- Taiwan

- /

- Electrical

- /

- TWSE:6781

Asian Companies Trading Below Estimated Value In April 2025

Reviewed by Simply Wall St

In April 2025, global markets are grappling with heightened trade tensions due to unexpected tariff increases by the U.S., which have sparked concerns over economic growth and inflation worldwide. Amidst this uncertainty, investors are increasingly looking towards undervalued stocks in Asia as potential opportunities, focusing on companies that demonstrate strong fundamentals and resilience in challenging market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥27.32 | CN¥54.07 | 49.5% |

| Future (TSE:4722) | ¥1688.00 | ¥3372.26 | 49.9% |

| Sichuan Injet Electric (SZSE:300820) | CN¥49.27 | CN¥96.54 | 49% |

| Cosel (TSE:6905) | ¥999.00 | ¥1934.50 | 48.4% |

| BuySell TechnologiesLtd (TSE:7685) | ¥2547.00 | ¥5068.23 | 49.7% |

| EVE Energy (SZSE:300014) | CN¥45.77 | CN¥89.85 | 49.1% |

| Eternal Hospitality GroupLtd (TSE:3193) | ¥2608.00 | ¥5053.77 | 48.4% |

| Kokusai Electric (TSE:6525) | ¥2105.50 | ¥4168.62 | 49.5% |

| Sunstone Development (SHSE:603612) | CN¥17.17 | CN¥33.32 | 48.5% |

| MicroPort CardioFlow Medtech (SEHK:2160) | HK$0.91 | HK$1.76 | 48.4% |

Here we highlight a subset of our preferred stocks from the screener.

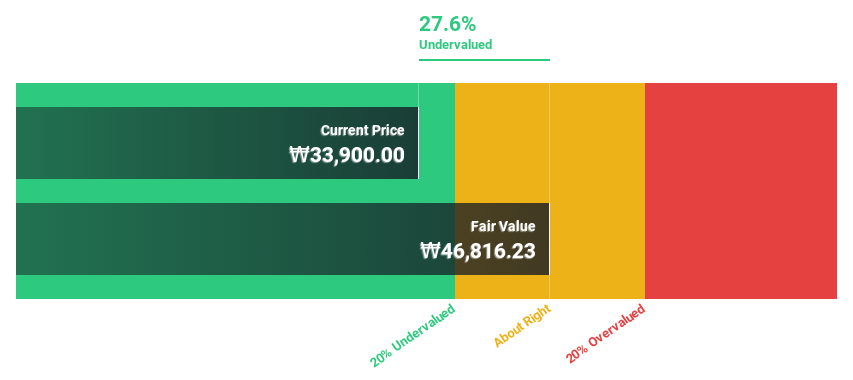

HD-Hyundai Marine Engine (KOSE:A071970)

Overview: HD-Hyundai Marine Engine Co., Ltd. manufactures and sells marine engines, industrial facilities, and plants both in South Korea and internationally, with a market cap of approximately ₩946.41 billion.

Operations: The company's revenue segment primarily comprises the Engine and Equipment division, which generated approximately ₩315.79 million.

Estimated Discount To Fair Value: 40.8%

HD-Hyundai Marine Engine's recent financial performance shows significant growth, with net income rising to ₩75.78 billion from ₩31.64 billion a year ago, and revenue more than doubling. Despite high share price volatility, the stock is trading at 40.8% below its estimated fair value of ₩47,121.09 per share, indicating potential undervaluation based on cash flows. Revenue is forecasted to grow rapidly at 30% annually, outpacing the market rate significantly.

- Our growth report here indicates HD-Hyundai Marine Engine may be poised for an improving outlook.

- Dive into the specifics of HD-Hyundai Marine Engine here with our thorough financial health report.

DPC Dash (SEHK:1405)

Overview: DPC Dash Ltd, with a market cap of HK$13.90 billion, operates a chain of fast-food restaurants in the People's Republic of China through its subsidiaries.

Operations: The company's revenue primarily comes from its fast-food restaurant operations in the People’s Republic of China, amounting to CN¥4.31 billion.

Estimated Discount To Fair Value: 11.3%

DPC Dash's recent annual results highlight a turnaround, with net income reaching CNY 55.2 million from a prior loss, driven by sales growth to CNY 4.31 billion. The stock trades at HK$106.3, slightly below its fair value of HK$119.91, suggesting modest undervaluation based on cash flows. Earnings are expected to grow significantly at over 51% annually, surpassing the Hong Kong market’s growth rate and indicating robust future performance potential despite a lower return on equity forecast.

- In light of our recent growth report, it seems possible that DPC Dash's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of DPC Dash.

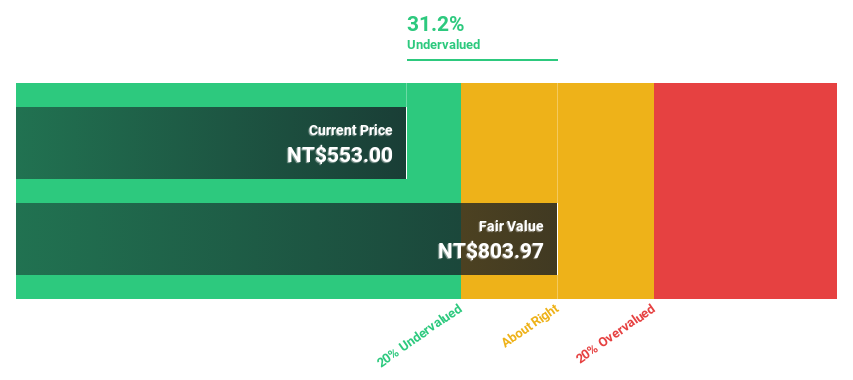

Advanced Energy Solution Holding (TWSE:6781)

Overview: Advanced Energy Solution Holding Co., Ltd. operates in the energy sector and has a market capitalization of approximately NT$74.74 billion.

Operations: Advanced Energy Solution Holding Co., Ltd. generates its revenue from various segments in the energy sector.

Estimated Discount To Fair Value: 23.8%

Advanced Energy Solution Holding Co., Ltd. reported a net income of TWD 2.17 billion for 2024, up from TWD 1.97 billion in the previous year, reflecting strong cash flow potential. The stock is trading at NT$875, below its estimated fair value of NT$1,148.74 and analysts expect earnings to grow significantly by 32.6% annually over the next three years, outpacing Taiwan's market growth rate despite recent share price volatility and a high dividend payout of TWD 12.5 per share for 2024.

- According our earnings growth report, there's an indication that Advanced Energy Solution Holding might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Advanced Energy Solution Holding.

Key Takeaways

- Access the full spectrum of 269 Undervalued Asian Stocks Based On Cash Flows by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6781

Advanced Energy Solution Holding

Advanced Energy Solution Holding Co., Ltd.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives