- South Korea

- /

- Machinery

- /

- KOSE:A071970

HD-Hyundai Marine Engine Co., Ltd.'s (KRX:071970) Popularity With Investors Under Threat As Stock Sinks 25%

The HD-Hyundai Marine Engine Co., Ltd. (KRX:071970) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. Still, a bad month hasn't completely ruined the past year with the stock gaining 49%, which is great even in a bull market.

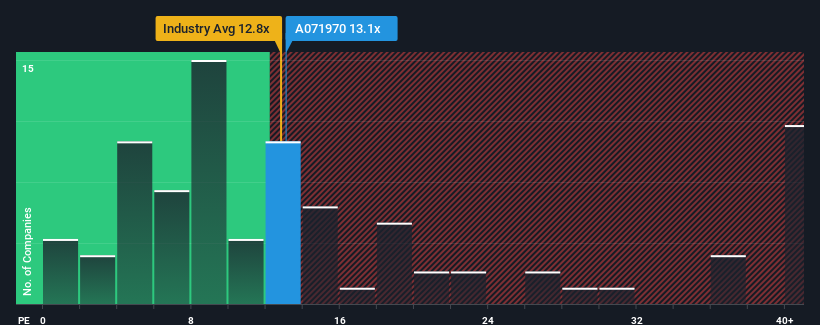

Although its price has dipped substantially, it's still not a stretch to say that HD-Hyundai Marine Engine's price-to-earnings (or "P/E") ratio of 13.1x right now seems quite "middle-of-the-road" compared to the market in Korea, where the median P/E ratio is around 11x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

HD-Hyundai Marine Engine certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for HD-Hyundai Marine Engine

Is There Some Growth For HD-Hyundai Marine Engine?

The only time you'd be comfortable seeing a P/E like HD-Hyundai Marine Engine's is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 97% last year. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 32% shows it's noticeably less attractive on an annualised basis.

In light of this, it's curious that HD-Hyundai Marine Engine's P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Key Takeaway

HD-Hyundai Marine Engine's plummeting stock price has brought its P/E right back to the rest of the market. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that HD-Hyundai Marine Engine currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 2 warning signs for HD-Hyundai Marine Engine you should know about.

You might be able to find a better investment than HD-Hyundai Marine Engine. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if HD-Hyundai Marine Engine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A071970

HD-Hyundai Marine Engine

Manufactures and sells marine engines, industrial facilities, and plants in South Korea and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives