- South Korea

- /

- Electrical

- /

- KOSE:A066970

It's Down 28% But L&F Co., Ltd. (KRX:066970) Could Be Riskier Than It Looks

The L&F Co., Ltd. (KRX:066970) share price has softened a substantial 28% over the previous 30 days, handing back much of the gains the stock has made lately. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 28% share price drop.

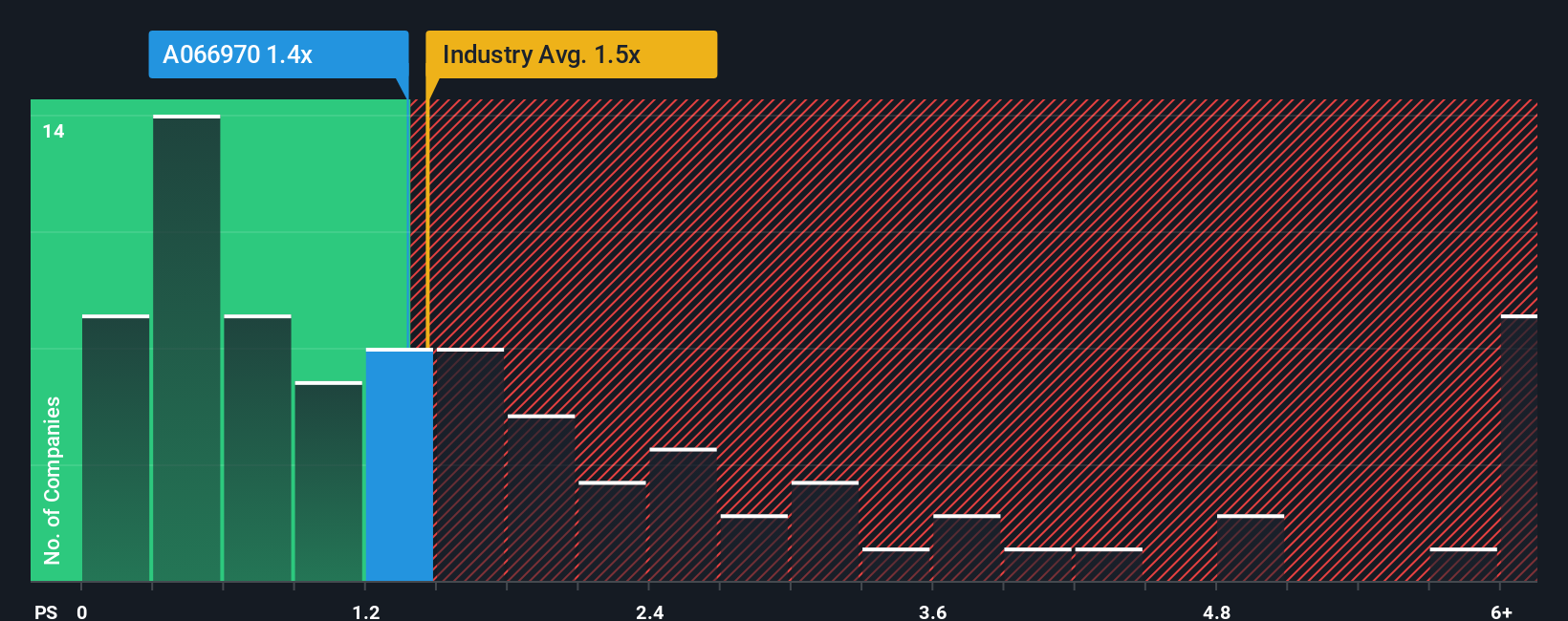

Although its price has dipped substantially, there still wouldn't be many who think L&F's price-to-sales (or "P/S") ratio of 1.4x is worth a mention when the median P/S in Korea's Electrical industry is similar at about 1.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for L&F

What Does L&F's Recent Performance Look Like?

L&F has been struggling lately as its revenue has declined faster than most other companies. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. You'd much rather the company improve its revenue if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on L&F.How Is L&F's Revenue Growth Trending?

L&F's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 48% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 21% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 39% each year as estimated by the analysts watching the company. That's shaping up to be materially higher than the 19% each year growth forecast for the broader industry.

With this information, we find it interesting that L&F is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does L&F's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for L&F looks to be in line with the rest of the Electrical industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at L&F's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for L&F that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A066970

L&F

Engages in the development and sale of electronic materials in Korea.

Exceptional growth potential with mediocre balance sheet.

Market Insights

Community Narratives