- South Korea

- /

- Machinery

- /

- KOSE:A075580

Investors Who Bought Sejin Heavy Industries (KRX:075580) Shares Five Years Ago Are Now Up 129%

While Sejin Heavy Industries Co., Ltd. (KRX:075580) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 25% in the last quarter. But that scarcely detracts from the really solid long term returns generated by the company over five years. Indeed, the share price is up an impressive 129% in that time. Generally speaking the long term returns will give you a better idea of business quality than short periods can. Of course, that doesn't necessarily mean it's cheap now.

Check out our latest analysis for Sejin Heavy Industries

We don't think that Sejin Heavy Industries' modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 5 years Sejin Heavy Industries saw its revenue shrink by 14% per year. On the other hand, the share price done the opposite, gaining 18%, compound, each year. It's a good reminder that expectations about the future, not the past history, always impact share prices. Still, this situation makes us a little wary of the stock.

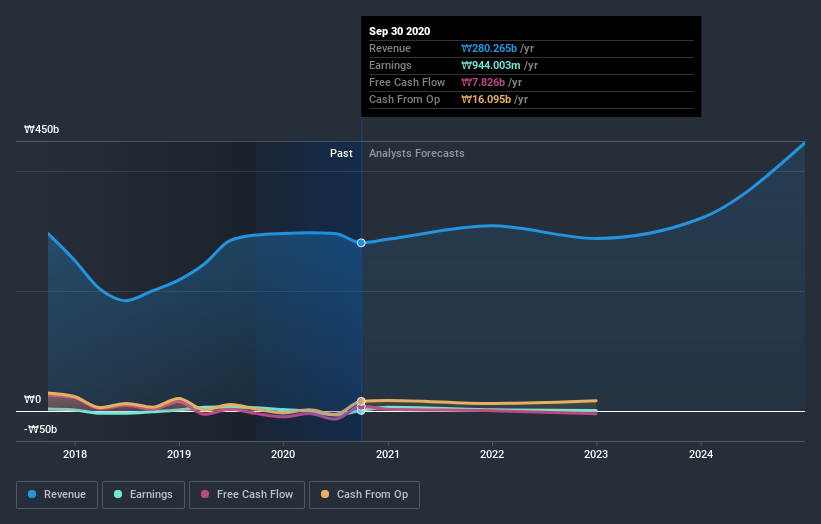

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Sejin Heavy Industries stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Sejin Heavy Industries, it has a TSR of 146% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that Sejin Heavy Industries shareholders have received a total shareholder return of 120% over one year. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 20% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with Sejin Heavy Industries (at least 2 which are a bit concerning) , and understanding them should be part of your investment process.

We will like Sejin Heavy Industries better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade Sejin Heavy Industries, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A075580

Sejin Heavy Industries

Manufactures and sells shipbuilding equipment in South Korea.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives