- South Korea

- /

- Electrical

- /

- KOSE:A010120

Optimistic Investors Push LS ELECTRIC Co., Ltd. (KRX:010120) Shares Up 27% But Growth Is Lacking

Despite an already strong run, LS ELECTRIC Co., Ltd. (KRX:010120) shares have been powering on, with a gain of 27% in the last thirty days. The annual gain comes to 236% following the latest surge, making investors sit up and take notice.

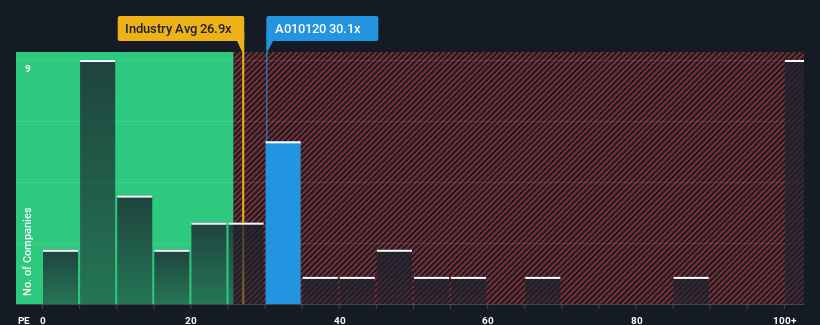

After such a large jump in price, LS ELECTRIC may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 30.1x, since almost half of all companies in Korea have P/E ratios under 13x and even P/E's lower than 7x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, LS ELECTRIC has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for LS ELECTRIC

Is There Enough Growth For LS ELECTRIC?

LS ELECTRIC's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered an exceptional 126% gain to the company's bottom line. The latest three year period has also seen an excellent 143% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 19% per annum over the next three years. Meanwhile, the rest of the market is forecast to expand by 19% each year, which is not materially different.

With this information, we find it interesting that LS ELECTRIC is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From LS ELECTRIC's P/E?

The strong share price surge has got LS ELECTRIC's P/E rushing to great heights as well. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of LS ELECTRIC's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Plus, you should also learn about these 2 warning signs we've spotted with LS ELECTRIC.

If these risks are making you reconsider your opinion on LS ELECTRIC, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A010120

LS ELECTRIC

Provides smart energy solutions in South Korea and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives