- South Korea

- /

- Machinery

- /

- KOSE:A071970

Undiscovered Gems in Asia for August 2025

Reviewed by Simply Wall St

As global markets navigate through a complex landscape, with the Nasdaq Composite reaching new heights and Asian economies showing resilience despite trade tensions, investors are increasingly looking towards small-cap opportunities in Asia. In this dynamic environment, discovering stocks that exhibit strong fundamentals and potential for growth amidst evolving economic conditions can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| GakkyushaLtd | 17.84% | 4.47% | 15.16% | ★★★★★★ |

| Kaneko Seeds | NA | 1.50% | -1.04% | ★★★★★★ |

| Thai Steel Cable | NA | 4.17% | 18.81% | ★★★★★★ |

| TOMONY Holdings | 58.71% | 8.05% | 13.43% | ★★★★★☆ |

| FDK | 89.05% | 1.03% | -12.00% | ★★★★★☆ |

| Mr Max Holdings | 57.59% | 1.17% | -2.00% | ★★★★☆☆ |

| Ogaki Kyoritsu Bank | 100.28% | 3.05% | 10.51% | ★★★★☆☆ |

| Bank of Iwate | 87.84% | 1.47% | 13.86% | ★★★★☆☆ |

| Marusan Securities | 3.64% | 0.57% | 3.44% | ★★★★☆☆ |

| Techno Smart | 24.76% | 15.56% | 25.47% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

HD-Hyundai Marine Engine (KOSE:A071970)

Simply Wall St Value Rating: ★★★★★★

Overview: HD-Hyundai Marine Engine Co., Ltd. manufactures and sells marine engines, industrial facilities, and plants in South Korea and internationally, with a market cap of ₩2.74 trillion.

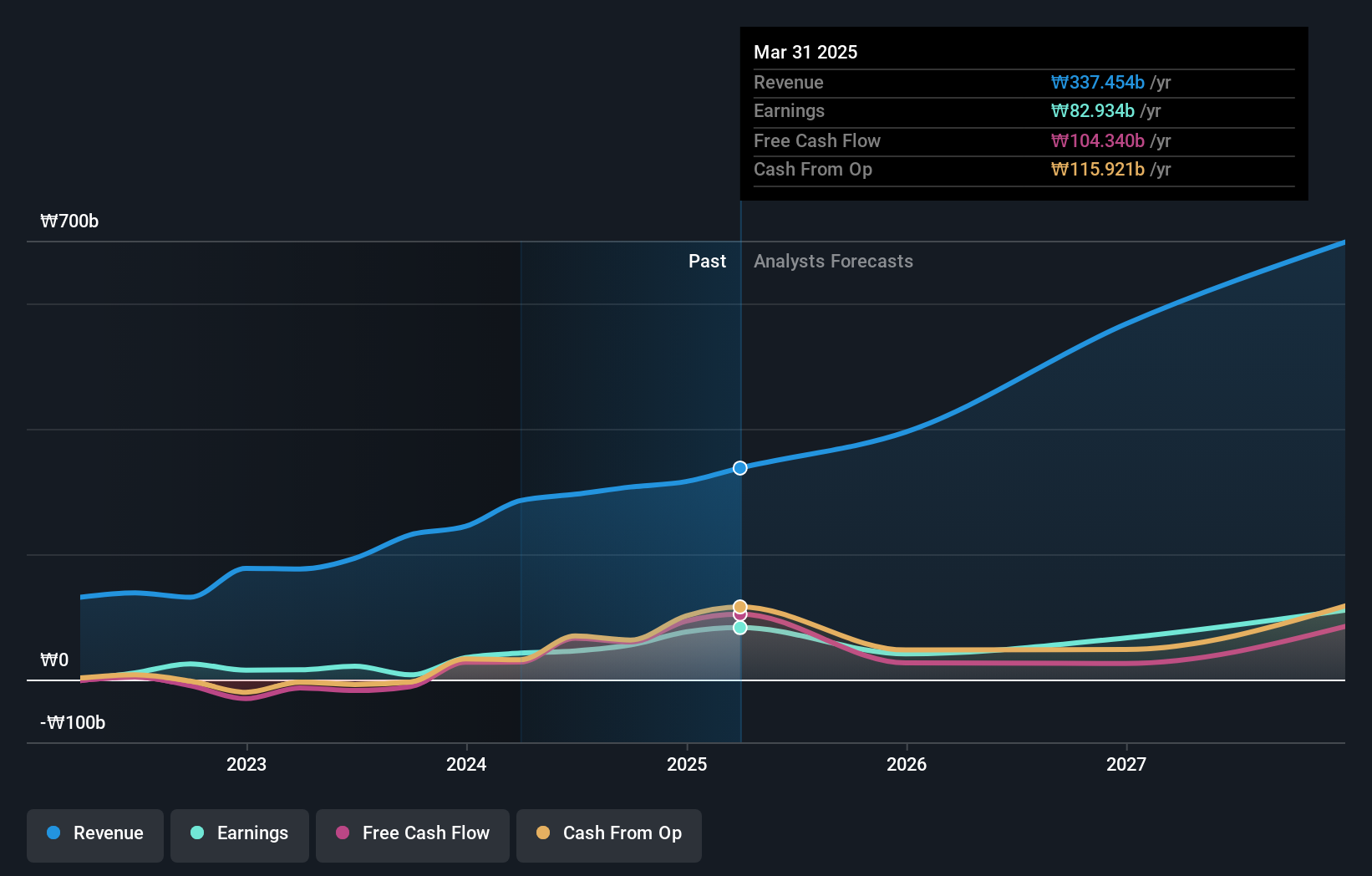

Operations: Revenue primarily comes from the Engine and Equipment segment, amounting to ₩337.45 billion.

HD-Hyundai Marine Engine, a smaller player in the machinery sector, has shown impressive growth with earnings surging by 96.4% over the past year, outpacing the industry's 3.3%. The firm is debt-free now compared to five years ago when its debt-to-equity ratio was 130.1%, reflecting significant financial improvement. Despite recent share price volatility, HD-Hyundai remains profitable with high-quality earnings and positive free cash flow. Recent quarterly results revealed sales of KRW 83 billion (approx US$63 million) and net income of KRW 13.86 billion (approx US$10 million), doubling from last year's figures, suggesting strong operational performance.

- Click here to discover the nuances of HD-Hyundai Marine Engine with our detailed analytical health report.

Assess HD-Hyundai Marine Engine's past performance with our detailed historical performance reports.

Qingdao Gon Technology (SZSE:002768)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Qingdao Gon Technology Co., Ltd. focuses on the research, development, production, and sale of modified plastic particles and products as well as functional plastic plates both in China and internationally, with a market cap of CN¥10.75 billion.

Operations: Qingdao Gon Technology generates revenue primarily through the sale of modified plastic particles and functional plastic plates. The company's financial performance is characterized by a focus on research and development to support its product offerings in both domestic and international markets.

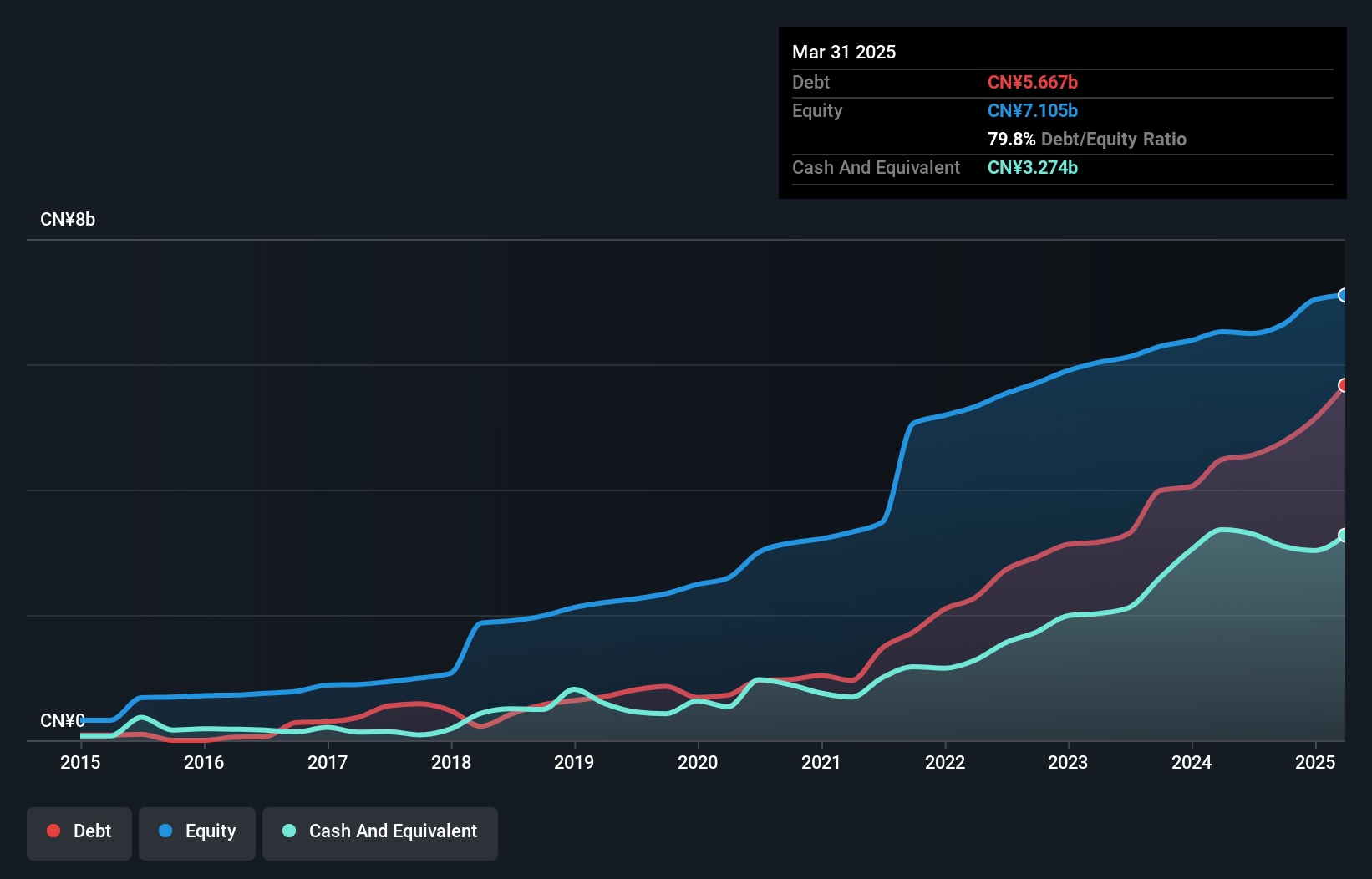

Qingdao Gon Technology, a nimble player in the chemicals sector, showcases a notable earnings growth of 36.6%, outpacing the industry average of 2.7%. Its net debt to equity ratio stands at a satisfactory 33.7%, indicating prudent financial management. The company's interest obligations are comfortably covered by EBIT, with coverage at 6.4 times, reflecting robust operational performance. Despite an increase in its debt to equity ratio from 27.9% to 79.8% over five years, it remains free cash flow positive and trades at an attractive price-to-earnings ratio of 16.2x compared to the broader CN market's 43.1x.

- Click here and access our complete health analysis report to understand the dynamics of Qingdao Gon Technology.

Evaluate Qingdao Gon Technology's historical performance by accessing our past performance report.

Guangdong Provincial Academy of Building Research Group (SZSE:301632)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangdong Provincial Academy of Building Research Group Co., Ltd. focuses on providing comprehensive building research and development services, with a market cap of approximately CN¥2.06 billion.

Operations: Guangdong Provincial Academy of Building Research Group generates revenue primarily from its Inspection and Testing Business, which accounts for CN¥1.19 billion.

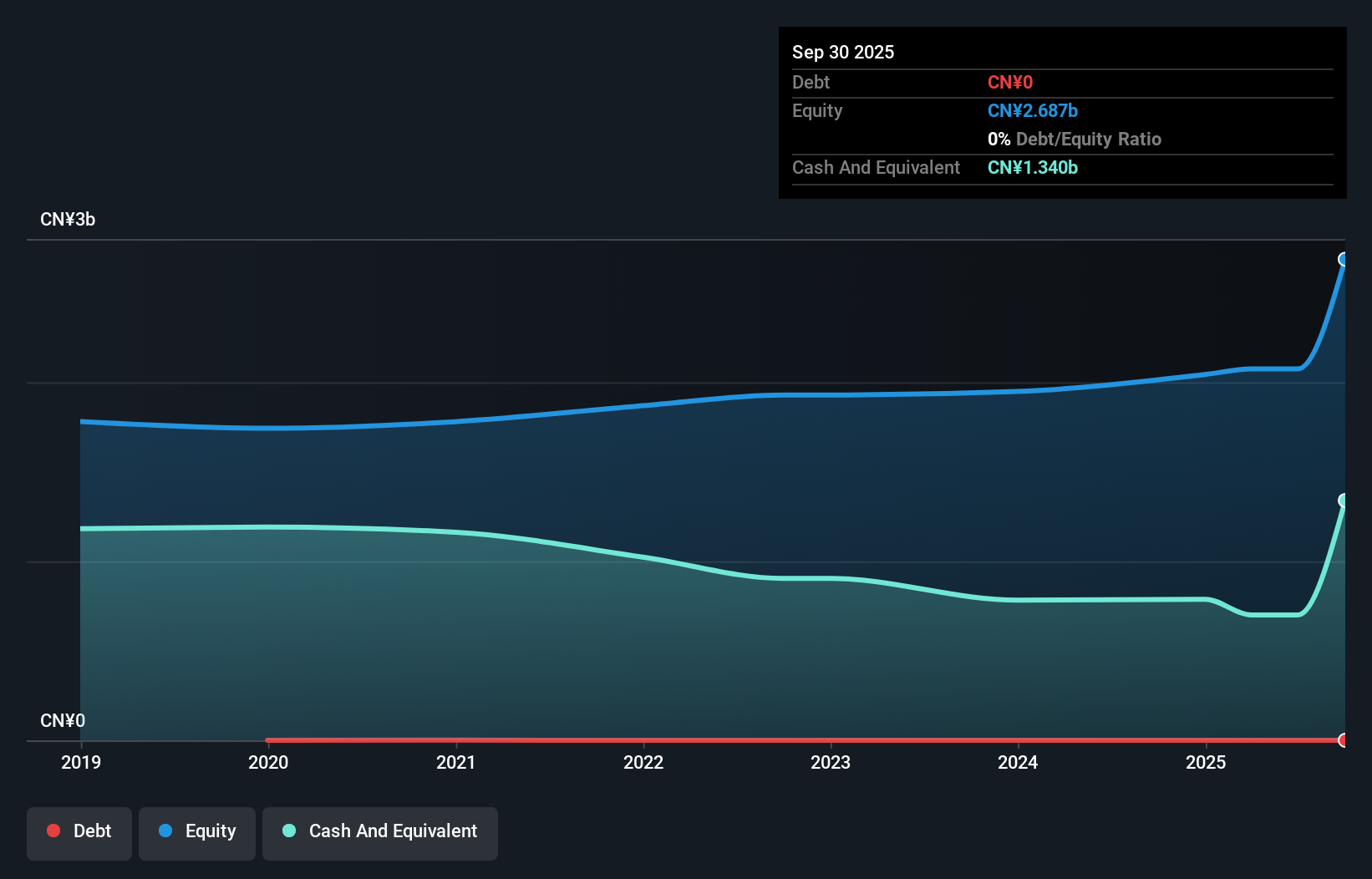

Guangdong Provincial Academy of Building Research Group, a small company with recent IPO proceeds of CNY 686.57 million, is debt-free and demonstrates high-quality earnings. Despite a 13% annual decline in earnings over the past five years, it saw an 8% growth last year, outpacing the Professional Services industry's -0.5%. With sales reaching CNY 1.19 billion and net income at CNY 107.13 million for the latest fiscal year, its shares remain highly illiquid but trade at a significant discount to estimated fair value by about 70%. Its financial health seems solid with positive free cash flow reported recently.

- Unlock comprehensive insights into our analysis of Guangdong Provincial Academy of Building Research Group stock in this health report.

Learn about Guangdong Provincial Academy of Building Research Group's historical performance.

Next Steps

- Navigate through the entire inventory of 2518 Asian Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HD-Hyundai Marine Engine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A071970

HD-Hyundai Marine Engine

Manufactures and sells marine engines, industrial facilities, and plants in South Korea and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives