- South Korea

- /

- Machinery

- /

- KOSE:A064350

Subdued Growth No Barrier To Hyundai Rotem Company (KRX:064350) With Shares Advancing 30%

Hyundai Rotem Company (KRX:064350) shares have continued their recent momentum with a 30% gain in the last month alone. The last month tops off a massive increase of 156% in the last year.

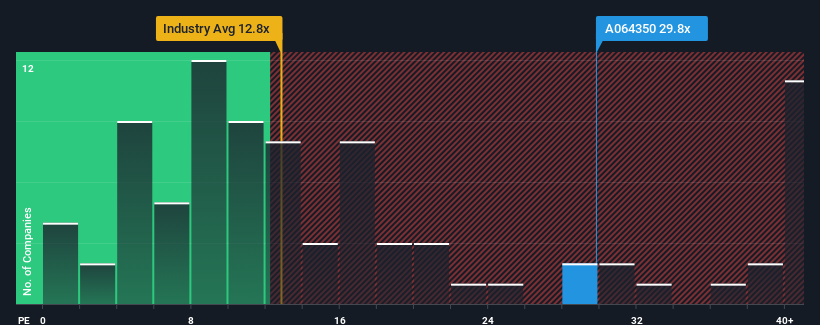

Since its price has surged higher, Hyundai Rotem's price-to-earnings (or "P/E") ratio of 29.8x might make it look like a strong sell right now compared to the market in Korea, where around half of the companies have P/E ratios below 11x and even P/E's below 6x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Hyundai Rotem has been doing relatively well. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Hyundai Rotem

Is There Enough Growth For Hyundai Rotem?

The only time you'd be truly comfortable seeing a P/E as steep as Hyundai Rotem's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a worthy increase of 6.9%. This was backed up an excellent period prior to see EPS up by 605% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 15% per annum during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to expand by 16% each year, which is not materially different.

With this information, we find it interesting that Hyundai Rotem is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Final Word

Hyundai Rotem's P/E is flying high just like its stock has during the last month. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Hyundai Rotem's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Hyundai Rotem with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Hyundai Rotem, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hyundai Rotem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A064350

Hyundai Rotem

Manufactures and sells railway vehicles, defense systems, and plants and machinery in South Korea and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives