- South Korea

- /

- Electrical

- /

- KOSE:A015860

Just Four Days Till ILJIN Holdings Co., Ltd. (KRX:015860) Will Be Trading Ex-Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that ILJIN Holdings Co., Ltd. (KRX:015860) is about to go ex-dividend in just 4 days. Investors can purchase shares before the 29th of December in order to be eligible for this dividend, which will be paid on the 8th of April.

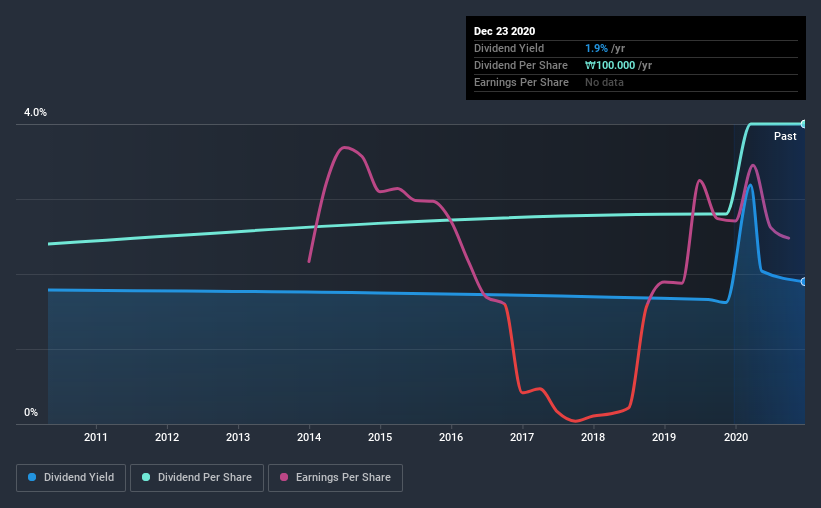

ILJIN Holdings's next dividend payment will be ₩100.00 per share, on the back of last year when the company paid a total of ₩100.00 to shareholders. Calculating the last year's worth of payments shows that ILJIN Holdings has a trailing yield of 1.9% on the current share price of ₩5270. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to investigate whether ILJIN Holdings can afford its dividend, and if the dividend could grow.

See our latest analysis for ILJIN Holdings

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Fortunately ILJIN Holdings's payout ratio is modest, at just 46% of profit. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. What's good is that dividends were well covered by free cash flow, with the company paying out 7.5% of its cash flow last year.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see how much of its profit ILJIN Holdings paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings fall far enough, the company could be forced to cut its dividend. ILJIN Holdings's earnings per share have fallen at approximately 10% a year over the previous five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. ILJIN Holdings has delivered an average of 5.2% per year annual increase in its dividend, based on the past 10 years of dividend payments.

The Bottom Line

Is ILJIN Holdings an attractive dividend stock, or better left on the shelf? Earnings per share are down meaningfully, although at least the company is paying out a low and conservative percentage of both its earnings and cash flow. It's definitely not great to see earnings falling, but at least there may be some buffer before the dividend needs to be cut. In summary, while it has some positive characteristics, we're not inclined to race out and buy ILJIN Holdings today.

While it's tempting to invest in ILJIN Holdings for the dividends alone, you should always be mindful of the risks involved. For example, ILJIN Holdings has 2 warning signs (and 1 which can't be ignored) we think you should know about.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade ILJIN Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A015860

ILJIN HoldingsLtd

Operates as a parts and material specialized company worldwide.

Flawless balance sheet and good value.

Market Insights

Community Narratives