- South Korea

- /

- Electrical

- /

- KOSE:A103590

Iljin Electric Co.,Ltd's (KRX:103590) Popularity With Investors Is Clear

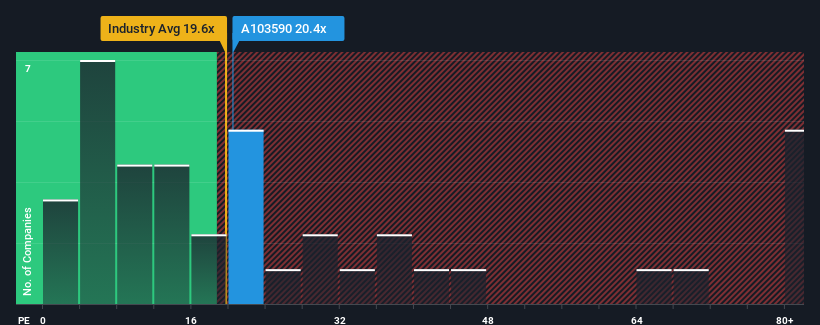

When close to half the companies in Korea have price-to-earnings ratios (or "P/E's") below 11x, you may consider Iljin Electric Co.,Ltd (KRX:103590) as a stock to avoid entirely with its 20.4x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Iljin ElectricLtd certainly has been doing a good job lately as it's been growing earnings more than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Iljin ElectricLtd

How Is Iljin ElectricLtd's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Iljin ElectricLtd's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered an exceptional 39% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 217% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 24% per annum during the coming three years according to the two analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 19% per annum, which is noticeably less attractive.

In light of this, it's understandable that Iljin ElectricLtd's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Iljin ElectricLtd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Iljin ElectricLtd is showing 2 warning signs in our investment analysis, you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A103590

Iljin ElectricLtd

Engages in the production of transmission and distribution of power equipment.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives