- South Korea

- /

- Biotech

- /

- KOSDAQ:A228760

3 KRX Growth Companies With High Insider Ownership And Up To 107% Earnings Growth

Reviewed by Simply Wall St

Separated by the Chuseok Thanksgiving holiday, the South Korea stock market has moved higher in three straight sessions, improving more than 65 points or 2.6 percent along the way. The KOSPI now sits just above the 2,580-point plateau and it's tipped to open in the green again on Friday. In this favorable market environment, growth companies with high insider ownership can be particularly appealing as they often demonstrate strong alignment between management and shareholder interests. Here are three such companies listed on KRX that have shown impressive earnings growth of up to 107%.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.5% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| Bioneer (KOSDAQ:A064550) | 17.5% | 97.6% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 99.5% |

| Oscotec (KOSDAQ:A039200) | 26.3% | 122% |

| Vuno (KOSDAQ:A338220) | 19.5% | 110.9% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 96.7% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 83.6% |

Let's explore several standout options from the results in the screener.

Genomictree (KOSDAQ:A228760)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Genomictree Inc. is a biomarker-based molecular diagnostics company that develops and commercializes products for detecting cancer and infectious diseases, with a market cap of ₩412.01 billion.

Operations: The company's revenue segments include ₩1.93 billion from the Cancer Molecular Diagnosis Business and ₩109.21 million from Genomic Analysis and Other Business.

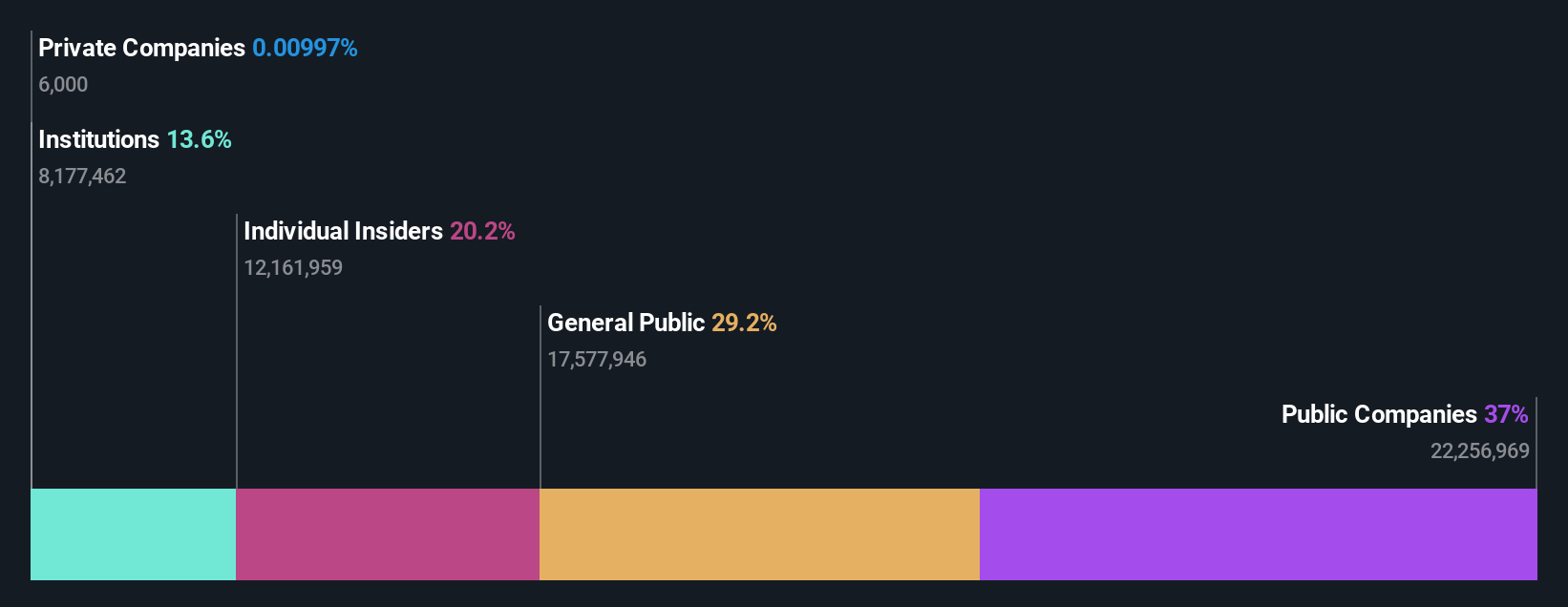

Insider Ownership: 16.2%

Earnings Growth Forecast: 107.8% p.a.

