- South Korea

- /

- Aerospace & Defense

- /

- KOSE:A047810

Korea Aerospace Industries'(KRX:047810) Share Price Is Down 70% Over The Past Five Years.

We think intelligent long term investing is the way to go. But no-one is immune from buying too high. For example the Korea Aerospace Industries, Ltd. (KRX:047810) share price dropped 70% over five years. That's an unpleasant experience for long term holders. We also note that the stock has performed poorly over the last year, with the share price down 33%. It's down 2.5% in the last seven days.

See our latest analysis for Korea Aerospace Industries

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Korea Aerospace Industries became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

The modest 1.7% dividend yield is unlikely to be guiding the market view of the stock. In contrast to the share price, revenue has actually increased by 0.9% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

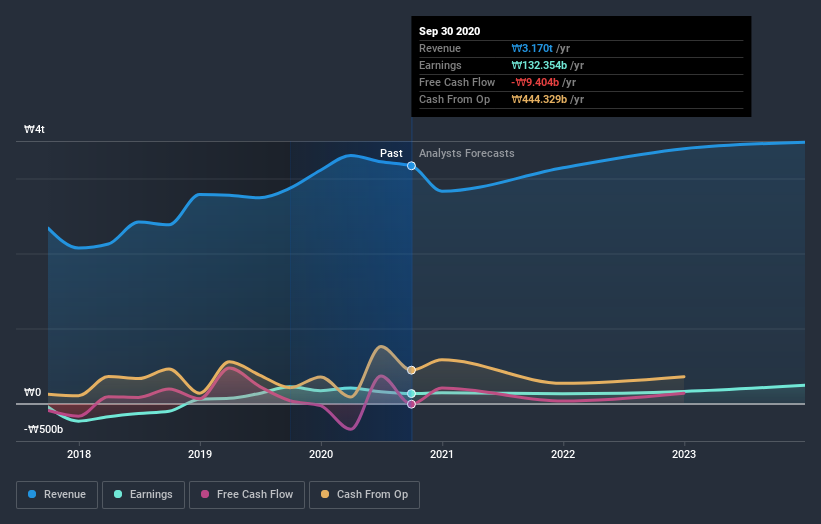

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Korea Aerospace Industries is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

Korea Aerospace Industries shareholders are down 32% for the year (even including dividends), but the market itself is up 38%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 4 warning signs we've spotted with Korea Aerospace Industries .

But note: Korea Aerospace Industries may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade Korea Aerospace Industries, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Korea Aerospace Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A047810

Korea Aerospace Industries

Manufactures and sells fixed and rotary wing aircrafts, and airframe products in South Korea.

Reasonable growth potential with adequate balance sheet.