- South Korea

- /

- Electrical

- /

- KOSE:A003670

Posco Future M Co., Ltd. (KRX:003670) Not Lagging Industry On Growth Or Pricing

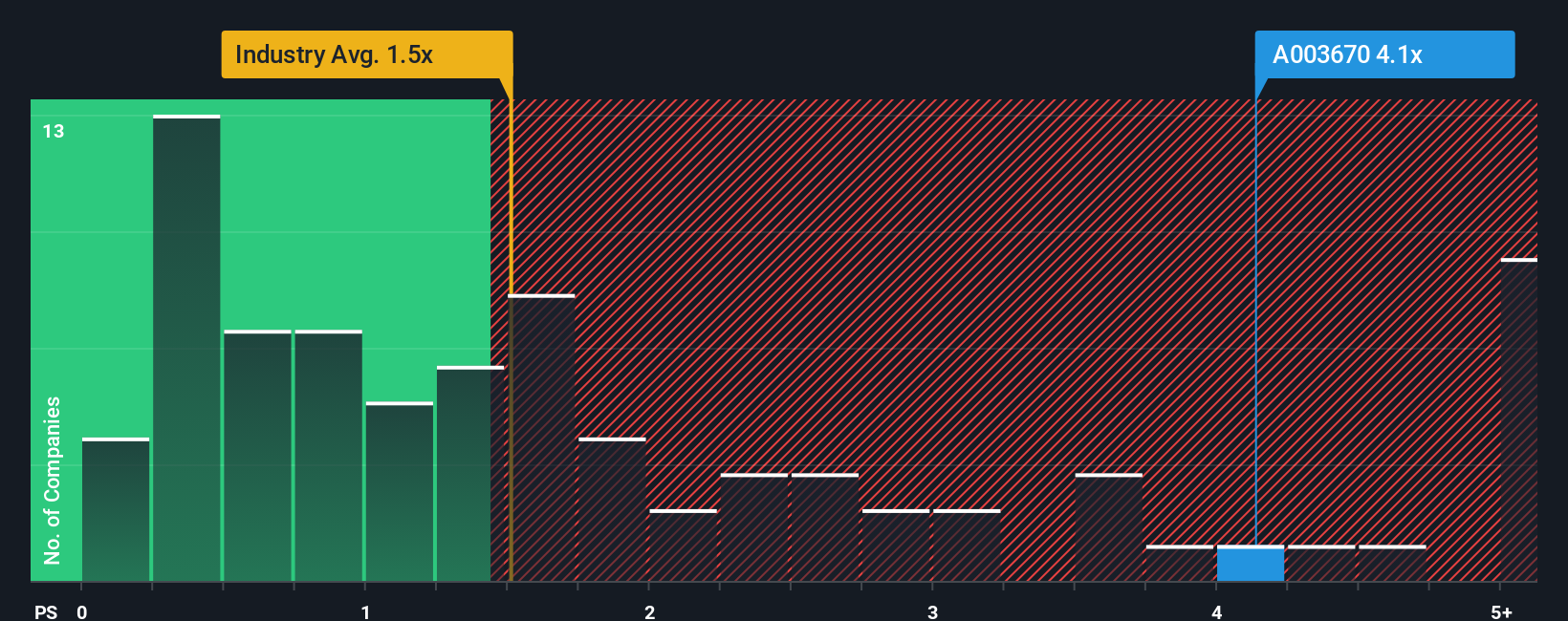

When you see that almost half of the companies in the Electrical industry in Korea have price-to-sales ratios (or "P/S") below 1.5x, Posco Future M Co., Ltd. (KRX:003670) looks to be giving off strong sell signals with its 4.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Posco Future M

What Does Posco Future M's P/S Mean For Shareholders?

Posco Future M has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think Posco Future M's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Posco Future M?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Posco Future M's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 30%. Regardless, revenue has managed to lift by a handy 26% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 30% each year over the next three years. With the industry only predicted to deliver 19% per annum, the company is positioned for a stronger revenue result.

With this information, we can see why Posco Future M is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Posco Future M's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Posco Future M shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Posco Future M (1 doesn't sit too well with us) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A003670

Posco Future M

Engages in the refractory, industrial furnaces, and lime businesses in South Korea, Europe, Southeast Asia, China, the United States, and internationally.

High growth potential with very low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.