- South Korea

- /

- Electrical

- /

- KOSE:A112610

CS Wind Corporation (KRX:112610) Shares Slammed 26% But Getting In Cheap Might Be Difficult Regardless

The CS Wind Corporation (KRX:112610) share price has fared very poorly over the last month, falling by a substantial 26%. Indeed, the recent drop has reduced its annual gain to a relatively sedate 2.0% over the last twelve months.

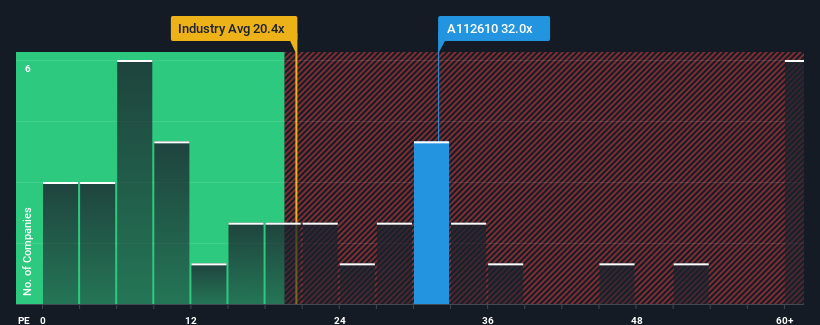

Even after such a large drop in price, given close to half the companies in Korea have price-to-earnings ratios (or "P/E's") below 11x, you may still consider CS Wind as a stock to avoid entirely with its 32x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times have been advantageous for CS Wind as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for CS Wind

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, CS Wind would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 100% gain to the company's bottom line. Still, incredibly EPS has fallen 2.0% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 59% per year during the coming three years according to the analysts following the company. With the market only predicted to deliver 16% per year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that CS Wind's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From CS Wind's P/E?

CS Wind's shares may have retreated, but its P/E is still flying high. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of CS Wind's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 3 warning signs for CS Wind (1 is concerning!) that you need to take into consideration.

If these risks are making you reconsider your opinion on CS Wind, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A112610

CS Wind

Manufactures and sells wind towers in Europe, North America, and Asia.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives