- South Korea

- /

- Aerospace & Defense

- /

- KOSE:A047810

If You Had Bought Korea Aerospace Industries' (KRX:047810) Shares Five Years Ago You Would Be Down 54%

Korea Aerospace Industries, Ltd. (KRX:047810) shareholders will doubtless be very grateful to see the share price up 42% in the last quarter. But don't envy holders -- looking back over 5 years the returns have been really bad. In that time the share price has delivered a rude shock to holders, who find themselves down 54% after a long stretch. Some might say the recent bounce is to be expected after such a bad drop. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

Check out our latest analysis for Korea Aerospace Industries

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Korea Aerospace Industries became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

We don't think that the 1.2% is big factor in the share price, since it's quite small, as dividends go. In contrast to the share price, revenue has actually increased by 0.9% a year in the five year period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

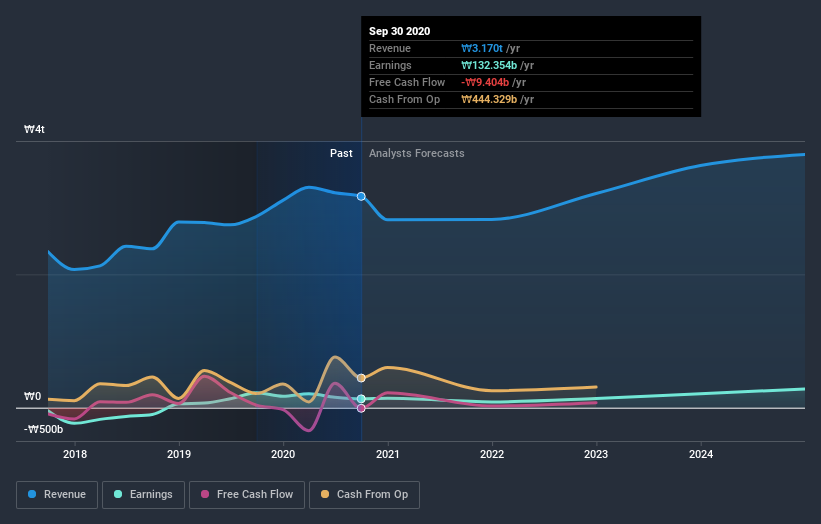

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Korea Aerospace Industries is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Korea Aerospace Industries will earn in the future (free analyst consensus estimates)

A Different Perspective

Korea Aerospace Industries provided a TSR of 36% over the last twelve months. But that was short of the market average. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 9% endured over half a decade. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand Korea Aerospace Industries better, we need to consider many other factors. Take risks, for example - Korea Aerospace Industries has 5 warning signs we think you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading Korea Aerospace Industries or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Korea Aerospace Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A047810

Korea Aerospace Industries

Manufactures and sells fixed and rotary wing aircrafts, and airframe products in South Korea.

Reasonable growth potential with adequate balance sheet.