- South Korea

- /

- Electrical

- /

- KOSE:A229640

Some LS Eco Energy Ltd. (KRX:229640) Shareholders Look For Exit As Shares Take 25% Pounding

Unfortunately for some shareholders, the LS Eco Energy Ltd. (KRX:229640) share price has dived 25% in the last thirty days, prolonging recent pain. Looking at the bigger picture, even after this poor month the stock is up 43% in the last year.

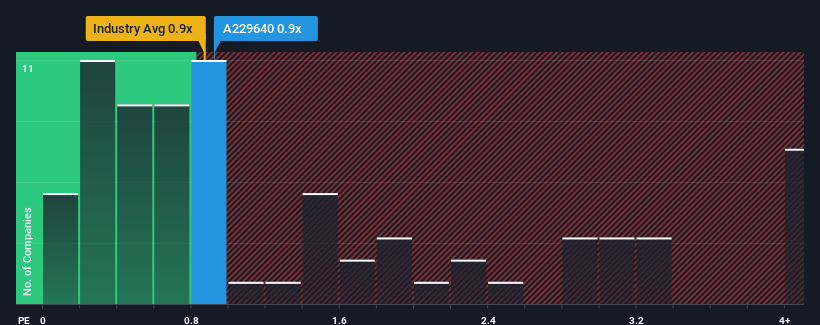

Although its price has dipped substantially, there still wouldn't be many who think LS Eco Energy's price-to-sales (or "P/S") ratio of 0.9x is worth a mention when it essentially matches the median P/S in Korea's Electrical industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for LS Eco Energy

How Has LS Eco Energy Performed Recently?

With its revenue growth in positive territory compared to the declining revenue of most other companies, LS Eco Energy has been doing quite well of late. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on LS Eco Energy .How Is LS Eco Energy's Revenue Growth Trending?

LS Eco Energy's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 19%. The latest three year period has also seen a 16% overall rise in revenue, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 16% per year during the coming three years according to the five analysts following the company. With the industry predicted to deliver 19% growth each year, the company is positioned for a weaker revenue result.

With this information, we find it interesting that LS Eco Energy is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Key Takeaway

LS Eco Energy's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at the analysts forecasts of LS Eco Energy's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware LS Eco Energy is showing 2 warning signs in our investment analysis, and 1 of those is significant.

If you're unsure about the strength of LS Eco Energy's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A229640

LS Eco Energy

Manufactures and sells cables for the electricity boards and news agencies worldwide.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives