- South Korea

- /

- Industrials

- /

- KOSE:A004990

Do These 3 Checks Before Buying LOTTE Corporation (KRX:004990) For Its Upcoming Dividend

Readers hoping to buy LOTTE Corporation (KRX:004990) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. This means that investors who purchase shares on or after the 29th of December will not receive the dividend, which will be paid on the 24th of April.

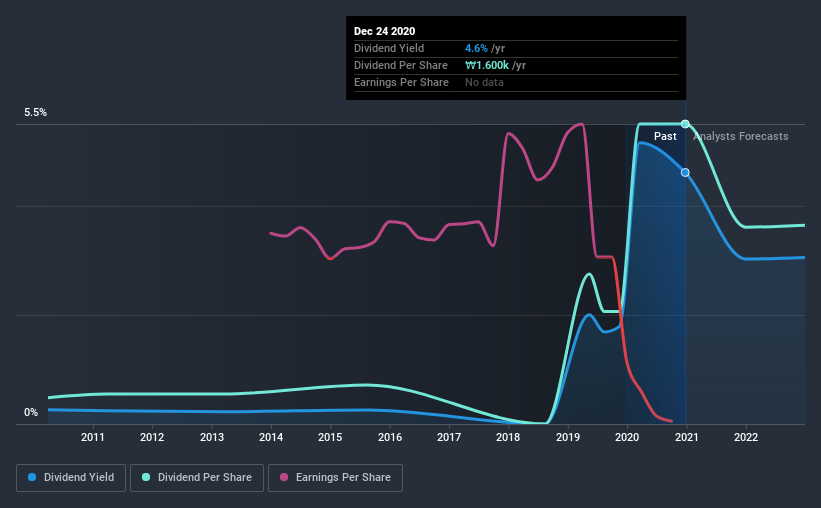

LOTTE's next dividend payment will be ₩800 per share, on the back of last year when the company paid a total of ₩1,600 to shareholders. Based on the last year's worth of payments, LOTTE stock has a trailing yield of around 4.6% on the current share price of ₩34700. If you buy this business for its dividend, you should have an idea of whether LOTTE's dividend is reliable and sustainable. We need to see whether the dividend is covered by earnings and if it's growing.

View our latest analysis for LOTTE

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. LOTTE reported a loss after tax last year, which means it's paying a dividend despite being unprofitable. While this might be a one-off event, this is unlikely to be sustainable in the long term. With the recent loss, it's important to check if the business generated enough cash to pay its dividend. If LOTTE didn't generate enough cash to pay the dividend, then it must have either paid from cash in the bank or by borrowing money, neither of which is sustainable in the long term. LOTTE paid out more free cash flow than it generated - 117%, to be precise - last year, which we think is concerningly high. It's hard to consistently pay out more cash than you generate without either borrowing or using company cash, so we'd wonder how the company justifies this payout level.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings fall far enough, the company could be forced to cut its dividend. LOTTE reported a loss last year, and the general trend suggests its earnings have also been declining in recent years, making us wonder if the dividend is at risk.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. LOTTE has delivered an average of 28% per year annual increase in its dividend, based on the past 10 years of dividend payments.

Get our latest analysis on LOTTE's balance sheet health here.

To Sum It Up

Has LOTTE got what it takes to maintain its dividend payments? First, it's not great to see the company paying a dividend despite being loss-making over the last year. Second, the dividend was not well covered by cash flow." Overall it doesn't look like the most suitable dividend stock for a long-term buy and hold investor.

So if you're still interested in LOTTE despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. To help with this, we've discovered 2 warning signs for LOTTE (1 is significant!) that you ought to be aware of before buying the shares.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade LOTTE, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A004990

LOTTE

Engages in the food, retail, tourism, chemical, construction, and finance businesses worldwide.

Very undervalued with moderate growth potential.

Market Insights

Community Narratives