- South Korea

- /

- Industrials

- /

- KOSE:A004800

Dividend Investors: Don't Be Too Quick To Buy Hyosung Corporation (KRX:004800) For Its Upcoming Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Hyosung Corporation (KRX:004800) is about to go ex-dividend in just four days. Investors can purchase shares before the 29th of December in order to be eligible for this dividend, which will be paid on the 25th of March.

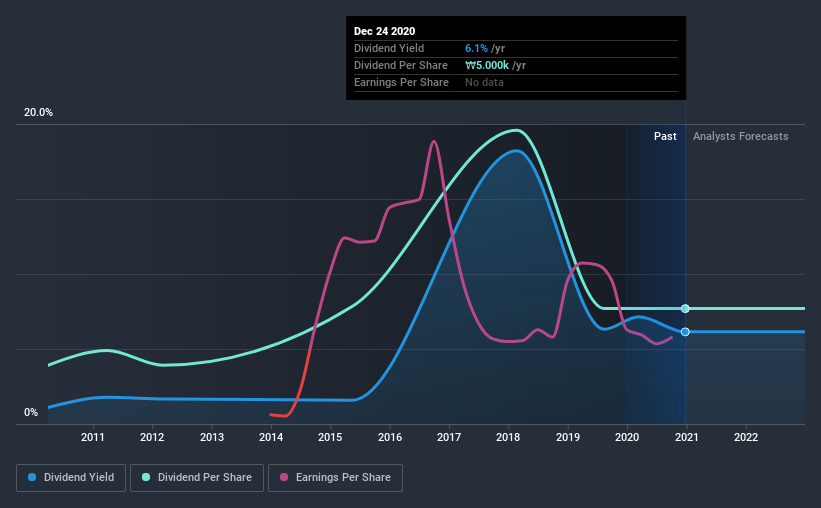

Hyosung's upcoming dividend is ₩5,000 a share, following on from the last 12 months, when the company distributed a total of ₩5,000 per share to shareholders. Based on the last year's worth of payments, Hyosung has a trailing yield of 6.1% on the current stock price of ₩81400. If you buy this business for its dividend, you should have an idea of whether Hyosung's dividend is reliable and sustainable. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

See our latest analysis for Hyosung

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Hyosung distributed an unsustainably high 165% of its profit as dividends to shareholders last year. Without extenuating circumstances, we'd consider the dividend at risk of a cut. A useful secondary check can be to evaluate whether Hyosung generated enough free cash flow to afford its dividend. Fortunately, it paid out only 44% of its free cash flow in the past year.

It's good to see that while Hyosung's dividends were not covered by profits, at least they are affordable from a cash perspective. If executives were to continue paying more in dividends than the company reported in profits, we'd view this as a warning sign. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Hyosung's earnings per share have plummeted approximately 32% a year over the previous five years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Since the start of our data, 10 years ago, Hyosung has lifted its dividend by approximately 7.0% a year on average. That's intriguing, but the combination of growing dividends despite declining earnings can typically only be achieved by paying out a larger percentage of profits. Hyosung is already paying out a high percentage of its income, so without earnings growth, we're doubtful of whether this dividend will grow much in the future.

The Bottom Line

Is Hyosung an attractive dividend stock, or better left on the shelf? It's not a great combination to see a company with earnings in decline and paying out 165% of its profits, which could imply the dividend may be at risk of being cut in the future. However, the cash payout ratio was much lower - good news from a dividend perspective - which makes us wonder why there is such a mis-match between income and cashflow. Overall it doesn't look like the most suitable dividend stock for a long-term buy and hold investor.

So if you're still interested in Hyosung despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. In terms of investment risks, we've identified 2 warning signs with Hyosung and understanding them should be part of your investment process.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Hyosung or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hyosung might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A004800

Hyosung

Engages in the textile, trading, power and industrial systems, construction, industrial materials, chemicals, and information and communication businesses in Korea and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives