- South Korea

- /

- Electrical

- /

- KOSE:A010120

LS ELECTRIC Co., Ltd. (KRX:010120) Looks Just Right With A 25% Price Jump

Those holding LS ELECTRIC Co., Ltd. (KRX:010120) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The last 30 days bring the annual gain to a very sharp 94%.

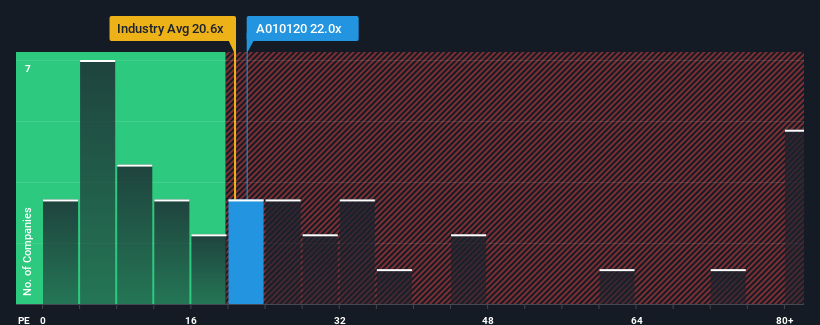

Since its price has surged higher, given close to half the companies in Korea have price-to-earnings ratios (or "P/E's") below 11x, you may consider LS ELECTRIC as a stock to avoid entirely with its 22x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times have been advantageous for LS ELECTRIC as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for LS ELECTRIC

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as LS ELECTRIC's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 47%. The strong recent performance means it was also able to grow EPS by 143% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 19% each year during the coming three years according to the analysts following the company. That's shaping up to be materially higher than the 16% per annum growth forecast for the broader market.

With this information, we can see why LS ELECTRIC is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On LS ELECTRIC's P/E

Shares in LS ELECTRIC have built up some good momentum lately, which has really inflated its P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that LS ELECTRIC maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for LS ELECTRIC you should know about.

Of course, you might also be able to find a better stock than LS ELECTRIC. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade LS ELECTRIC, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A010120

LS ELECTRIC

Provides smart energy solutions in South Korea and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives