summing It All Up

- Explore the 48 names from our KRX High Growth Tech and AI Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A214450

PharmaResearch

Operates as a biopharmaceutical company primarily in South Korea.

Flawless balance sheet with high growth potential.