- South Korea

- /

- Construction

- /

- KOSE:A006360

Is GS Engineering & Construction (KRX:006360) A Risky Investment?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies GS Engineering & Construction Corporation (KRX:006360) makes use of debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for GS Engineering & Construction

What Is GS Engineering & Construction's Net Debt?

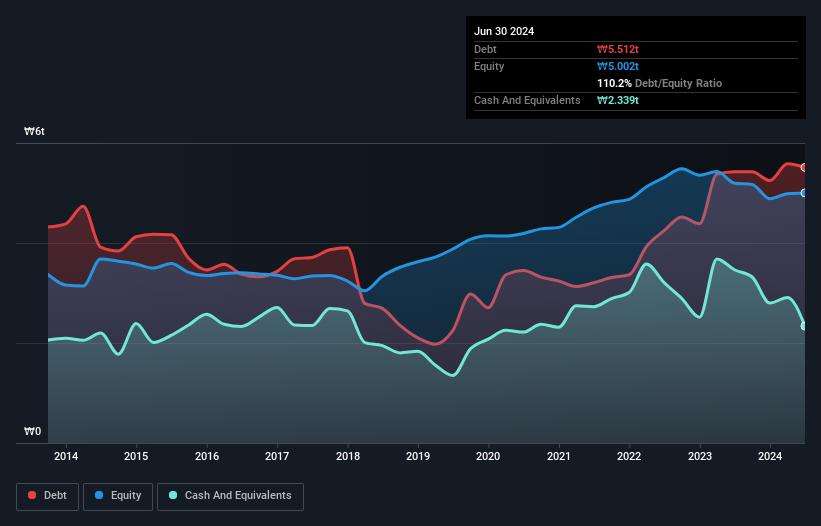

The chart below, which you can click on for greater detail, shows that GS Engineering & Construction had ₩5.51t in debt in June 2024; about the same as the year before. However, because it has a cash reserve of ₩2.34t, its net debt is less, at about ₩3.17t.

A Look At GS Engineering & Construction's Liabilities

Zooming in on the latest balance sheet data, we can see that GS Engineering & Construction had liabilities of ₩1.95t due within 12 months and liabilities of ₩11t due beyond that. Offsetting this, it had ₩2.34t in cash and ₩4.63t in receivables that were due within 12 months. So its liabilities total ₩5.61t more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the ₩1.45t company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, GS Engineering & Construction would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

GS Engineering & Construction's debt of just -11.5 times EBITDA is clearly modest. But strangely, EBIT was only 0.24 times interest expenses, suggesting the that may paint an overly pretty picture of the stock. We also note that GS Engineering & Construction improved its EBIT from a last year's loss to a positive ₩31b. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if GS Engineering & Construction can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. During the last year, GS Engineering & Construction burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

To be frank both GS Engineering & Construction's conversion of EBIT to free cash flow and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But at least it's pretty decent at managing its debt, based on its EBITDA,; that's encouraging. Taking into account all the aforementioned factors, it looks like GS Engineering & Construction has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that GS Engineering & Construction is showing 2 warning signs in our investment analysis , you should know about...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A006360

GS Engineering & Construction

Engages in the civil works and construction, sales of new houses, repairs and maintenance, overseas general construction, and technology consultation activities in South Korea and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026