- South Korea

- /

- Machinery

- /

- KOSE:A075580

Investors Who Bought Sejin Heavy Industries (KRX:075580) Shares Three Years Ago Are Now Up 268%

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But if you buy shares in a really great company, you can more than double your money. For example, the Sejin Heavy Industries Co., Ltd. (KRX:075580) share price has soared 268% in the last three years. Most would be happy with that. It's also good to see the share price up 124% over the last quarter.

See our latest analysis for Sejin Heavy Industries

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the three years of share price growth, Sejin Heavy Industries actually saw its earnings per share (EPS) drop 9.6% per year.

Thus, it seems unlikely that the market is focussed on EPS growth at the moment. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

The modest 0.2% dividend yield is unlikely to be propping up the share price. It could be that the revenue growth of 3.3% per year is viewed as evidence that Sejin Heavy Industries is growing. If the company is being managed for the long term good, today's shareholders might be right to hold on.

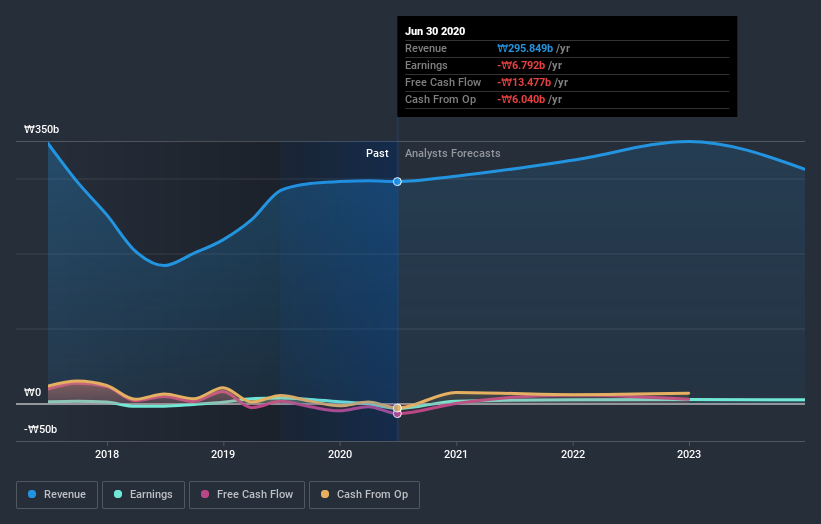

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Sejin Heavy Industries' financial health with this free report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Sejin Heavy Industries' TSR for the last 3 years was 276%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that Sejin Heavy Industries rewarded shareholders with a total shareholder return of 149% over the last year. And yes, that does include the dividend. So this year's TSR was actually better than the three-year TSR (annualized) of 55%. Given the track record of solid returns over varying time frames, it might be worth putting Sejin Heavy Industries on your watchlist. It's always interesting to track share price performance over the longer term. But to understand Sejin Heavy Industries better, we need to consider many other factors. For example, we've discovered 2 warning signs for Sejin Heavy Industries (1 is a bit unpleasant!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade Sejin Heavy Industries, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Sejin Heavy Industries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A075580

Sejin Heavy Industries

Manufactures and sells shipbuilding equipment in South Korea.

High growth potential with solid track record.