- South Korea

- /

- Electrical

- /

- KOSE:A229640

More Unpleasant Surprises Could Be In Store For LS Eco Energy Ltd.'s (KRX:229640) Shares After Tumbling 26%

LS Eco Energy Ltd. (KRX:229640) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. Regardless, last month's decline is barely a blip on the stock's price chart as it has gained a monstrous 351% in the last year.

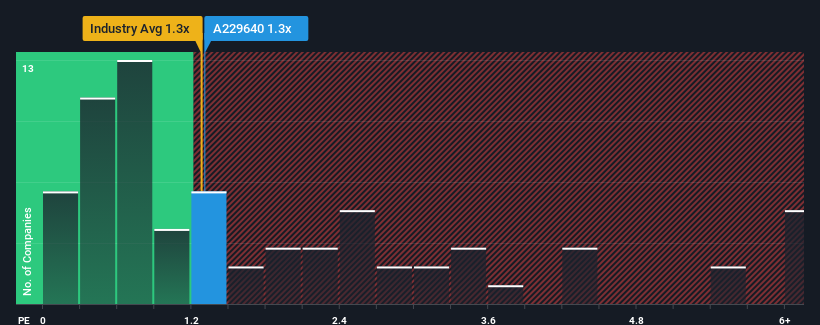

Even after such a large drop in price, there still wouldn't be many who think LS Eco Energy's price-to-sales (or "P/S") ratio of 1.3x is worth a mention when it essentially matches the median P/S in Korea's Electrical industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for LS Eco Energy

How Has LS Eco Energy Performed Recently?

LS Eco Energy could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on LS Eco Energy.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like LS Eco Energy's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.1%. Regardless, revenue has managed to lift by a handy 20% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 6.9% per year during the coming three years according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 25% each year, which is noticeably more attractive.

With this information, we find it interesting that LS Eco Energy is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Following LS Eco Energy's share price tumble, its P/S is just clinging on to the industry median P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at the analysts forecasts of LS Eco Energy's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 2 warning signs for LS Eco Energy that you need to be mindful of.

If these risks are making you reconsider your opinion on LS Eco Energy, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A229640

LS Eco Energy

Manufactures and sells cables for the electricity boards and news agencies worldwide.

Solid track record with mediocre balance sheet.

Market Insights

Community Narratives