- Hong Kong

- /

- Specialty Stores

- /

- SEHK:887

Asian Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate the complexities of interest rate expectations and economic shifts, Asian stock markets have shown resilience, with China's indices boosted by domestic liquidity and Japan's benefiting from revised GDP growth figures. In this dynamic environment, dividend stocks can offer stability and potential income for investors seeking to balance growth with consistent returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.00% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.67% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.38% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.72% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.81% | ★★★★★★ |

| NCD (TSE:4783) | 4.24% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.45% | ★★★★★★ |

| Daicel (TSE:4202) | 4.32% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.73% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.51% | ★★★★★★ |

Click here to see the full list of 1007 stocks from our Top Asian Dividend Stocks screener.

We'll examine a selection from our screener results.

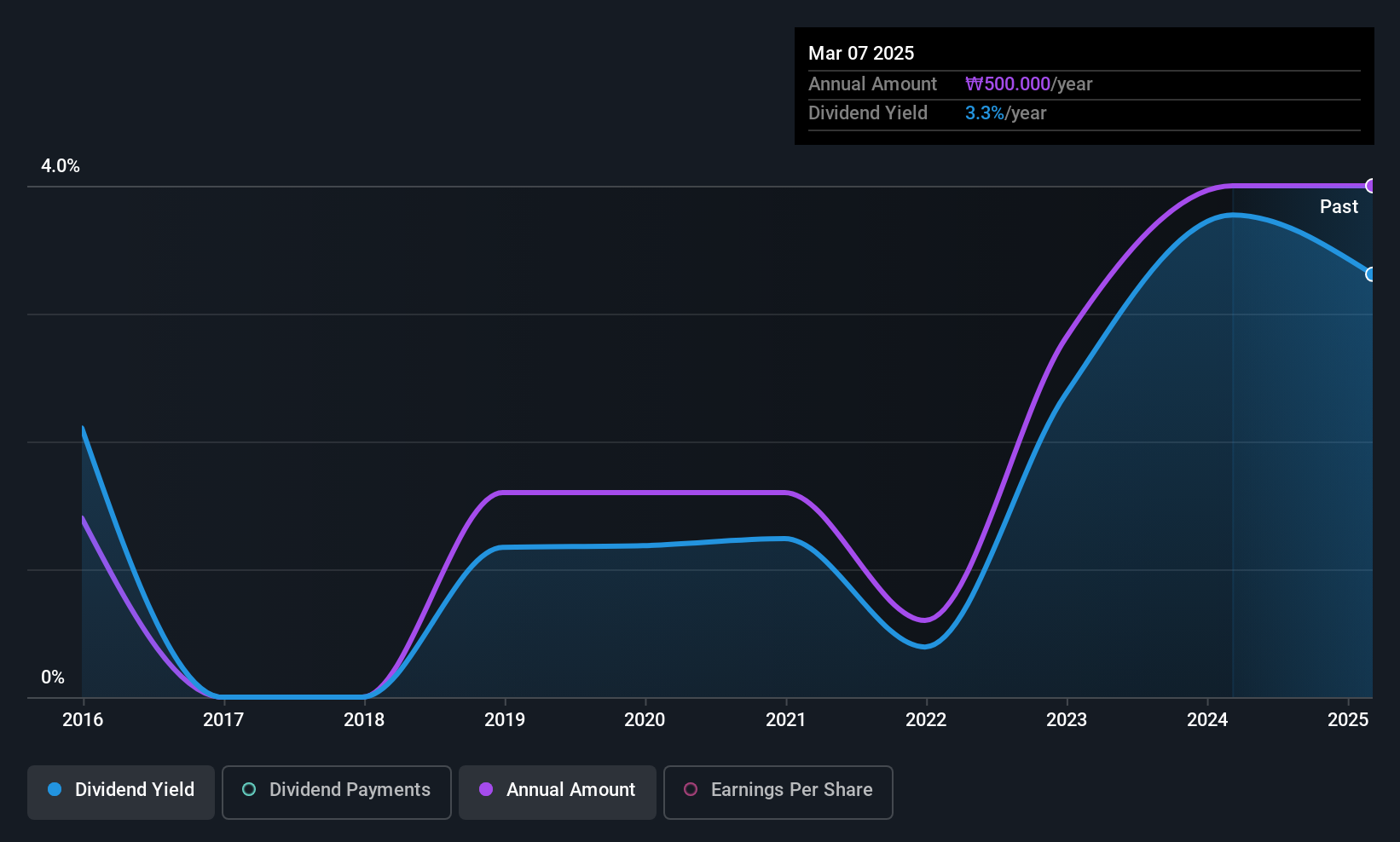

Dong-Ah Geological Engineering (KOSE:A028100)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dong-Ah Geological Engineering Company Ltd. operates in the field of geological engineering and related services, with a market cap of approximately ₩208.57 billion.

Operations: Dong-Ah Geological Engineering Company Ltd. generates revenue primarily from its Civil Engineering segment, which amounts to approximately ₩417.16 million.

Dividend Yield: 3.1%

Dong-Ah Geological Engineering's dividend payments are supported by a low cash payout ratio of 17.9% and a reasonable earnings payout ratio of 52.4%, indicating strong coverage by both cash flows and earnings. Despite the recent volatility in its dividend history, the company has increased dividends over the past decade. The stock trades at 95.3% below its estimated fair value, offering potential value for investors, though its current yield is below top-tier levels in Korea's market at 3.14%. Recent completion of a share buyback plan worth KRW 5 billion may also positively impact shareholder returns.

- Delve into the full analysis dividend report here for a deeper understanding of Dong-Ah Geological Engineering.

- Our expertly prepared valuation report Dong-Ah Geological Engineering implies its share price may be too high.

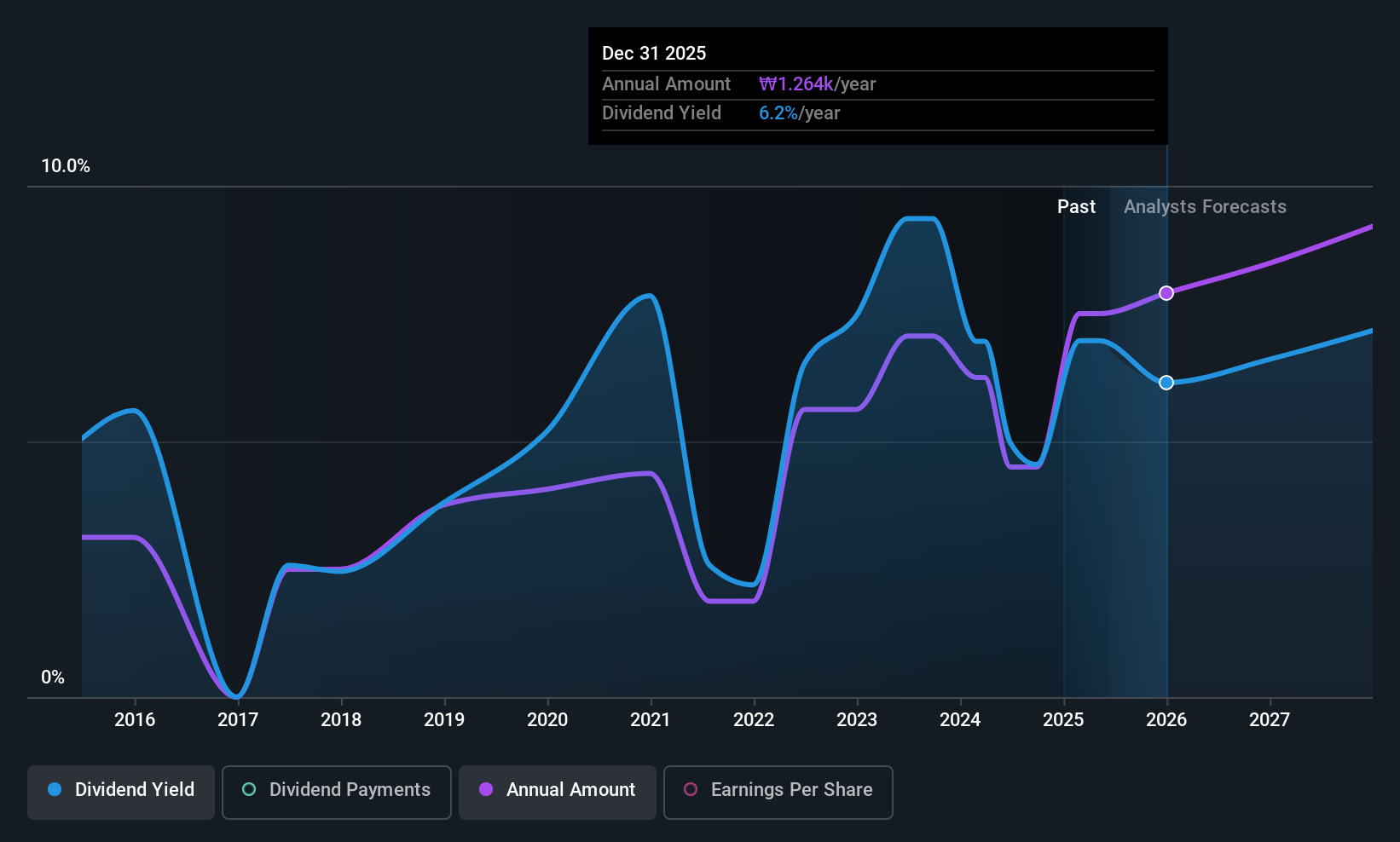

Woori Financial Group (KOSE:A316140)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Woori Financial Group Inc., along with its subsidiaries, operates as a commercial bank offering a range of financial services to individual, business, and institutional customers in Korea, with a market cap of ₩19.41 trillion.

Operations: Woori Financial Group Inc.'s revenue segments include Banking at ₩7.84 billion, Capital at ₩279.53 million, Credit Cards at ₩506.92 million, and Investment Securities at ₩110.78 million.

Dividend Yield: 4.5%

Woori Financial Group's dividend payments, while volatile over the past decade, have shown growth. With a payout ratio of 33.6%, dividends are well covered by earnings and expected to remain so in three years at 31.1%. The stock is trading at 53.2% below its estimated fair value, presenting potential value opportunities for investors. Recently, Woori completed a share buyback worth KRW 149.99 billion, which may enhance shareholder returns alongside its top-tier dividend yield in Korea's market at 4.54%.

- Click here and access our complete dividend analysis report to understand the dynamics of Woori Financial Group.

- The valuation report we've compiled suggests that Woori Financial Group's current price could be quite moderate.

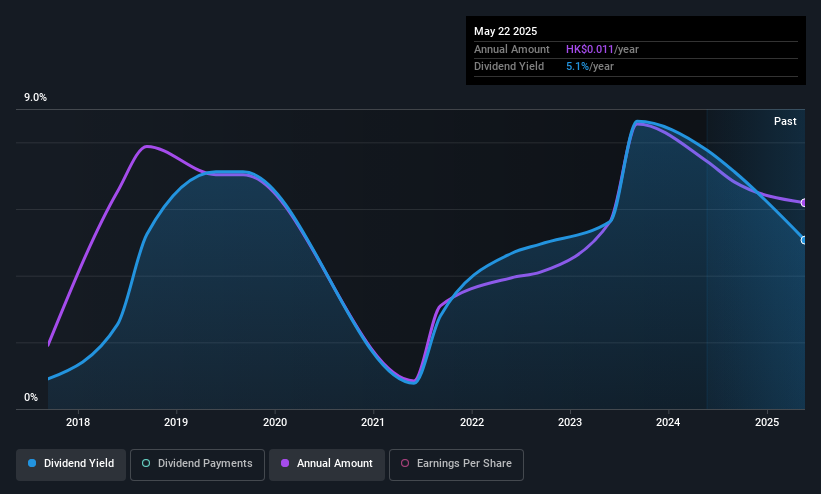

Emperor Watch & Jewellery (SEHK:887)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Emperor Watch & Jewellery Limited is an investment holding company involved in the sale of watches and jewelry products, with a market cap of HK$2.47 billion.

Operations: Emperor Watch & Jewellery Limited generates revenue from its watch and jewelry sales, totaling HK$5.43 billion.

Dividend Yield: 3.2%

Emperor Watch & Jewellery's dividends are well-covered by earnings and cash flows, with payout ratios of 26.1% and 9.2%, respectively. However, the dividend track record has been volatile over the past decade despite some growth. The recent interim dividend of HK$0.0055 reflects a decrease, highlighting ongoing unreliability in payments. Trading at 89.7% below estimated fair value offers potential value for investors, though its low yield of 3.24% lags behind Hong Kong's top-tier payers at 6.56%.

- Click here to discover the nuances of Emperor Watch & Jewellery with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Emperor Watch & Jewellery is trading behind its estimated value.

Taking Advantage

- Take a closer look at our Top Asian Dividend Stocks list of 1007 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emperor Watch & Jewellery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:887

Emperor Watch & Jewellery

An investment holding company, engages in the sale of watches and jewelry products.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives