- South Korea

- /

- Electrical

- /

- KOSE:A017040

Here's Why We Think Kwang Myung ElectricLtd (KRX:017040) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In contrast to all that, I prefer to spend time on companies like Kwang Myung ElectricLtd (KRX:017040), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Kwang Myung ElectricLtd

Kwang Myung ElectricLtd's Improving Profits

In the last three years Kwang Myung ElectricLtd's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a falcon taking flight, Kwang Myung ElectricLtd's EPS soared from ₩109 to ₩147, over the last year. That's a commendable gain of 35%.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. This approach makes Kwang Myung ElectricLtd look pretty good, on balance; although revenue is flattish, EBIT margins improved from 3.2% to 5.8% in the last year. That's a real positive.

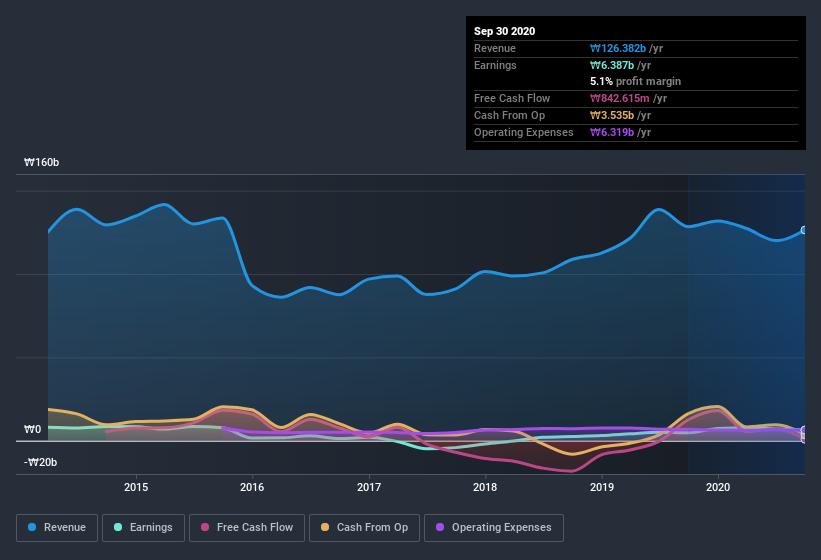

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Kwang Myung ElectricLtd is no giant, with a market capitalization of ₩116b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Kwang Myung ElectricLtd Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Kwang Myung ElectricLtd insiders have a significant amount of capital invested in the stock. To be specific, they have ₩40b worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 34% of the company, demonstrating a degree of high-level alignment with shareholders.

Does Kwang Myung ElectricLtd Deserve A Spot On Your Watchlist?

You can't deny that Kwang Myung ElectricLtd has grown its earnings per share at a very impressive rate. That's attractive. I think that EPS growth is something to boast of, and it doesn't surprise me that insiders are holding on to a considerable chunk of shares. So this is very likely the kind of business that I like to spend time researching, with a view to discerning its true value. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Kwang Myung ElectricLtd , and understanding this should be part of your investment process.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Kwang Myung ElectricLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Kwang Myung ElectricLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kwang Myung ElectricLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A017040

Kwang Myung ElectricLtd

Manufactures and sells various switchgears in South Korea and internationally.

Adequate balance sheet low.

Market Insights

Community Narratives