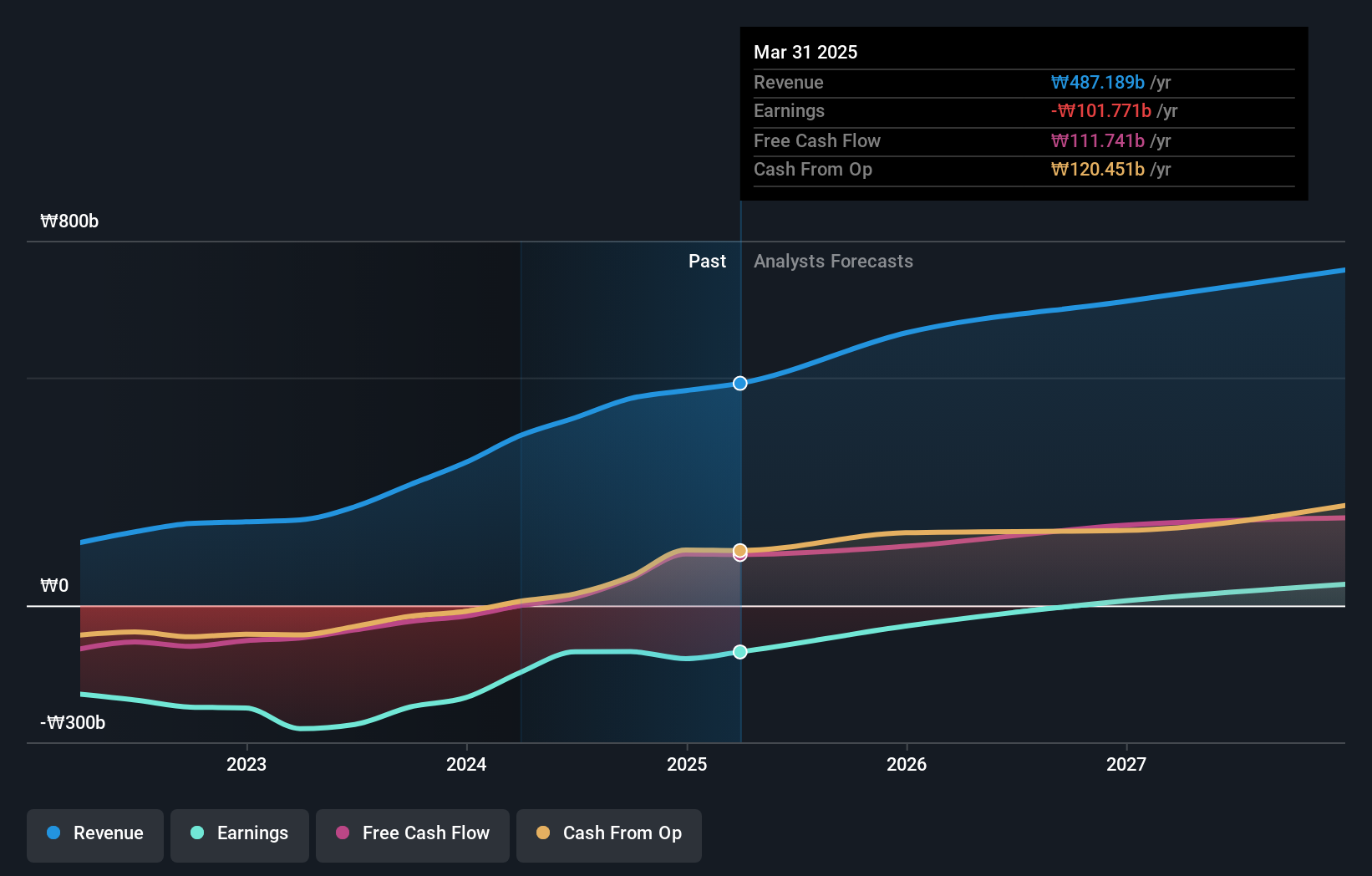

Genomictree is forecast to achieve substantial revenue growth of 90.5% per year, significantly outpacing the South Korean market's average. Despite its current low revenue of ₩2B, it is expected to become profitable within the next three years, with earnings projected to grow at 107.81% annually. Trading at 63.5% below estimated fair value, Genomictree remains highly volatile but shows promise as a growth company with high insider ownership in South Korea.

- Click here to discover the nuances of Genomictree with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential undervaluation of Genomictree shares in the market.

Lotte Tour Development (KOSE:A032350)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lotte Tour Development Co., Ltd., with a market cap of ₩717.77 billion, operates in South Korea providing travel and tourism services through its subsidiaries.

Operations: Lotte Tour Development Co., Ltd. generates revenue through its Internet Media Sector (₩2.19 billion), Dream Tower Integrated Resort Division (₩337.15 billion), and Travel Related Service Sector excluding Internet Journalism (₩72.47 billion).

Insider Ownership: 29.4%

Earnings Growth Forecast: 103.4% p.a.

Lotte Tour Development is forecast to achieve significant revenue growth of 15% per year, outpacing the South Korean market's average. Although currently unprofitable, it is expected to become profitable within three years with earnings projected to grow at 103.42% annually. The stock trades at 76.8% below its estimated fair value and reported a substantial reduction in net loss for the second quarter of 2024, indicating potential for future growth despite recent financial challenges.

- Click here and access our complete growth analysis report to understand the dynamics of Lotte Tour Development.

- Upon reviewing our latest valuation report, Lotte Tour Development's share price might be too pessimistic.

SK oceanplantLtd (KOSE:A100090)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SK oceanplant Co., Ltd. specializes in engineering, procurement, and construction of offshore projects in South Korea and has a market cap of ₩919.31 billion.

Operations: The company's revenue segments include Shipbuilding/Marine at ₩900.87 million and the Steel Pipe Division at ₩26.42 million.

Insider Ownership: 20.7%

Earnings Growth Forecast: 32.8% p.a.

SK oceanplant Ltd. is projected to achieve significant earnings growth of 32.83% annually over the next three years, outpacing the South Korean market's average growth rate of 28.7%. Despite this, its revenue growth forecast of 18.4% per year lags behind the desired threshold for high-growth companies but remains above the market average of 10.1%. However, profit margins have declined from 5.5% to 3%, and Return on Equity is expected to be low at 9.1%.

- Navigate through the intricacies of SK oceanplantLtd with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that SK oceanplantLtd is priced higher than what may be justified by its financials.

Summing It All Up

- Dive into all 88 of the Fast Growing KRX Companies With High Insider Ownership we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A228760

Genomictree

A biomarker-based molecular diagnostics company, develops and commercializes molecular diagnostic products for the detection of cancer and various infectious diseases.

High growth potential with adequate balance sheet.